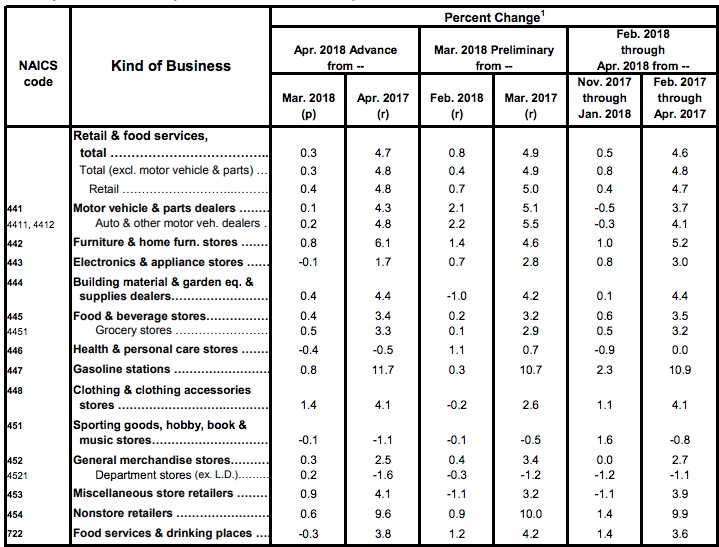

Wall Street is looking to open lower on the heels of Home Depot missing on the top line and monthly retail sales data from the Census Bureau. Let’s get to that headline data firstly as we’ve entered the retail earnings season. April retail sales rose 0.3 percent (±0.4 percent)* from the previous month, and 4.7 percent (±0.5 percent) above April 2017. Total sales for the February 2018 through April 2018 period were up 4.6 percent (±0.5 percent) from the same period a year ago. The February 2018 to March 2018 percent change was revised from up 0.6 percent (±0.5 percent) to up 0.8 percent (±0.2 percent). The revision to last month’s retail sales shows that the consumer has shown resiliency even as gasoline prices have risen.

April marked the 2nd consecutively MoM gain for retail sales after 3 consecutive monthly declines.

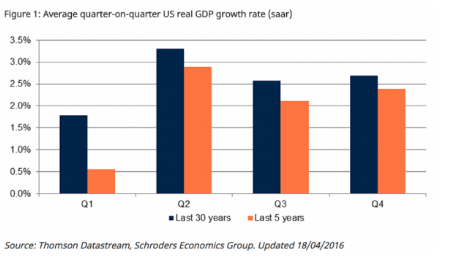

As one can see from the categorical retail sales breakdown for April, clothing stores posted the biggest increase in sales in April as Americans bought the latest fashions or got new outfits for the warm weather. Also, consumers spent a lot more on fuel in April, with sales at gas stations rising 0.8%. Auto sales barely rose. Consumers spent a bit less last month on appliances, electronics, health-care items and sporting goods. Monthly retail sales marks the first major piece of economic data that helps economists forecast GDP for the quarter. The acceleration in spending in the spring points to a stronger reading in gross domestic product in the 2nd quarter than that of the 1st quarter.

Ahead of the strong monthly retail sales data, Home Depot reported less than expected top line results even as bottom line results beat analysts’ estimates. The home-improvement retailer made $2.4 billion, or $2.08 a share, up 19% from the $2.01 billion, or $1.67 a share, it made during the same quarter a year ago. Net sales rose 4.4% to $24.95 billion. Analysts polled by Thomson Reuters were expecting revenue of $25.15 billion. Cost of sales rose 3.8% to $16.33 billion. Home Depot said comparable-store sales rose 4.2% and U.S. comparable-store sales rose 3.9%. Analysts polled by Consensus Metrix were expecting same-store sales to rise by 5.6% and U.S. same-store sales to rise by 5.5%. Total operating expenses rose 9% to $5.24 billion. The company said it expects sales to increase by about 6.7% for the year. In the company’s fourth-quarter earnings results, it said it expected sales for 2018, including the 53rd week, to rise by about 6.5 percent. Home Depot said in its latest earnings report it expects comparable-sales in 2018 to rise by about 5 percent.

While the economic data reported strongly, almost simultaneously the 10-yr. Treasury spiked to its highest level since 2014 at just over 3.04 percent.

Equity futures dropped significantly in light of this move. After a rather strong move for the S&P 500 over the last several trading sessions that put the index nicely above its 50-DMA, we’ll have to see how Wall Street feels about a further risk-on environment. One thing that was made pretty clear this morning is that precious metals aren’t finding favor as a risk parity trade for fund managers. Gold futures early Tuesday in New York broke sharply lower, flirting with seven-month lows after the economic data was released. Rising rates have played a key role in undermining appetite for the asset considered a safe haven.

https://www.youtube.com/channel/UC27GoaYlX4Fn6cbdt_hOdVg

Tags: HD SPX VIX SPY DJIA IWM QQQ