If you’re not enjoying the market’s roller coaster ride in February, you’re likely not alone with that sentiment. Yesterday proved to be another wild day for the markets with the Fed minutes coming forward at 2:00, spurring equity prices in both directions. In the Fed minutes from January 2017, there was much to be extrapolated.

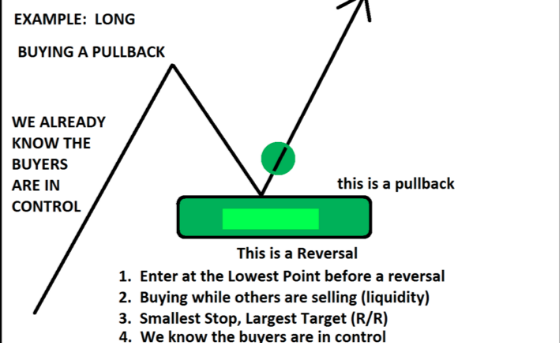

The Federal Reserve offered in its meeting minutes that it would continue to raise rates, which initially sent stocks higher. The major indices rose on the news that expressed the Fed was not overly worried about inflation. The Dow was up by as much as 300 points before an all-out collapse in the major averages persisted through the closing bell. It was a rather stunning reversal, but one that acknowledged that within the Fed minutes, the verbiage laid the groundwork for more rate hikes. “MORE” was the key word that found bonds selling off, sending yields higher and equities lower. The Fed basically said that the stronger economic growth raises the likelihood that “further gradual policy firming would be appropriate.” The Fed also said there are upside risks to growth from the tax cuts and overhaul package, and a number of officials raised growth.

“I think what [soothed] the market is it’s hiking for the right reason because economic growth is better, not because inflation is moving at a breakneck pace, at least according to the Fed,” said Michael Arone, chief investment strategist at State Street Global Advisors. “That’s the best kind of environment for stocks. The reason rates are rising is because the economy is doing better.”

Ward McCarthy, chief financial economist at Jefferies, said the minutes really revealed nothing new despite the market action.

“There’s not much to think about here. … They seem to be more optimistic about the economy, a little bit less confused about inflation, but there’s not profound change here between December and January. You wouldn’t expect to see it as it was Janet Yellen’s last meeting,” he said, adding there will be more information on how many rate hikes this year when the Fed releases its forecasts after its meeting March 21.

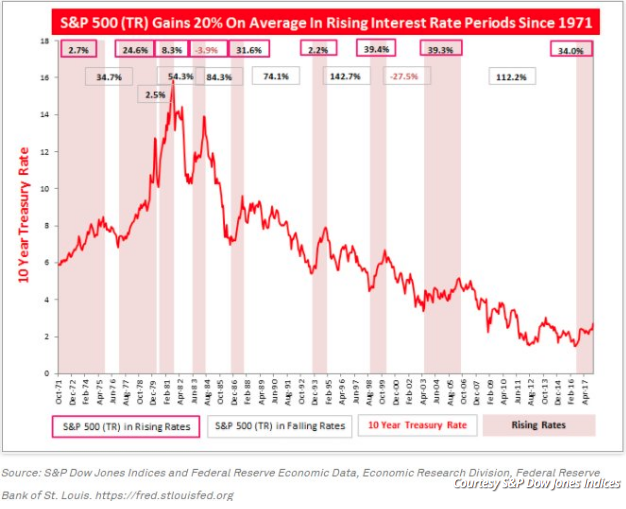

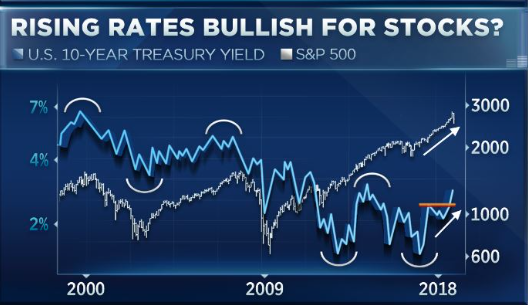

On the heels of the Fed minutes being released, the 10-year Treasury rose to as much as 2.95% identifying that there is still a debate regarding inflation. This debate feeds upon itself and manifests in equity prices. But make no mistake about it; throughout history when rates rise it is normal to witness equity prices rise in tandem. Despite the recent rollercoaster ride in equity markets, historically, “equities have gained significantly in periods of rising rates,” wrote Jodie Gunzberg, managing director and head of U.S. equities at S&P Dow Jones Indices, in an email.

“Since 1971, the S&P 500 has gained about 20% on average in rising rate periods, has gained 8 of 9 times and has gained nearly 40% twice, with less than a 4% loss for its worst rising rate period.” Gunzberg’s analysis evaluated the benchmark U.S. index on a total-return basis. While there’s more upside in falling-rate environments, “If there is accelerating growth and inflation, like now, rising interest rates can result in appreciating assets,” she wrote.

Oppenheimer technician Ari Wald also recently chimed in on the conversation surrounding rising rates and equity prices. He offered that history shows that rising rates are actually bullish for the market.

“The key point for us is that the direction of interest rates is equally, if not more important, than the level of interest rates,” he said Tuesday on CNBC’s “Trading Nation.” “So in general, we’re of the view that low and rising tends to be bullish for stocks and high and [falling rates] is what’s bearish. If you look back through history, you’ll see that it was a downturn in interest rates that coincided with market tops in 2000 and 2007, as well as what we’ve been calling the top in risk in that 2014 to 2015 period,” he said. “So we see rising rates as growth coming back into the market.”

The Dow Industrials are down 5.2% for the month and much of the losses are attributed to signs of an uptick in inflation and bets the U.S. central bank won’t delay raising interest rates further. Today we’ll also hear more in the way of the inflation or reflation subject matter from Fed speakers. Fed officials scheduled to speak Thursday, include New York Fed President William Dudley, due to make remarks at 10 a.m. Eastern Time, and Atlanta Fed President Raphael Bostic, due to speak at 12:10 p.m. Eastern. Dudley’s official speech will be foreshadowed by an earlier interview the Fed President gave to CNBC Thursday morning. “Central bankers need to be careful not to increase interest rates too quickly this year because that could have a restrictive effect on the economy, Bullard stated on CNBC’s Squawk Box. Also earlier on Thursday, the Fed’s Vice Chairman for supervision, Randall Quarles, said in Tokyo that recent low inflation readings are not “a great concern,” and the economy is “performing very well.”

After the whipsawing market reaction to the Fed minutes being released yesterday, U.S. equity futures are largely flat and with the HSI and Nikkei falling more than 1% each overnight. European indices are also lower by nearly 1% ahead of Wall Street’s opening bell.

Photo: http://www.pak101.com/c/funnypictures/view/4843/Cartoons/Cartoon_on_Inflation

Tags: SPY DJIA IWM QQQ