“There are two types of investors”, according to Bank of America CIO Michael Hartnett: those who want to get rich, and those that want to stay rich.

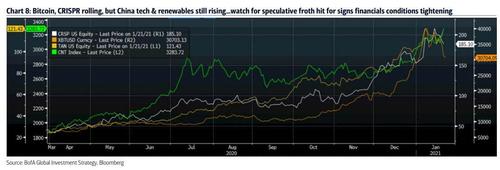

That’s how Hartnett begins his latest Flow Show note, warning that “when those who want to stay rich start acting like those who want to get rich, it suggests a late-stage speculative blow-off”, which one look at Gamestop (GME) today confirms is precisely where in the bubble we are today. Yet even though some speculative “froth” assets have gotten hit, with Bitcoin and CRISPR rolling on one hand, on the other China tech & renewables still rising (and actually so is bitcoin… again).

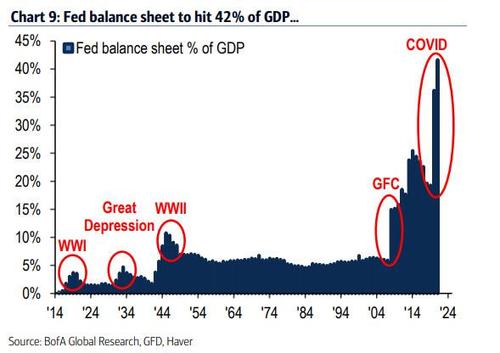

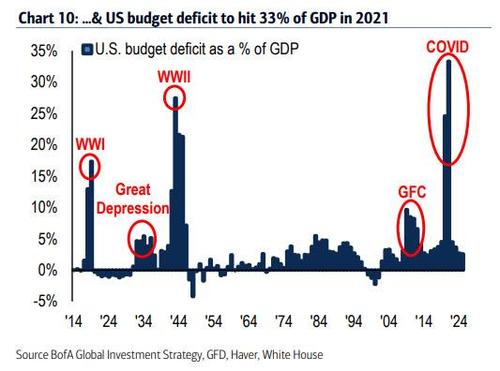

This is the current landscape investors are navigating due to the “Immoral hazard” unleashed by those in charge… a stimulus which BofA sees expanding the Fed balance sheet to a 42% of U.S. GDP and sending the U.S. budget deficit to a record 33% of GDP.

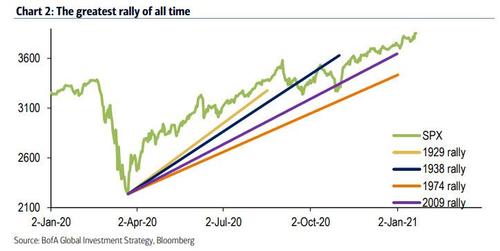

“It is this extreme policy, which remains the best explanation for extreme rally off lows in 2020, and the consensus macro boom in 2021.”

“Fiscal policies are fueling the equity rally, resulting in asset inflation which could drag Main Street inflation higher, risking a disorderly rise in bond yields, which could also result in a taper tantrum, tighter financial conditions and “volatility events” because there is nothing ever new under the sun and ’twas ever thus”:

- 1994: Orange County, Mexico

- 1999/2000: internet

- 2007/2008: subprime, housing

- 2013: IG, EM

- 2018: HY, leveraged loans.

The answer to the pandemic itself is likely to catalyze a disorderly spike in yields providing a trigger for the crash-like event. The widespread use of the Covid vaccine has the potential to bring about animal spirits. This reinforces our “Sell the Vaccine” tactical approach.

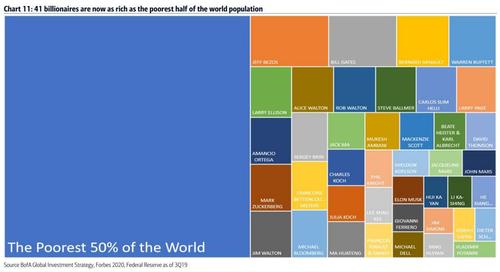

Meanwhile, until that happens, U.S. policy continues stoking inequality, with 41 billionaires now as rich as the poorest half of the world’s population.

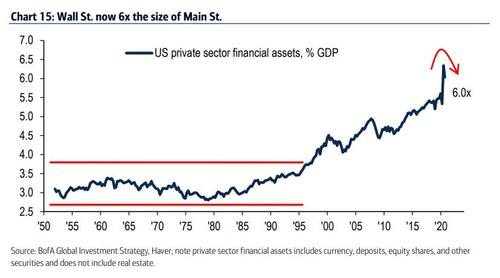

The market cap of Tesla now exceeds the MSCI India, Wall Street assets 6.0x Main Street GDP and the S&P500 trailing PE 2nd highest in 100 years, which in turn threatens populist backlash via taxation and regulation.

