It didn’t seem to affect the markets all that much yesterday, but it is certainly getting all the attention in the last 12 hours or so. Tuesday morning on CNBC, Jim Cramer discussed conversations that he was having with corporate CEO’s about the probability of slowing earnings growth.

“There are many parts of the economy that are slowing. I would love to say it’s all systems go. But my work does not show that.

The pastiche of industrialist CEOs I deal with right now, everything from retail to oil and gas to steel, it doesn’t matter. It changed. It changed in the last six weeks.”

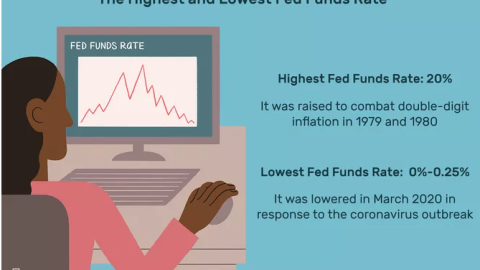

Cramer also reiterated his comments about a shift at the Federal Reserve from being data-dependent to being blinded by the desire to normalize interest rates.

“I really think [Fed Chairman Jerome] Powell is going to walk back things. He’s too thoughtful of a man to stay on autopilot. Autopilot means crash landing.”

Cramer said central bankers need to look at the economic data, which he says, show steady growth without problematic inflation. There’s no reason for the Fed to raise rates more aggressively, he contended. “A real slowdown in the economy could occur here; not a recession, but a slowdown.”

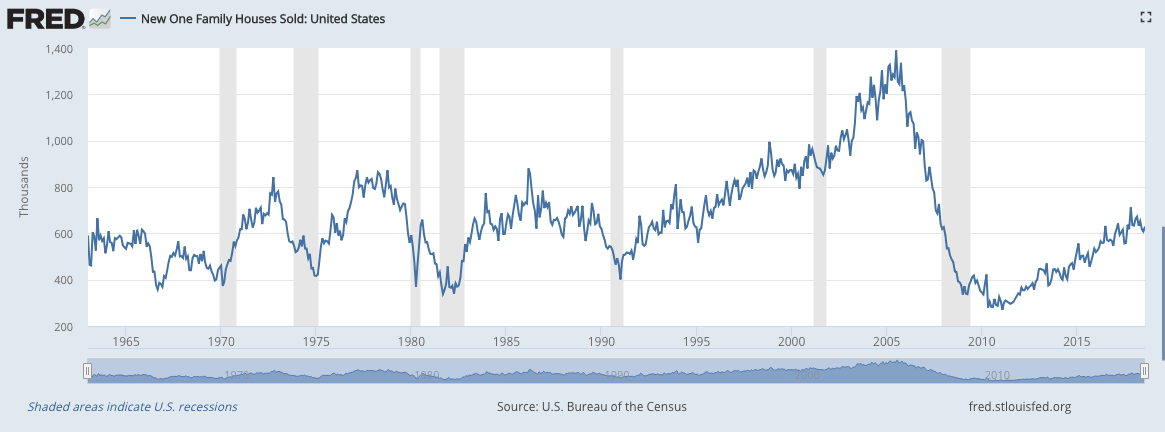

All the aforementioned comments and concerns from Jim Cramer should be, at least, taken into consideration. The CNBC Mad Money host and Actionable Alerts Founder does indeed have many conversations with corporate CEOs on air and off air. We’ve seen slowdowns in key economic sectors over the course of 2018, mainly autos and housing. The latest new home sales report showed a strengthening in housing sales, but revisions to the previous 2 months cast a cloud over housing.

Sales of new single-family houses in August 2018 were at a seasonally adjusted annual rate of 629,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.5 percent (±13.7 percent)* above the revised July rate of 608,000 and is 12.7percent (±20.7 percent)* above the August 2017 estimate of 558,000.

As shown in the chart of New Home sales above, there are always these periods of monthly new home sales slowdowns. As housing prices and interest rates rise, new home buyers extend their search periods and as the overall market adjusts to the higher pricing. On the whole, New Home sales are still higher in 2018 when compared to 2017 and we’ve seen these characteristics in the market many a time before. Nonetheless, it’s something to keep an eye on for future housing reports.

To date, the slowdown in these sectors has not proven to spill over into the broader economy. In fact, the broader economy that is more consumer-centric (retail and services) has only strengthened. Next week’s monthly retail sales report may be more important than ever, given the concerns of an economic slowdown highlighted by Jim Cramer. This week, investors will be delivered certain inflation-centric economic data in the form of the Producer Price Index, Consumer Price Index and Core CPI. None of the data is anticipated to show breakaway inflation, in line with the Fed’s forecast for subdued inflation.

