With the Fed’s pivot now well understood and appreciated, investor attention now turns to growth which is slowing faster...

Author Archive for: Seth Golden

A financial market resource for the every-day investor and trader.

Research Report Excerpt #1 In order for drawdowns to not become realized losses, sometimes we also have to elongate...

It is not often that Finom Group is tasked with delivering a pessimistic interim outlook, but technicals are delivering...

“Buying on red days is where longterm profits begin! 90%+ of investors/traders are dedicated to finding problems in a...

Our new Fed forecast simply brings forward our call for lower equity valuations and raises the risk in the...

Fed Funds Rate History The charts below show the targeted fed funds rate changes since 1971. The Federal Open Market...

Macro Strategy—Expansion and Profits Growth to Continue in 2022: Current Federal Reserve (Fed) projections and the leads and lags...

“Anyone can get lucky for a short period of time. But consistent outperformance over long periods is probably evidence...

Weekly Warm-up: PMIs and Earnings Will Ultimately Determine the End of the Correction

Seth Golden, , Research Reports, 0With all the attention on rate moves so far this year, investors may soon shift that focus to growth....

Research Report Excerpt #1 It’s important to respect seasonal patterns/data, but the seasonal data is often best utilized when...

After 3 consecutive years of double-digit returns for investors who stayed the course, through the ups and downs, downs...

“If you can’t pull the trigger on stocks here it may be because you’re focused on the next 3%...

A new year brings new investment opportunities even if the narrative isn’t changing. We still recommend a large cap...

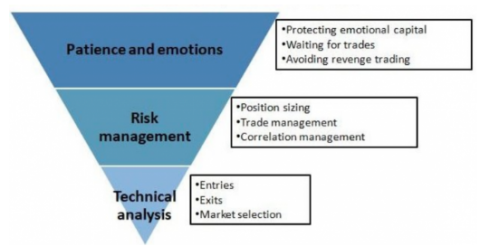

The way Technicians feel about Fundamentals is the way Quants feel about Technicians!! Know which discipline aligns mostly with...

Fundstrat 2022 Outlook: Stocks + Treachery = Challenging but +11%

Seth Golden, , Research Reports, 07 GENERAL PRINCIPLES: What is evidence-based research 1. Nothing new under the sun: Importance of looking at cycles 2....

Macro Strategy—The U.S. trade-weighted dollar remains overvalued, much as we anticipated one year ago, and may well be able...

For those who have never experienced a bear market before, welcome to the worst of times! Know that for...

Ease is a greater threat to progress than hardship ~ Denzel Washington If you want to view our weekly...

Morgan Stanley’s Weekly Warm-up: Tapering on Deck — Stick with Defensive Quality in Factor Frenzy

Seth Golden, , Research Reports, 0While expected, we think the Fed’s pivot to a more aggressive tapering schedule poses a larger risk for asset...

Key Metrics Earnings Growth: For Q4 2021, the estimated earnings growth rate for the S&P 500 is 21.2%. If...

Look for further upside in 2022, the cycle is far from finished… the dip driven by new variant scare...

A new COVID variant started the ruckus for markets, but we view that as secondary to the real culprit—the...

Research Report Excerpt #1 Nonetheless, some variables provide greater force and as such are characterized as force factors. I’m of the opinion, the force...

Who needs a reset? Is it the S&P 500 (SPX), the forward price/earnings (P/E) multiple, the Nasdaq (COMPQ), the...

Recent Articles

Featured Products

-

JPM Market Recap

$0.00

JPM Market Recap

$0.00

-

JPM Research Note

$0.00

JPM Research Note

$0.00

-

JP Morgan Market Volatility Report

$0.00

JP Morgan Market Volatility Report

$0.00