The big news headline overnight that will likely carry onward throughout the week is the signed agreement between the United States and North Korea during the joint summit between the 2 nations. U.S. President Donald Trump and North Korean leader Kim Jong Un signed an agreement to work toward complete denuclearization of the Korean Peninsula on Tuesday, but the declaration has been criticized as falling short on new commitments from Pyongyang. The agreement also calls for both sides to recover the remains of prisoners of war and those missing in action in the Korean War, and to repatriate these. The signed agreement does not use the words “irreversible” and “verifiable” to describe the denuclearization process, 2 factors the U.S. has pursued in the past. Below are direct particulars of the agreement:

- The United States and the DPRK commit to establish new U.S.-DPRK relations in accordance with the desire of the peoples of the two countries for peace and prosperity.

- The United States and the DPRK will join their efforts to build a lasting and stable peace regime on the Korean Peninsula.

- Reaffirming the April 27, 2018 Panmunjom Declaration, the DPRK commits to work toward complete denuclearization of the Korean Peninsula.

- The United States and the DPRK commit to recovering POW/MIA remains, including the immediate repatriation of those already identified.”

While the media and political pundits will pick apart the pros and cons of the agreement, we would be of the opinion that a door has opened that lays a path toward future peace keeping processes. With that said, the European markets are little affected by the Summit’s agreement with Asian markets somewhat mixed. U.S. equity futures are mixed ahead of latter week’s central bank rate and policy disseminations.

Prior to the Federal Open Market Committee’s rate decision tomorrow and the European Central Bank’s policy statement on Thursday, Consumer Price Index will be released Tuesday morning ahead of the opening bell on Wall Street.

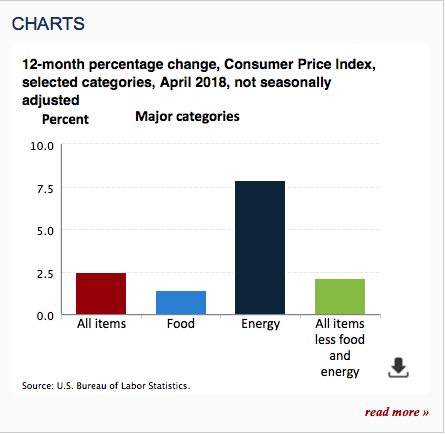

As shown in the chart, April CPI expressed a .2% uptick in pricing with overall consumer prices edging higher on a 12-month basis by 2.5%. The expectations for CPI in May are for another reading of .2% growth in prices.

In other economic data already released Tuesday morning, the National Federation of Independent Business small-business optimism index rose 3 points in May to a reading of 107.8, its second-highest level in 45 years and strongest of the recovery. On Thursday, investors will also achieve another piece of economic data regarding the consumer in the way of monthly retail sales.

So what is going on with the markets and their seemingly extraordinary ability to shrug off a plethora of geopolitical and central bank related concerns? Let’s discuss this topic by reviewing some of the latest comments from two high profile fund/asset managers and television personalities. Michael Arone, chief investment strategist for State Street Global Advisors suggests that investors aren’t necessarily ignoring geopolitical risks, but they are weighing those risks against a strengthening U.S. economy.

“While there has been “a lot of tough talk and scary headlines around trade” in recent weeks, there hasn’t been much follow-through, leaving investors to pay closer attention to underlying data that points to a strengthening U.S. economy. Moreover, even in a scenario that sees, for example, a hit of around $50 billion, the tax cuts and spending plans enacted late last year and in early 2018 are still much larger.”

When it comes to the Fed and the upcoming rate hike/policy statement, Arone also offered the following in his phone interview with MarketWatch reporters:

“Anything that persuades investors that the Fed would be set to deliver two more rate increases in 2018, rather than the one that’s largely penciled in, could stir some nervousness among investors.”

