While no easing or resolution to the rising tensions between the U.S. and Iran have been revealed over the weekend, Wall Street found itself rebounding on Monday. The major indices followed the European indices higher on Monday and led by the Nasdaq (NDX), which was higher by .71 percent on the day. Without geopolitical relief, the markets seemed to rejoice in the promise of a bipartisan deal over the U.S. debt ceiling that became a reality in the late afternoon.

President Donald Trump and congressional leaders announced Monday they had struck a critical debt and budget agreement. The deal amounts to an against-the-odds victory for Washington pragmatists seeking to avoid politically dangerous tumult over the possibility of a government shutdown or first-ever federal default.

The deal, announced by Trump on Twitter and in a statement by Democratic House Speaker Nancy Pelosi and Senate Democratic leader Chuck Schumer, will restore the government’s ability to borrow to pay its bills past next year’s elections and build upon recent large budget gains for both the Pentagon and domestic agencies.

The U.S. equity markets have done a remarkable job of climbing the proverbial “wall of worry” over the last 6+ months. From trade feud escalations, trade threats and Mideast skirmishes to various domestic political debates and upheavals in the U.K. and the U.S., the S&P 500 (SPX) has risen roughly 20% in 2019. With yesterday’s debt ceiling deal being removed from the rising list of market concerns, another item on the list seems to be getting checked-off. On Monday it was also headlined that the U.S. trade delegates would finally be traveling back to China for further trade talks.

The initial arrangements for the meeting in Beijing, according to the source who declined to be identified, came after the United States announced that it would offer exemptions to 110 Chinese products, including medical equipment and key electronic components, from import tariffs. In a goodwill gesture of their own, China also said that several companies would buy American agricultural products having already applied for exemptions from the tariffs imposed by Beijing.

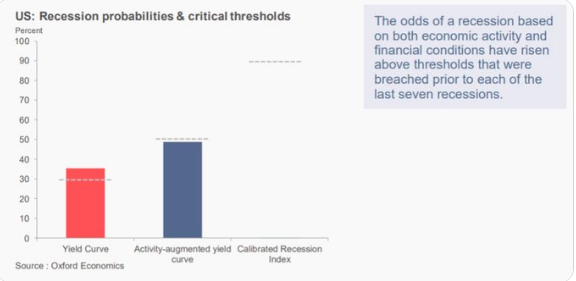

Certain of the U.S. economic data continues to prove worrisome for many analysts and economists. This remains yet another hurdle for equities going forward and with investor sentiment proving to be mostly sanguine over the course of 2019. Modeling from Oxford Economics shows alarming U.S. recession odds in 6-12 months.

“Though we think this overstates risks and the U.S. economy isn’t sick, with protectionism, policy uncertainty, and a sniffling global economy, immunization, via a Fed rate cut, looks timely”

