Admittedly, that was a trading week not worth forgetting. More importantly, it was a trading week that was very concerning even as the S&P 500 finished higher by .49% for the week.

The news of the week that contributed to the action was both domestic and foreign in nature. The failure of Italy to form a government last Sunday sent global markets into a tailspin. Italy’s efforts to form a government broke down on Sunday after the president rejected a eurosceptic pick for the key economy ministry, triggering a potential constitutional crisis and opening the prospect of fresh elections. Italian bond yields skyrocketed on the news, highlighting the countries debt issues and as one of the largest global economies with extreme debt to GDP levels.

After nearly a week of looming political strife in the nation, on Friday Italian stocks leapt nearly 3% intraday after populist parties the 5 Star Movement and the League made a new deal to form a coalition government. The government was sworn in on Friday, ending months of political deadlock. Italy’s new prime minister, Giuseppe Conte, is a lawyer, an academic and a political novice.

“Though political uncertainty in Italy is nothing new, this latest bout of volatility highlights some of the structural challenges Europe faces that may constrain growth and upend financial markets periodically,” noted Chief Investment Strategist John Lynch at LPL Financial.

The most important aspect of the Italian drama that plagued global equities last week is that all is now well in Italy. Of course that’s an untruth! The reality is that very little was solved with the swearing in of a new government.

Having said that, the Italian economy is not in dire conditions and has been quite stable for several years. As indicated in the table of Italy’s GDP over the last several years, the country is still experiencing an expanding economy.

The biggest news or more confounding news of the trading week came from within the United States and in the form of trade tariffs. The headlines were not taken with favor by investors, economists or analysts when the U.S. administration announced implementation of trade tariffs against its allies.

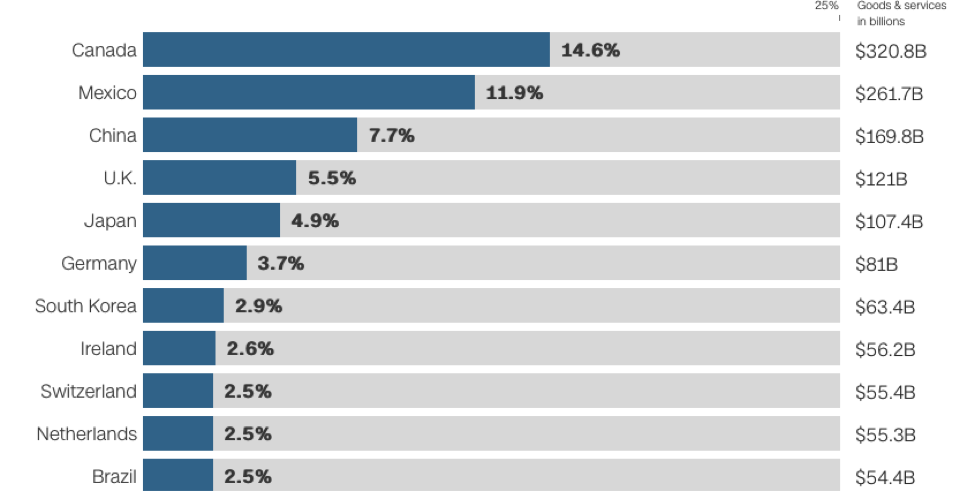

It was announced Thursday that the U.S. will impose tariffs on steel and aluminum imports from Canada, Mexico and the European Union starting on Friday. Both European and U.S. markets took a hit on the news that broke in the early morning hours. Of course, the U.S. imposed tariffs did not come without hints of retaliatory measures from allies.

Much of the concerns surrounding the implementation of tariffs on our ally nations are that not only will it hurt these relationships, but also that it will hurt U.S. consumers. However, this may be sensationalistic fear of tariffs more so than researched, logical impact on consumers and the economy. Here’s what Goldman Sachs had to say about the potential impact from the imposing tariffs.

From Goldman Sachs:

“The incremental inflation effect of these tariffs should be small. We estimate that adding Canada, Mexico, and the EU to the countries facing a tariff of 25% on steel and 10% on aluminum could boost core PCE by roughly 1bp.