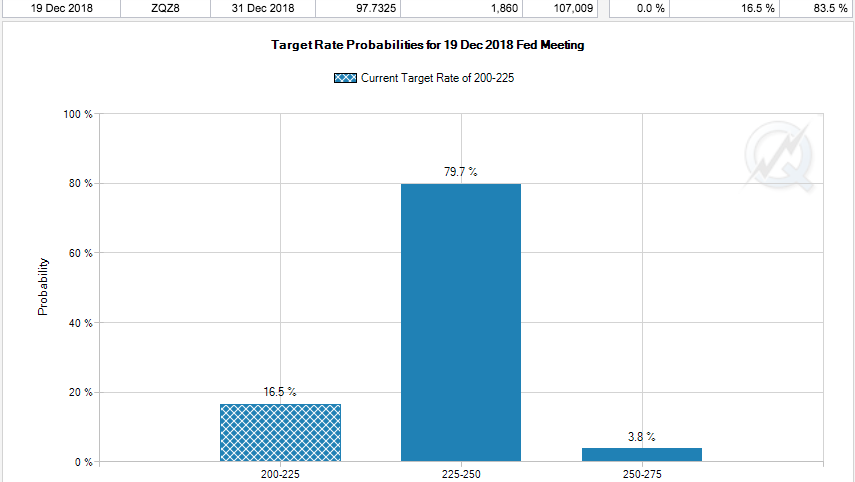

With regards to the Fed hiking rates, the economy can withstand rising rates, but slowing is slowing and that could affect equity valuations. For investors, that is all that really matters. That comment brings forward the question of whether or not the Fed should raise rates, as it already plans to do, come December. The market already largely expects the Fed to raise rates by another .25% bps in December as depicted by the CME’s FedWatch Tool.

Presently, there is a 79% chance the Fed will raise rates again in December 2018. The FedWatch Tool has successfully delivered a nearly perfect forecast for each Fed rate hike and investors would be wise to watch the evolution of the probability over the next couple of months and as we edge closer to the forecasted rate hike.

Higher prices are on their way, some due to the natural and cyclical rising rates that occur during an economic expansion and some coming from the ongoing trade war, which threatens to hike prices on thousands of goods. Much of the higher prices from the trade war are impacting, to one degree or another, the auto and housing industry prices already. In terms of retail goods at the department store level, such prices aren’t expected to rise until 2019, as much of the goods for the category have already been purchased out 6 months or so. With higher prices, one consideration we factor in is affordability as wage growth takes hold. If both rise on par, the impact from rising prices is nullified.

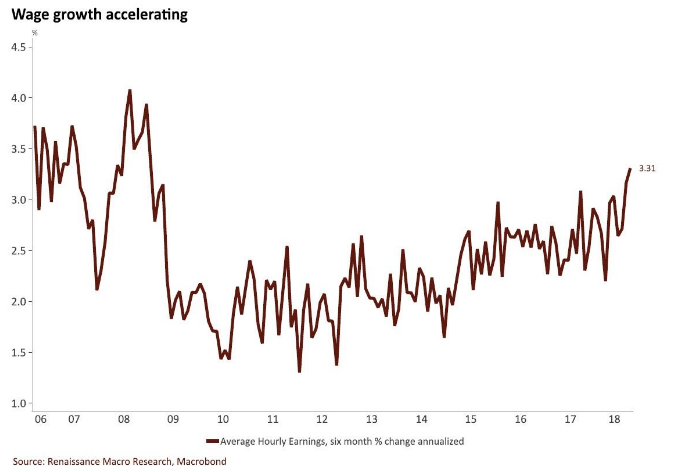

The most important calculation for wage growth is weekly earnings. Year over year weekly earnings growth was up from 3.21% to 3.35 percent. This was one of the best reports of this expansion period. Growth was only higher in June 2018 and October 2010. Wage growth in October 2010 is less meaningful. The unemployment rate was high; fewer workers received those gains.

What we see in the chart above is significant to the conversation concerning an economic slowdown. Wages do not typically rise during an economic slowdown. And to further the point, the NFIB doesn’t detail such strong sentiment when the economy slows, as it is more forward looking. Most importantly, even if the economy slows down, it won’t come anywhere near a recession if wage growth keeps accelerating.

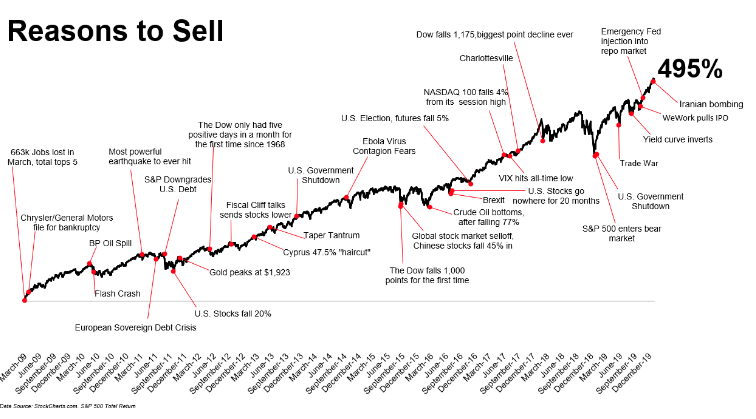

The recent warning from Jim Cramer is definitely to be considered and reason enough to pay close attention to the upcoming earnings season commentary from CEOs. Friday, the banks will begin reporting quarterly results. At midweek, the S&P is only down roughly $5 and in a week where the expected move is some $48. With the VIX at 16+ and seemingly getting comfortable at this level, preparing for its next move, investors should expect bigger S&P 500 moves by week’s end. Investors, might be well advised to “tread cautiously” if found with near term trading objectives. Having said that, the long-term outlook for the equity market and economy are still positive and trending higher.

Tags: F GM SPX VIX SPY DJIA IWM QQQ TVIX UVXY XHB XLY XRT