-

Seth Golden posted an update 4 years ago

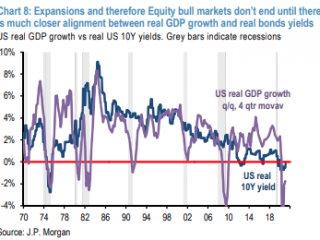

4) What level of interest rates stresses the economy

and Equities? Interest rates always rise to some degree asthe economy revives, but the risk of a negative feedback

loop from higher financing costs to slower growth due to too much leverage isn’t even relevant when real rates are

negative. Indeed, business cycles don’t end until real ratesare much closer to the rate of real GDP growth (chart 8),

and Equity bull markets don’t end until the business cycledoes. So thinking transitively, the Equity bull market

shouldn’t be threatened until real rates are well intopositive territory.