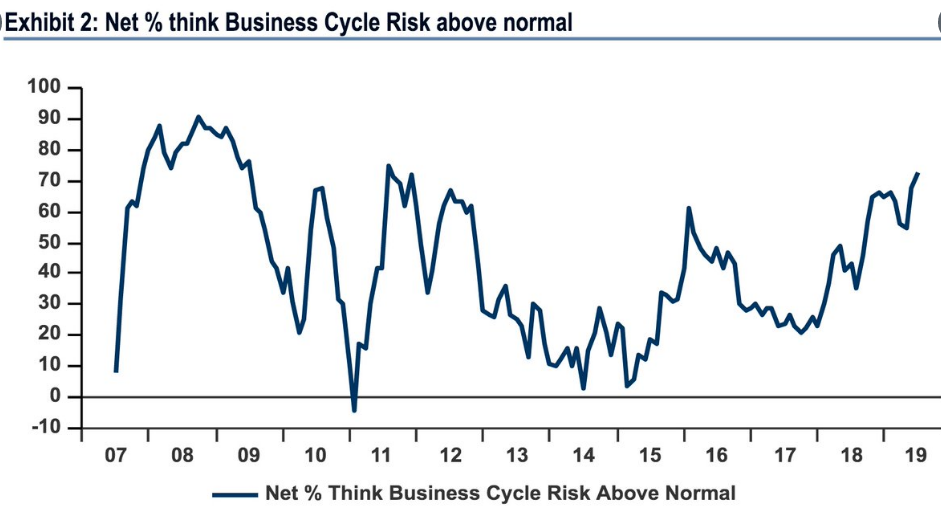

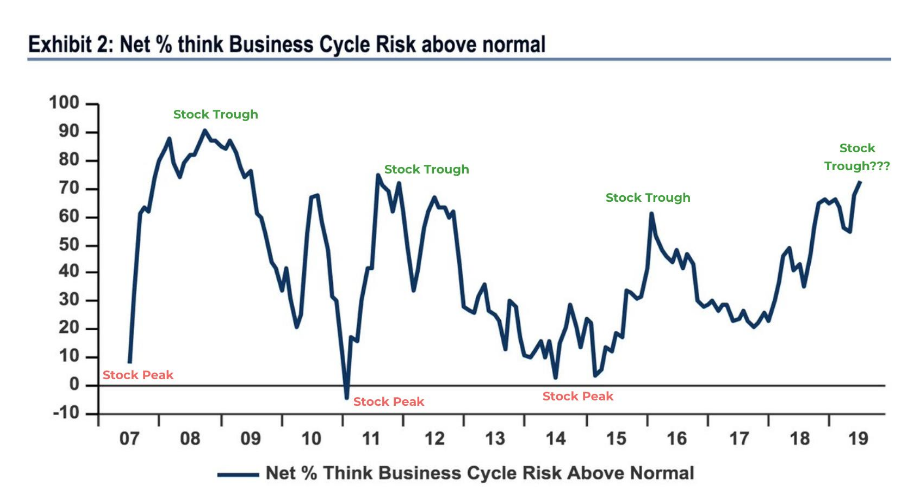

Oxford Economics is the only firm out with a chart or table and verbiage that shows concerns about the economy or business cycle. The most recent Bank of America Merrill Lynch Fund Manager Survey (FMS) shows a similar concern over what is now the longest expansion cycle in U.S. history. Over 70% of fund managers think there is a chance of a recession, as indicated in the chart below:

Both charts offering sentiment about the economy look rather ominous, but look what happens when we point out what stocks are doing, juxtaposed against the FMS survey data.

Usually, stocks are performing poorly when economic recession risks are on the rise and or peaking, but that isn’t the case in 2019. The S&P 500 has achieved record highs. If you don’t think that this time is different, the chart indicates otherwise. Most fund managers & analysts are notoriously wrong at major inflection points.

It might seem as though Finom Group is being dismissive of risks and fears of a recession, but to the contrary, we simply stay clear of confirmation bias and herd mentality. Simply put, there’s far too much of that in the marketplace and even dedicated publications that prey on investor’s fear and bias.

As Thio Brkan puts it, private wealth manager, “It’s much easier to herd with the majority (over 70%) of other fund managers in the Merrill Lynch Fund Manager Survey and go on a “Recession Watch” for 2 weeks — interviewing everyone who shares a similar view to you. This is partly known as a “Confirmation Bias” and partly “the False-Consensus Effect”. The confirmation bias shows that “people tend to listen more often to information that confirms the beliefs they already have. So you go and interview people who see the same things as you, confirming to yourself you’ll be right.”

As fears of a recession on the horizon loom large and pervade investor sentiment, Morgan Stanley is seemingly the biggest bear voice on Wall Street in 2019. Interest rate cuts might come too late to save an economy that is dangerously close to slipping into recession, according to Morgan Stanley economists.

“For now, the path to the bear case of a U.S. recession is still narrow, but not unrealistic,” a team led by the firm’s chief U.S. economist, Ellen Zentner, told Morgan Stanley clients in a lengthy analysis that spells out the likelihood of negative growth within the next 12 months and what investors should do if that comes to pass.

Trade tensions that could lead to layoffs and a pullback from consumers are at the center of the recession case. Zentner said the current “credible bear case” probability is about 20%, but that could change quickly.

“If trade tensions escalate further, our economists see the direct impact of tariffs interacting with the indirect effects of tighter financial conditions and other spillovers, potentially leading consumers to retrench. Corporates may start laying off workers and cutting capex as margins are hit further and uncertainty rises.”

Zentner said Fed policy easing could be negated by increasing pressure from tariffs that could pull both the U.S. and global economy into recession.

“If cuts are not enough to stave off recession, risk assets will not work — for example, US equities have been down between roughly 15% and 50% from their pre-recession peaks at the end of prior cycles, notwithstanding a Fed that is cutting.”

Clues for when the recession will start come from a variety of measures: Nonfarm payrolls, consumer strength, manufacturing and aggregate indicators of growth such as those the Conference Board publishers are reliable yardsticks, Zentner said.

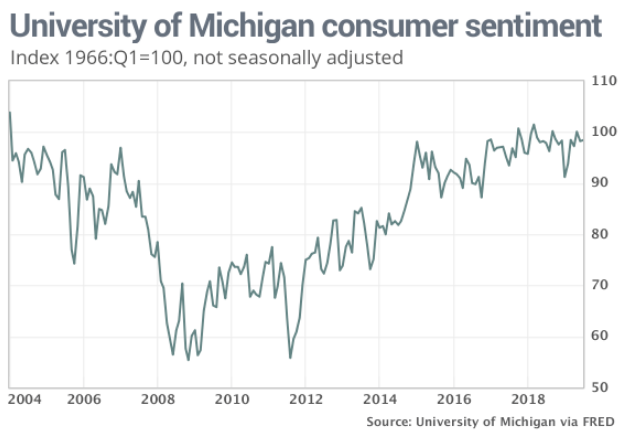

As mentioned earlier, certain of the economic data remains under pressure, especially that within the manufacturing sector. Having said that, since the trade truce with China was enacted and the threat of tariffs on Mexico removed, regional manufacturing indexes have rebounded sharply. Additionally, consumer confidence remains elevated. The consumer sentiment survey edged up to 98.4 this month from 98.2 in June, according to a preliminary reading from the University Michigan.

