September is very much living up to its usual swooning of price action, and finding investors recoiling. The seasonality...

Author Archive for: Seth Golden

A financial market resource for the every-day investor and trader.

Man Institute: If history is any guide, at this juncture bonds may be a more attractive proposition than equities, at least in the short term.

Seth Golden, , Research Reports, 0Let’s begin with a mea culpa. In my note of 18 May 2023, I wrote that the risk/reward for equities...

Capital Economics: Soft landings, immaculate disinflation, and US equities

Seth Golden, , Research Reports, 0A “soft landing” for the economy in the US seems increasingly possible, so we look back at previous similar episodes...

The explosion of interest in artificial intelligence this year has fueled a major rally in technology stocks, with a concentrated group...

Let’s not blow things out of proportion, as the first full trading week of September and month-to-date returns are...

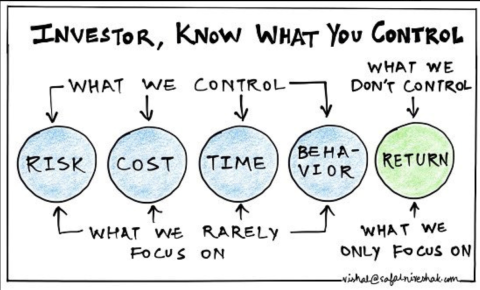

The Paradox: The #1 concern for most investors/traders forces the diversification of a portfolio, which ultimately and perpetually underperforms...

RBC Capital: Historical Election Playbook, Tactical Problems With Growth Persist

Seth Golden, , Research Reports, 0RBC Capital’s chief market strategist Lori Calvasina: Welcome to RBC’s Markets in Motion podcast recording August 28th, 2023. I’m...

Well, it looks like I’ll be the only one at Finom Group working this weekend. Edward and the Support...

Cross-Asset Strategy: US Q2 reporting delivered soft earnings growth and less upbeat corporate guidance, as corporates are seeing demand...

Why the US money supply is shrinking for the first time in 74 years

Seth Golden, , Research Reports, 0The U.S. money supply is shrinking for the first time since 1949, as savings deposits decline and the Federal...

Capital Economics We think the 10-year Treasury yield will end the year well below its current level. The sell-off in...

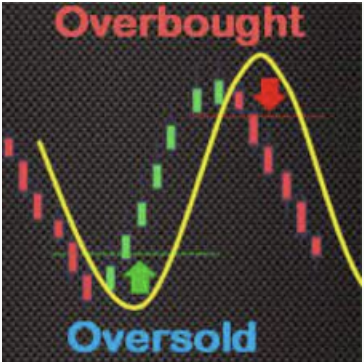

The following charts and analysis were previously offered inside Finom Group’s weekend macro-market Research Report titled “From Good Overbought...

Keep it simple stunad! Permabears/doomsayers live in a world of predetermined, low probability, negative finality. Bulls/optimists get paid! You...

Price momentum is a key driver of sentiment, especially in a late cycle environment when uncertainty about the outcome...

Welcome to another trading week. In appreciation for all of our Basic Membership level participants and daily readers of...

August has proven itself to be a “Wall of Worry” and the point for which the former “good overbought”...

Question: “How do you perform well over time and never let the volatility deter you?” Answer: “Position long, hope...

Developing Seasonal Pressure: Macro-Technical Updates From RBC Capital & Fundstrat

Seth Golden, , Research Reports, 0The stock market rally off the washed-out lows of early last fall has run further and for longer than...

Welcome to RBC’s Markets in Motion podcast recorded August 7th, 2023. I’m Lori Calvasina, head of US equity strategy...

Welcome to another trading week. In appreciation for all of our Basic Membership level participants and daily readers of...

The consolidation phase is upon us. It is more recognizably taking place, and as usual, causing investors to doubt...

The month of October gets all the “love,” but since 1990, August has been the cruelest month for stocks....

Those who are unwilling to accept double-digit drawdowns are less likely to receive double-digit returns! Take your drawdown like...

Optimism around a US policy pivot has continued to support valuation. In today’s note, we discuss parallels to prior...

Recent Articles

Featured Products

-

JPM Market Recap

$0.00

JPM Market Recap

$0.00

-

JPM Research Note

$0.00

JPM Research Note

$0.00

-

JP Morgan Market Volatility Report

$0.00

JP Morgan Market Volatility Report

$0.00