Slower spending growth in February The growth in Bank of America credit and debit card spending per household decelerated...

Archive for category: Research Reports

A financial market resource for the every-day investor and trader.

To achieve long-term success over many financial market and economic cycles, observing a few rules is not enough. Too...

by Ian Shephardson of Pantheon MacroEconomic ADP and JOLTS are Unreliable Guides to Labor Market Trends The record of...

For those disappointed that February’s employment report won’t be released until March 10th, we have something to consider in...

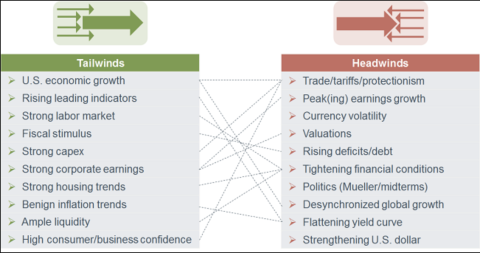

Can’t say it hasn’t been an interesting Q1 2023, right? With the New Year getting off to a sizzling...

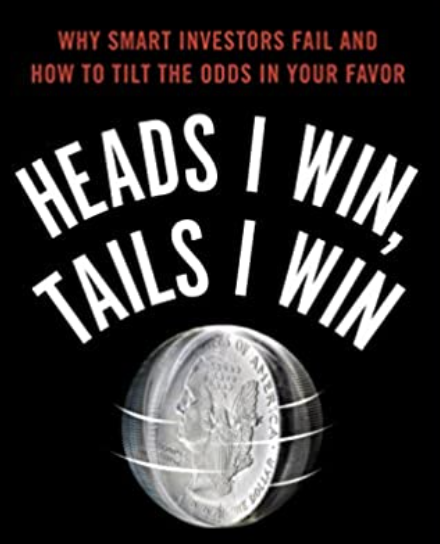

All intelligent investing is value investing, acquiring more than you are paying for. You must value the business in...

February Auto Sales will Mark a Turn in the Data as the January Boost Fades

Seth Golden, , Research Reports, 0by Ian Shephardson of Pantheon MacroEconomics The first indication that January’s warmer-than usual weather would boost economic activity was...

Humans are addicted to doomsday narratives. I’ve noticed that sometimes people WANT things to be worse than they are,...

Stepping back from the January noise, the trends in core economic activity data are discouraging. It’s unrealistic to think...

We only know what we know! In the future, we’ll know more through experiences or dedicated educational exercises, or...

Good day Finom Group members. As I continue to recover from my illness early this year (cough/cold), we will...

Core Services Inflation is Sticky, but the Fed is Exerting a Lot of Pressure Core CPI services inflation is...

Cross-Asset Strategy: With equities trading near last summer’s highs and at above-average multiples, despite weakening earnings and the recent...

Larger narrative is Fed “disinflation” is a massive course correction. Strong Jan equity returns borrowing from Feb, but dip...

To take a page out of last weekend’s Research Report, let’s highlight the theme centered on the probability of...

“During his tenure Lynch trounced the market overall and beat it in most years, racking up a 29 percent...

Macro Strategy—Fixed Income Positioning: Be Circumspect and Mind the Disconnect: For the past several months, risk assets including credit...

If you would like to watch our weekly State of the Market video, please click the provided link...

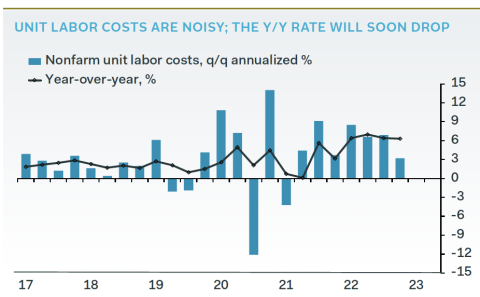

The ECI is the best measure of wage growth, but you still need to look under the hood, not...

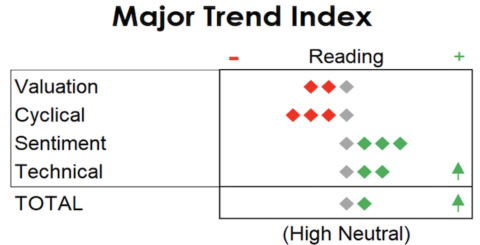

Doug Ramsey Chief Investment Officer & Portfolio Manager: Doug is the Chief Investment Officer of The Leuthold Group, LLC, and...

Chief Investment Office Macro Strategy Team at Merrill Lynch: Macro Strategy—Treasury Offsetting QT Until Mid-Year: The looming debt ceiling...

Yield curve is the most inverted in decades, yet many parts of the market are making new 52-week highs....

The bull vs. bear battle wagered on this past trading week, as the bears attempted to wrestle back into...

Recent Articles

Featured Products

-

JPM Market Recap

$0.00

JPM Market Recap

$0.00

-

JPM Research Note

$0.00

JPM Research Note

$0.00

-

JP Morgan Market Volatility Report

$0.00

JP Morgan Market Volatility Report

$0.00