U.S. trade with other nations is worth $4.9 trillion per year. China, Canada and Mexico are the country’s largest trading partners, accounting for nearly $1.9 trillion worth of imports and exports. But this landscape could be reshaped as President Trump pursues “America First” policies and reworks free trade deals.

As depicted in the chart above, the 3 largest trading partners with the U.S. are Canada, Mexico and China. The U.S. administration is claiming that the tariffs are part of a national security issue, which will likely be declared invalid by the WTO. Under the Bush administration, such tariffs with an exact claim were attempted and failed.

Oddly enough, despite the heavy-handed issues with Italy and implementation of trade tariffs against the United States greatest allies, the markets did indeed bounce back strongly on Friday. The Dow, S&P 500 and Nasdaq all finished sharply higher on the day and all 3 major averages finished higher for the month of May for a 6th consecutive year.

While investors seemingly brushed off a slew of concerns last week, Finom Group’s chief market strategist Seth Golden isn’t of the opinion we’ve heard the last of these issues.

“It’s somewhat befuddling that the markets largely side-stepped Euro debt and trade war concerns. These are issues that have the potential to affect GDP levels in their respective regions. If they impact GDP levels they can impact corporate earnings. That’s where we are at odds with last week’s trading activity. Italy, I can understand the markets putting that issue in the rear view mirror. The EU has plenty of tools and willingness to correct for Italy’s debt issues and given the economies contribution to the overall EU economy, there resides an obligation on the part of the EU to support Italy during times of debt complications, which may arise. But with regards to the tariffs implemented on the EU, Mexico and Canada, that’s of much greater concern. On a percentage basis the tariffs don’t amount to terribly much on what is an almost $18tn economy. That’s the black and white, on paper numbers that Commerce Secretary Wilbur Ross is looking at, the size of the potential impact from the tariffs on an $18trn U.S. economy from retaliatory tariffs placed on U.S. goods and/or services. I’m sorry, but the world economies don’t operate in black and white and on paper. If we use sports analogies, the New England Patriots should win the Super Bowl every year, on paper. But that’s not how it plays out.”

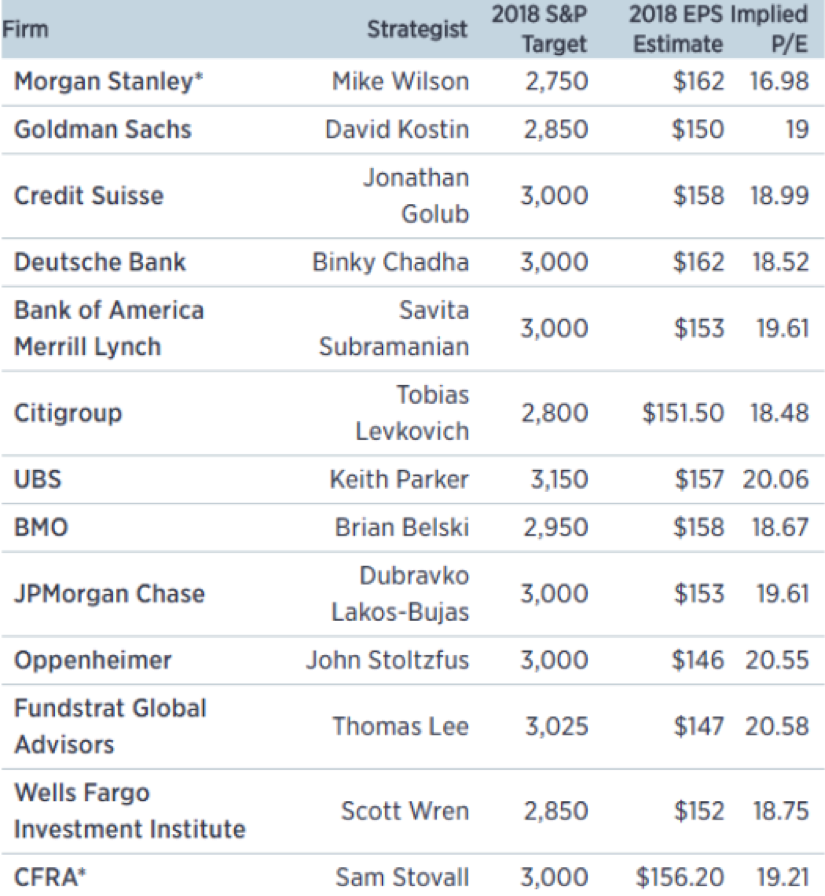

What investors will need to keep in mind is that these two issues are now alive and produce greater uncertainty on many fronts. As such, they have the potential to curb equity market multiple expansion. Most analysts believe markets will finish significantly higher than where we are entering Monday morning’s trade on the S&P 500, but that was before the reality of tariff implementation. (See firm price targets below)