To be sure, inflation alone will do nothing to spark a crash – any serious selloff would require Fed intervention, namely tapering (first) and tightening or rate hikes (next). To Hartnett the critical early signs that financial conditions are tightening will be i) a U.S. dollar rally and ii) weaker corporate bonds (LQD<$133, HYG <$85), the assets which the Fed proved to backstop last March.

BofA is not predicting another bear market, and believes that after a Q1 correction normalizes asset prices and general market participation, value will once again present opportunity, and according to Hartnett, his base case for 2021, one of “big rotation and small returns assumes on the big investment trends of i) bigger government, ii) smaller world, iii) U.S. dollar debasement, iv) FX wars, v) monetary to fiscal excess, vi) subservient central banks, vii) peak inequality; viii) buy-the-dip strategies, which however should be confined to inflation assets (i.e. small cap, value, EAFE, EM, commodities, gold) that will increasingly indicate 2020 was secular low point for rates & inflation..

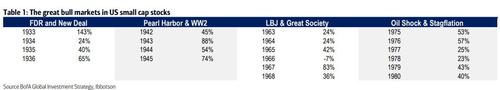

Hartnett also points to the multi-year outperformance of U.S. small cap stocks following secular lows in 1933, 1942, 1963, and 1975.

We leave you with some brief bulletin observations from Hartnett:

Winners & losers: winners: CRISPR 21%, solar 18%, EV 12%, energy 11%, China tech 11%, oil 10%, EEM 9%; losers: staples -2%, silver-3%, 30-year Treasury -5%.

For Whom the Barbell Tolls: investor embrace “Asia growth, global value” barbell; most overbought sectors (trading >20% above 200dma) are China/Japan/Korea/Taiwan tech and UK/Aussie/Brazil materials & HK/India/Spain banks.

Weekly flows: $21.6bn to equities, $17.4bn to bonds, $1.6bn to gold, $13.5bn from cash; past 12 weeks largest inflow ($255bn) to stocks ever (follows GOAT rally).

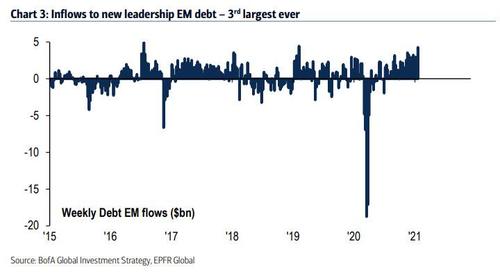

For Whom the Barbell Flows: inflows to new leadership EM debt ($4.3bn, 3rd largest ever – Chart 3), EM stocks ($4.1bn), financials ($2.3bn), energy ($1.6bn), bank loans ($1.0bn); still inflows to IG bonds ($8.5bn), health care ($2.4bn, 7th largest), tech ($2.0bn).

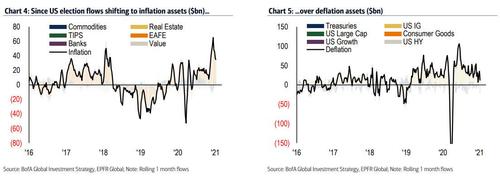

Investors buying Inflation: since U.S. election, trend in flows shifting to inflation assets (commodities, real estate, TIPS, EAFE, banks, value – Chart 4) over deflation assets (UST, IG, HY, large cap, consumer, growth – Chart 5), $457bn vs $320bn past 10 weeks, c/o with $0.8tn vs $3.2tn in prior 4 years; inflation expectations unambiguously rising as YoY lumber 36%, shipping rates 19%, appliances 17%, raw materials 13%, home prices 8%.

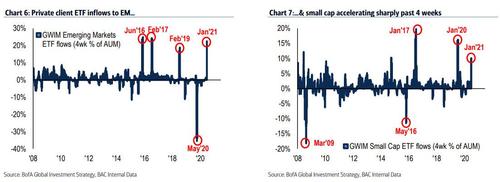

BofA private clients: GWIM AA 62.1% equity, 19.5% debt, 12.1% cash; note private client ETF inflows to EM & small cap accelerating sharply past 4 weeks (Charts 6 & 7).

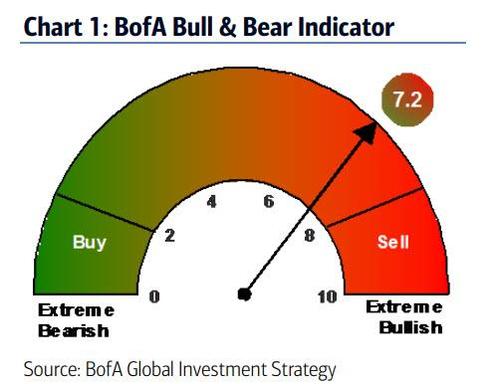

Waiting for Godot: BofA Bull & Bear Indicator up to 7.2 (Chart 1) from 7.1; note Bull & Bear indicator peaked 7.1 exactly 12 months ago when “sell signal” (>8) denied due to U.S. Treasury rally in Jan’20; yields trending higher in ‘21, we expect peak positioning & correction in Q1.