Although it may have seemed a strong rally on Wall Street Monday, the reality is that it was a mixed bag given tech lagged. The Dow closed up almost 200 points, with the S&P 500 also rising, after headlines that Canada had joined the U.S. and Mexico in a new trade deal. While the new trade deal is somewhat of a relief for many investors, its significance is far less than that which is in doubt between the U.S. and China. With that said, the favorable sentiment surrounding trade within the former NAFTA alliance, the tech-heavy Nasdaq could not hold gains, falling by .11% on the day.

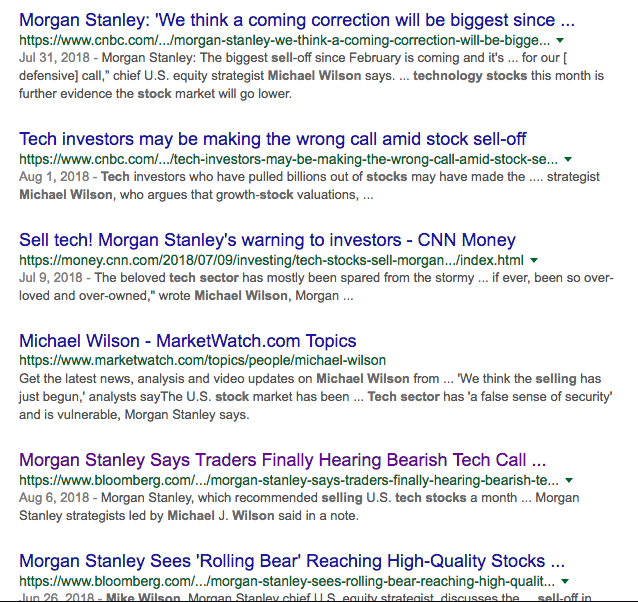

Tech and/or the Nasdaq have experienced a great deal of whipsawing over the last couple of months. There have been outsized moves in both directions during the months of August and September. Morgan Stanley has issued many warnings about the tech sector over the summer months, only to witness the Nasdaq achieve record level highs thereafter. Michael Wilson of Morgan Stanley believes the rolling bear market is underway and the market internals have broken down. He has suggested, as early as July that investors should be selling tech.

“When we made the call, feedback was fairly lopsided against us. Phones were not ringing and even those who had sympathy for our views of a poor near-term risk reward in tech could only muster an ‘I see your points, but … good luck,’ ” Michael J. Wilson said in a note back in August.

“If we are right, and tech gets its turn on the volatility roller coaster, its market weighting, crowded positioning and overweight in growth and momentum strategies mean the pain will likely spread beyond just the tech sector.”

We’ve chronicled Michael Wilson’s many, many warnings concerning his rolling bear market thesis throughout the summer and now here into the fall. To date, the bear market call hasn’t come to fruition, but as is the case with any strategist calling for a bear market, all they need to do is keep beating the drum given the eventuality of the call.

Wilson aired his bull market rhetoric on Monday once again on CNBC’s Fast Money show. Amongst his many considerations, Wilson shared his recent opinion that banks are signaling trouble is ahead with the 10-year yield at 3.10% and 16.5% forward looking earnings is the best we can get in the market going forward.

Wilson goes on, during the interview, to discuss corporate profit margins that he believes will be the big disappointment in 2019 as tariffs weigh more heavily on corporations. Not forgetting his bigger call from the summer, Wilson reiterates his concerns for the tech sector stating, “Tech will roll over with more and more tech names falling through the cycle.”

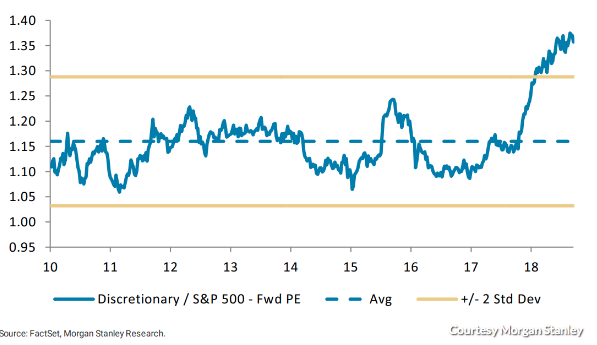

While Morgan Stanley’s bear market scenario hasn’t shown up as of yet and their chief market strategist’s warnings about the tech sector haven’t either, another sector has recently come under fire from the firm. The consumer-discretionary sector could be poised for a sharp retreat, according to Morgan Stanley, which described the industry as “an early-cycle sector trading at peak valuations in a late-cycle environment.” With such lofty valuations, the firm has recommended investors underweight the sector. Per the investment bank’s data, the aggregate price-to-earnings ratio for discretionary stocks is 35% above the S&P 500.