Having said all that concerning the tariffs, we still have yet to better understand the talks on trade surrounding the U.S. and China. Meetings are ongoing between the 2 nations, but have shown little progress. Given the propensity of President Trump for delivering on his campaign promises, the possibility to move forward with tariffs on Chinese trade is not out of the question and could prove to be yet another hurdle for equity markets. With that, let’s move away from the geopolitical and towards the U.S. economy and earnings drivers.

Last week’s big economic report was the May Nonfarm Payroll report and it was a beat. In May, the U.S. economy created 223,000 new jobs while the unemployment rate fell to a new post-crisis low of 3.8%, according to the latest release from the Bureau of Labor Statistics. This is the lowest unemployment rate since April 2000. If the unemployment rate drops another 0.1% it’ll be the lowest since the 1960s. According to estimates from Bloomberg, nonfarm payrolls were expected to grow by 190,000 while the unemployment rate was forecast to remain at 3.9% in May.

The NFP report was almost a perfect report for investors and possibly the real, underlying reason as to why the market bounced back after Thursday’s market drop. The dip in the unemployment rate was an unexpected positive, but the subdued wage growth was also a positive for the bulls. Hourly pay rose by a scant 8 cents, or 0.3% to $28.92 an hour in May. As a result, the 12-month increase in wages rose to 2.7% after holding at 2.6% for three months in a row. Employment gains for April and March were revised up by a combined 15,000. The government said 159,000 new jobs were created in April instead of 164,000. March’s increase was raised to 155,000 from 135,000. The big picture takeaway from the jobs report is that the economy is steadily producing more and more jobs. Even as labor is increasingly in short supply wages are not rising at a concerning pace, suggesting breakout inflation.

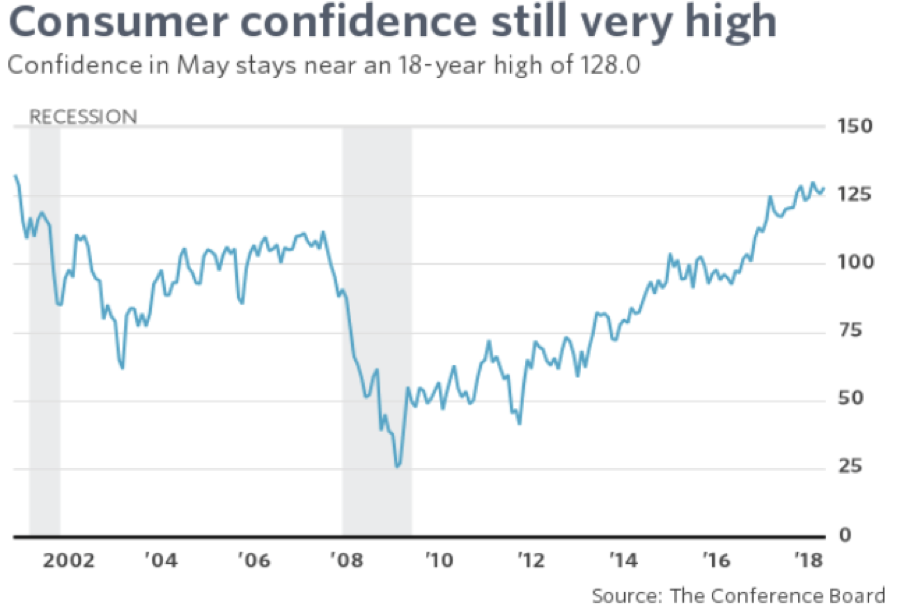

What’s been supporting a strong labor market is the consumer. The level of confidence Americans expressed in the economy remained near an 18-year high in May, suggesting steady U.S. growth in the coming months.