The Fed could remove language in the statement that says the fed-funds rate is likely to remain, “for some time, below levels that are expected to prevail in the longer run.” There’s a risk investors could view such a change as hawkish, but in reality, it could instead reflect a signal that the Fed believes it is getting nearer the end of its rate-raising cycle than investors expect.”

Yesterday, “Mad Money” host Jim Cramer offered his commentary as to why the market hasn’t reflected the potential impact from trade conflicts that seemingly are rising out of the G-7 Summit. When reviewing the market’s climb prior to and after the Summit, Cramer floated the idea that investors think that President Trump may have it right on trade. He dove deeper into the subject matter on his Mad Money show by offering that chaos and keeping our allies on their toes may create the best outcome for the United States in the long run.

“Plus, judging from today’s positive actions, there are plenty of investors who clearly aren’t worried about these things,” he said. “At the end of the day, though, President Trump thrives on chaos, and whether you voted for him or not, that’s the world we’re in now. Can it really be that simple or that simplistic? You bet it can.”

After considering the potential reasons the market hasn’t necessarily reflected underlying geopolitical concerns from Arone and Cramer, it simply may take more time for these issues to play out. At present, little action has been taken on the trade front and we will hear a good deal more from central banks around the globe in the coming days. As such, it’s possible that delayed reactions to trade concerns may be combined to express an outcome post central bank policy and rate hike statements.

The current calm, complacency or seeming content in the equity market may find even greater calm after central bank announcements later this week. Then again, they may be found with disturbance and a spike in volatility. The VIX is currently expressing complacency in the markets with a reading in the 12% range ahead of central banks meetings and announcements. This could all change rather abruptly, but for now it’s optimal to stay the course as the long game remains unchanged.

By and large, a June rate hike is a given for U.S. markets while it remains open to debate how the Bank of Japan and ECB will deliver its QE messages and policy announcements. The ECB is expected to discontinue its QE activity by September of this year, but the greatest central bank consternation still resides with what the BOJ’s next steps will show about the state of its monetary policy and economy. With central banks highlighting the remainder of the trading week, Finom Group encourages investors to maintain a long-term outlook. Equity markets historically follow corporate earnings growth and U.S. earnings are expected to grow between 18% and 20% in 2018, suggesting appreciating market indexes by year’s end.