“The sector’s valuations are failing to appropriately price in the risks of an end of cycle slowdown that is being discounted in other sectors,” Morgan Stanley wrote in a note to clients. “Despite the contribution of returns and secular tailwinds by Amazon, a broader slowdown in growth and rising costs will likely challenge the earnings growth story on a sector wide basis more than is appreciated by the market.”

It’s not a pretty picture being offered by Morgan Stanley and with their year-end S&P 500 target of 2,750 in the rear view mirror presently. Noted below is a table of many financial firms S&P 500, 12-month targets.

| Firm | Strategist | 2018 S&P Target | 2018 EPS Estimate | Implied P/E |

| Morgan Stanley* | Mike Wilson | 2,750 | $162 | 16.98 |

| Goldman Sachs | David Kostin | 2,850 | $150 | 19 |

| Credit Suisse | Jonathan Golub | 3,000 | $161.50 | 18.58 |

| Deutsche Bank | Binky Chadha | 3,000 | $162 | 18.52 |

| Bank of America Merrill Lynch | Savita Subramanian | 3,000 | $153 | 19.61 |

| Citigroup | Tobias Levkovich | 2,800 | $153 | 18.3 |

| UBS | Keith Parker | 3,150 | $157 | 20.06 |

| BMO | Brian Belski | 2,950 | $158 | 18.67 |

| JPMorgan Chase | Dubravko Lakos-Bujas | 3,000 | $153 | 19.61 |

| Oppenheimer | John Stoltzfus | 3,000 | $146 | 20.55 |

| Fundstrat Global Advisors | Thomas Lee | 3,025 | $147 | 20.58 |

| Wells Fargo Investment Institute | Scott Wren | 2,850 | $152 | 18.75 |

| CFRA* | Sam Stovall | 3,000 | $156.20 | 19.21 |

| BNY Mellon Wealth Management | Jeff Mortimer | 2,850 | $152.50 | 18.69 |

| Canaccord Genuity | Tony Dwyer | 3,200 | $160 | 20 |

| RBC Capital Markets | Lori Calvasina | 2,890 | $151 | 19.14 |

| BTIG | Julian Emanuel | 3,000 | $150 | 20 |

| Bernstein | Noah Weisberger | 3,000 | $160 | 18.75 |

| Barclays | Maneesh Deshpande | 3,000 | $162.6 | 18.45 |

Finom Group’s chief market strategist, Seth Golden, remains of the opinion that the S&P 500 has not peaked as of yet. “All economic indicators continue to point in the direction of higher earnings for 2018 and the first half of 2019, at least”, he stated in a recent interview with Thomson Reuters.

“Small business confidence, labor and employment measures, retail sales and consumer spending are all suggesting the economy is on solid footing. We’ve had 3 consecutive months of 6%+ retail sales growth and consumer sentiment hitting all-time highs. Wage gains have been modest, but so has inflation with the real fed funds rate still near zero. I can foresee a time when the laws of large numbers start to impact corporate earnings, possibly as early as Q2 or Q3 2019, but that is still some 6-9 months off. And it’s not like earnings are set to fall off a cliff come that time. It’s merely a curtailment of earnings growth that we’re likely going to see. Instead of the 20% earnings growth in 2018, next year we’re likely to see high single digit earnings on the whole.

Of course the lingering trade disputes with Europe and China remain a headwind and could curb earnings growth further in 2019, but investors who heed dire warnings in favor of current trends in the economy are likely going to limit their potential. I’m not sure I ever understood the notion of selling equities outside of a recession. That’s never, in the history of the stock market proven to be a recipe for success.”

At Finom Group, one of the things we continue to notice throughout these latter innings of the bull market cycle is the proliferation of “top calling” and bear market warnings. What these heralding sentiments offer tends to confuse investors, as they tend to cite factors that amplify a bear market, but not factors that cause a bear market. The causations of a bear market are usually the collection of many variables. Having said that, the U.S. is a consumer driven economy and therefore all roads that make up the infrastructure lead to the consumer.

