-

Seth Golden posted an update 4 years ago

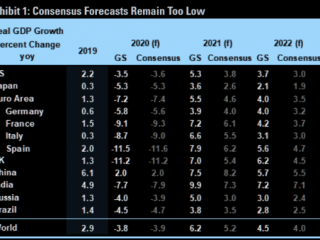

Jan Hatzius explains why Goldman is right and consensus is wrong: “Our global growth numbers remain well above consensus because we think too many forecasters are extrapolating too much from past cycles. Most recent recessions have resulted from asset price busts and other financial shocks, whose negative effects on output took time to develop and even more time to unwind. By contrast, the 2020 slump resulted from a health crisis, whose negative effect on output was huge and immediate but also quickly reversible. Some sectors that largely shut down in the spring lockdowns—e.g. auto manufacturing—have learned to keep producing even in a virus-ridden environment. Other sectors that remain depressed for now—e.g. travel and entertainment—are likely to rebound sharply once enough people are vaccinated. This is likely to trigger renewed upgrades in consensus growth forecasts”