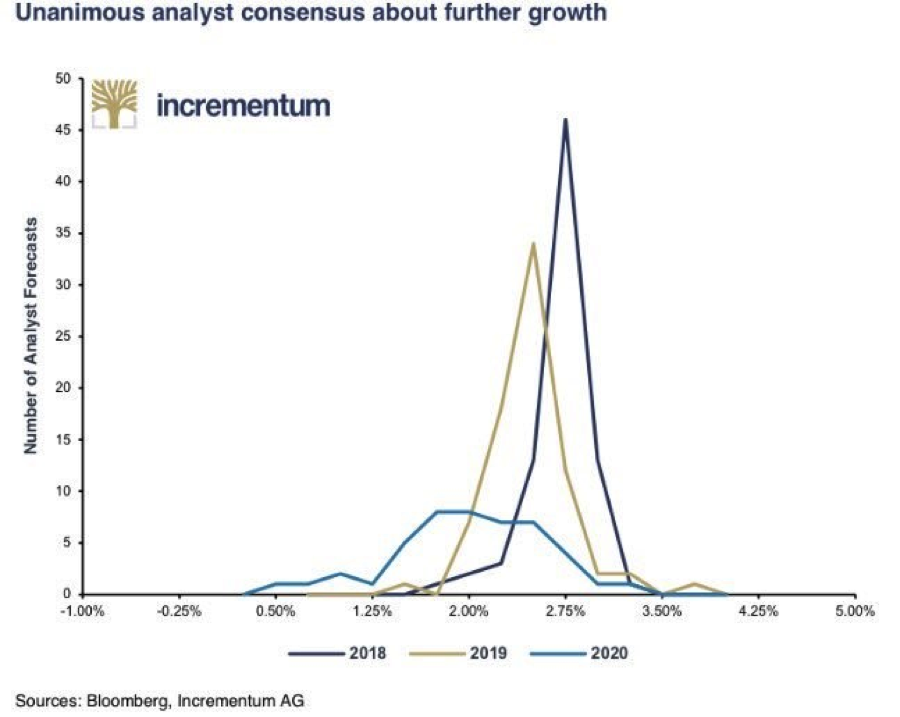

With regards to the strength of the U.S. economy, most economists forecast a continued era of economic expansion out to 2020. The Incrementum chart below shows a survey of 78 analysts’ forecasts on future GDP growth as performed by Bloomberg.

Within the chart, there is unanimous consent that economic growth will be positive over the next 18 months. The expectation is for about 2.75% growth in 2018 and 2.5% growth in 2019. Even though those who are willing to predict recessions are now calling for one in 2020, none of the analysts surveyed are actually calling for negative GDP growth at this time.

Investors should always be considering the major underlying factors of the economy that serve to support growth in corporate earnings. Finom Group believes the Fed and central banks will play a critical role in determining the market’s direction for the remainder of the week. Leading up to central bank announcements, we expect bouts of volatility that create lasting trading opportunities and as such Finom Group plans to trade these opportunities according to their weighted risk and our risk appetite. Admittedly, our risk appetite is robust when it comes to the technology and retail sectors as well as the volatility complex.

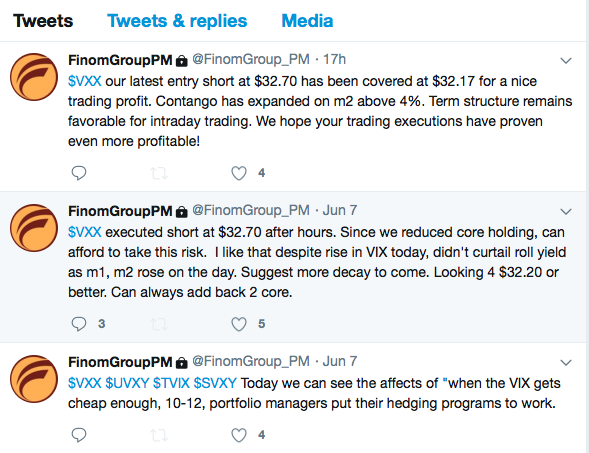

Our most recent delivered trade alert (depicted below) to subscribers proved successful as we shorted shares of our favored VIX-exchange traded product for 2018, iPath S&P 500 VIX Short-Term Futures ETN (VXX).

We chose VXX as our primary short-VOL trading vehicle for 2018 as we believed volatility would elevate YOY and from an abnormally low volatility regime in 2017. In forecasting an elevated volatility regime with at least one major VIX event, deleveraging from a 2X VIX-ETP to a 1X VIX-ETP proved prudent and in keeping with our overall thesis for trading volatility in 2018.

The short-VOL trade has been a broadly highlighted, criticized and sensationalized trading strategy in 2018 given the February VIX event that found XIV expressing an accelerated termination event. Subsequent the termination of XIV, several of the VIX-ETPs were restructured to express less leverage and with varied assets under management for these exchange traded notes and funds. Nonetheless, many of the VIX-ETPs have reverted to their share prices in place prior to the February “volpocolypse”, as it is commonly referred. Shares of VXX are only some $5 higher than where they came into 2018, further evidencing the short-VOL strategy as optimal for achieving portfolio outperformance when compared to the benchmark S&P 500 index returns. If one had shorted volatility during and post the February VIX event and held or continued executing such activity since… well the following chart paints quite the profitable picture me thinks.

Subscribe to Finom Group today and achieve our many trade alerts on the volatility complex for which we’ve assisted many investors and traders with achieving their portfolio growth objectives!

Tags: SPX VIX SPY DJIA IWM QQQ SVXY TVIX UVXY VXX