Economic recessions are caused by a loss of business and consumer confidence. As confidence recedes, so does demand. This is the tipping point in the business cycle. It’s where the peak, accompanied by irrational exuberance, moves into contraction. If we we’re to list the 3 broadest contributing factors that lead to an economic recession we would offer them as follows:

- High interest rates. When rates rise, they limit liquidity, or the amount of money available to invest

- A stock market crash. The sudden loss of confidence in investing can create a subsequent bear market, draining capital out of businesses.

- Falling housing prices and sales. As homeowners lose equity, it forces a cutback in spending as they can no longer take out second mortgages. Over time, it will cause foreclosures. This was the initial trigger that set off the Great Recession, but for different reasons. Banks that lost money on the complicated derivatives based on underlying home values.

The problem with suggesting that the aforementioned warning signs and economic recession indicators might be that the last recession distorts future recession indicators. In other words, rates are and have been rising over the last 18 months, but they are rising from historically low levels, levels not seen since the 1970s. Given the size of the labor market and level of unemployment, the populous has the ability to absorb higher rates, which are only relatively high on a YOY basis and not even at levels reached prior to the last recession. The 10-year Treasury would need to yield more than 5.25% before it achieves the prior expansion cycle high. And it wasn’t interest rates that caused the previous recession, but rather a multitude of factors surrounding the procurement of variable interest rate/subprime loans, deregulation and over exuberance surrounding the housing market that was derived from a lacking of regulations whereby financial institutions leveraged too heavily.

Moreover, another difficulty with assigning a time frame for the eventual market downturn and economic recession would have to be the chronology of economic stimulus impacting the economy. Never has an economic expansion born witness to such late cycle stimulus, defined by the longevity of the expansion cycle, as the most recent tax reform has offered. Given the longstanding gap between the last tax reform package and the most recent, there is not much in the way of historic modeling to offer a reasonable forecast for economic output thereafter. To some degree, it’s a guessing game that consists of following the data and projecting the most likely outcomes based on trend.

Investors aren’t left without options, as we do believe in the eventuality theory. Eventually the economy will falter and the bull market will come to an end. What investors do between now and “the great eventuality” is crucial to their long-term investing goals and success. Most investors, however, fail to prepare in favor of “riding the bull” and with an emphasis on beating the bull market. For many this can be a big mistake.

Investors and financial advisers should be focusing more of their energies on how to limit bear market losses than on how to beat the S&P 500 during a bull market at this stage of the cycle. Additionally they should be reviewing their long-term strategy and possibly game planning the next 6-12 months Nowadays, with the U.S. stock market at an all-time high, this is the perfect time to express such an exercise in portfolio management. It will be too late if you wait until the bear market is upon us. Does this mean you should start selling equities? This is not the likely action one should take, as previously mentioned.

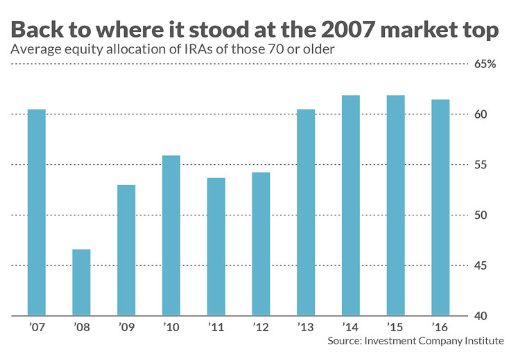

A new book by Brian Livingston, “Muscular Portfolios: The Investing Revolution for Superior Returns with Lower Risk.” , discusses the steps that investors take during bull markets that can shield their capital during bear markets. Check it out! Within the book, the author highlights asset allocation and compares IRA exposure to equities in 2007 with equity exposures today.

The psychology of a bear market is difficult to navigate and when selling pressure exacerbates, it becomes compelling and finds great capitulation. Most investors sell into such capitulation and as the natural element of fear takes over. Investors forget the long-term eventuality of the stock market, which is historically validated. Over time, the equity market climbs higher and higher, with intermittent declines that prove temporary. So what should investors be doing now? Plan ahead and evaluate your risk tolerance with a long-term outlook.

Tags: PEP SPX VIX SPY DJIA IWM QQQ XLK XLY XRT