The consumer confidence index rose to 128 from a revised 125.6 in April, the Conference Board said Tuesday. Originally the April index was reported at 128.7. The present situation index, a measure of current conditions, climbed to a 17-year high of 161.7 from 157.5 in the prior month. The future expectations index edged up to 105.6 from 104.3. Even as global trade rhetoric and market volatility has persisted in 2018, the consumer has remained quite resilient.

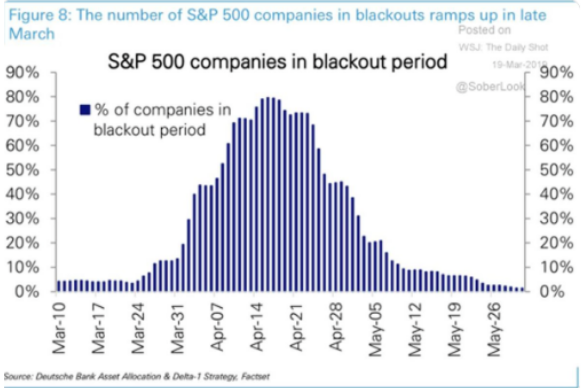

Earnings will be the most significant driver for the major averages and at present those earnings are expected to grow in the high teens for the Q2 2018 period.

- According to FactSet, the estimated earnings growth rate for the S&P 500 is 18.9% for Q2 2018.

- If 18.9% is the actual growth rate for the quarter, it will mark the second highest earnings growth since Q1 2011 (19.5%).

- On a per-share basis, estimated earnings for the second quarter have increased by 0.2% since March 31.

- In a typical quarter, analysts usually reduce earnings estimates.

- Because of the upward revisions to earnings estimates, the estimated year-over-year earnings growth rate for Q2 2018 has increased from 18.6% on March 31 to 18.9% today.

- Because of the upward revisions to sales estimates, the estimated year-over-year sales growth rate for Q2 2018 has increased from 7.8% on March 31 to 8.6% today.

- The forward 12-month P/E ratio is 16.2, which is equal to the 5-year average but above the 10-year average.

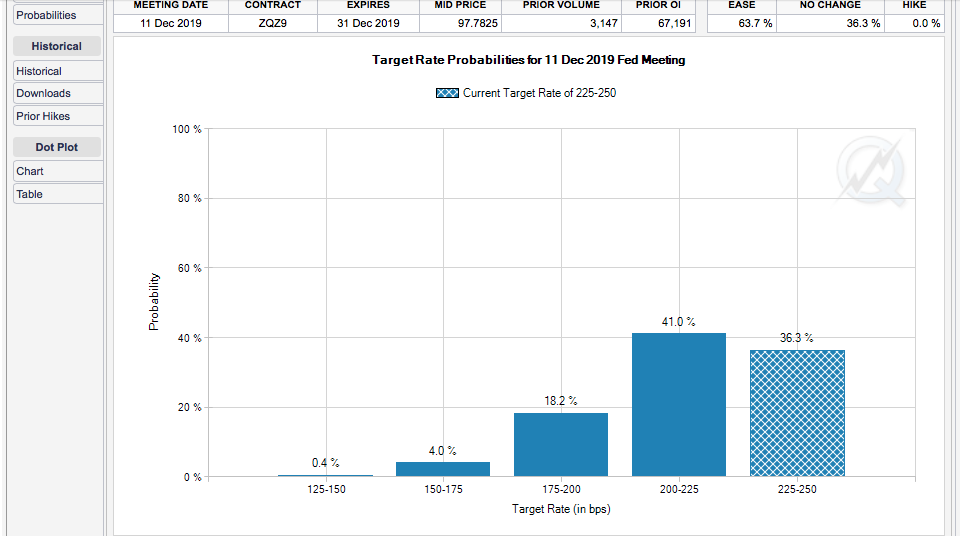

And there you have it investors! While there are storms brewing on the macro and geopolitical front, the central components of economic growth are still intact. The market may find difficulty with multiple expansion, but a bear market scenario isn’t in the cards near-term. This does not discount the potential for market corrections more obviously. Finom Group fully expects another Fed rate hike in June alongside rising bond yields. Given the expectation of rising rates/yields we also expect bouts of market volatility to persist.

Tags: SPX VIX SPY DJIA IWM QQQ TNX