Some of the 21st century’s biggest breakthroughs are happening in health care, transforming the way we diagnose, treat and...

Archive for category: Research Reports

A financial market resource for the every-day investor and trader.

Welcome back investors and traders! This past week proved a pretty strong bounce-back week for markets after the prior...

As we entered 2024, investors have been told that just because the calendar changes that doesn’t mean the market...

by Michael Cembalest

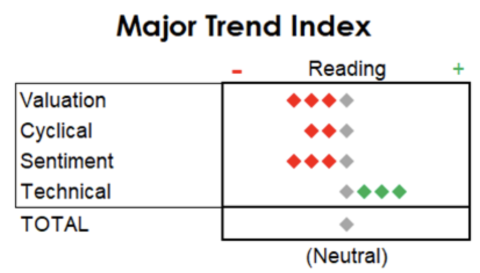

The Major Trend Index held at a neutral reading of zero in the week ended December 22nd. Bullish market...

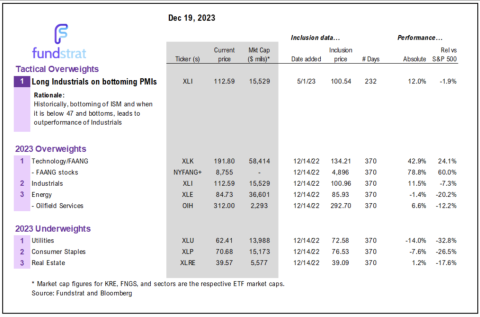

We discuss: how S&P 500 valuation is very reasonable as we enter 2024 and this is particularly notable when...

IT’S OFFICIAL! The S&P 500 has achieved our year-end price target of 4,750, formerly disseminated within our weekly Research...

By Robert Sluymer CMT Equity markets are resolving 2-year trading ranges to the upside – Further upside likely in...

S&P 500’s annual return after a NEGATIVE RETURN year. Average return the next year = 18%. Remember, however, the...

By Ellen Zetner chief U.S. ecoomist: We expect the Fed to hold the policy rate at 5.375% and to...

In 2023, the S&P 500 gained 20% yet most investors sat on the sidelines as many expected the U.S....

Most of the measures in the MTI’s Sentiment category—including the Bullish Sentiment of stock market newsletter writers—are interpreted in...

Since the start of the rate hike cycle in 2022, regional business cycles have weakened, earnings growth has stagnated...

Good weekend Finom Group investors and traders. As a reminder, throughout the month of December, our chief equity market...

Context and Comprehension are Key 🔑 A woman without her man is nothing! A woman: without her, man is...

CTAs’ net long position in USD/JPY cut by half from its recent peak Macro hedge funds may act on...

Seasonal trends are mostly about knowing where to look… and when! For this weekend Research note we are going...

J.P. Morgan on NVIDIA Corporation: Strong Results/Guide On AI Demand Pull For Datacenter Compute/Networking Products; Software Sales Accelerating; Reit OW

Seth Golden, , Research Reports, 0NVIDIA reported Oct results (revenue/GMs/EPS ) well above consensus and off of a higher Oct-Qtr revenue base, the team...

The Major Trend Index moved up to the neutral zone in the week ended November 17th, winding up a...

Recent Articles

Featured Products

-

JPM Market Recap

$0.00

JPM Market Recap

$0.00

-

JPM Research Note

$0.00

JPM Research Note

$0.00

-

JP Morgan Market Volatility Report

$0.00

JP Morgan Market Volatility Report

$0.00