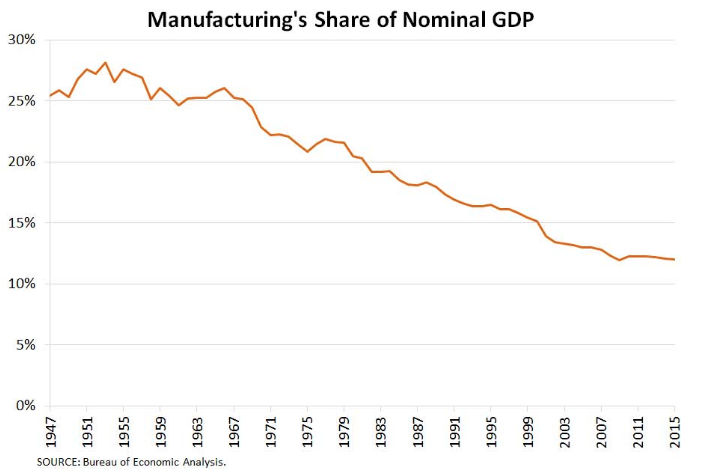

And while the manufacturing rebound doesn’t suggest a new uptrend just yet, manufacturing continues to decline as a percentage of GDP and has been for the last 70+ years.

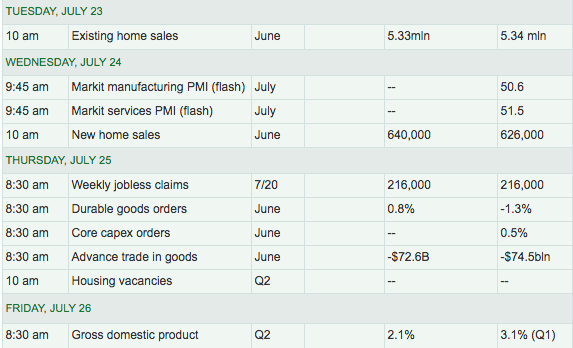

The U.S. is an increasingly service-driven and consumer-driven economy that is ever less reliant upon manufacturing. Investors will receive more economic data as the trading week rolls forward with equity futures on the rise Tuesday. The only piece of economic data due out Tuesday comes via Existing home sales. New homes will be released Wednesday while investors await their first look at Q2 GDP on Friday, ahead of the ECB meeting the same day.

A 1.2% pullback in the S&P 500 doesn’t amount to a hill of beans after a greater than 20% rise in 2019, but it has been enough to suggest a pullback is underway. That could easily be found with error should earnings continue to come in better than anticipated with supportive forward looking guidance. Nonetheless, many don’t believe the risk/reward potential is favorable for bulls presently.

After the S&P 500′s nearly 19% gain this year, the benchmark index is now trading near its fair value relative to interest rates, profitability as well as price-to-book valuations, according to David Kostin, Goldman’s chief U.S. equity strategist.

“The path forward for index return on equity is likely to be challenging, although lower interest rates and lower tax rates may provide support. We believe policy uncertainty and negative revisions to 2020 EPS forecasts will limit equity upside.

We forecast flat S&P 500 margins through 2020, with risks tilted to the downside. … Amid concerns about the growth and profitability outlook this year, investors have assigned a premium to companies able to expand ROE.”

Canaccord Genuity’s chief market strategist and noted market bull Tony Dwyer is also of the opinion that the market could pullback some 5%, but that dip in valuation should be bought by investors. Here is what Dwyer offered in his latest interview on CNBC’s Fast Money.

In the interview, the strategist discusses the likelihood of a similar pullback to what occurred in May, but with the backdrop of an easing cycle commencing, investors shouldn’t fight the Fed.

Dwyer goes on to say that the Fed is concerned that about finding unemployment at 50+ year lows and yet core PCE is just 1.6 percent. Given such conditions, the Fed has no choice but to cut rates in July.

But how much higher can equities rise given that earnings forecasts are muddied and may show very little to no growth in 2019? The market is a forward pricing/looking mechanism and as such, forecasts will become increasingly important to investors as 2019 carries forward. For now, many strategists simply suggest to stay the course as the Fed embarks on an easing campaign and with low interest rate policies firmed around the world.

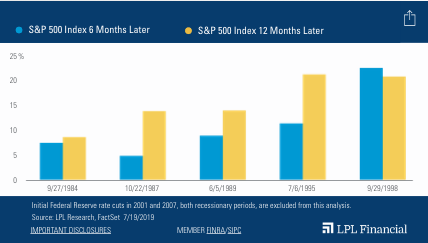

LPL Financial recognizes the achievement of S&P 500 reaching all-time highs in their recent notes and suggests investors should continue to hold equities and look for better valuations to add market exposure.

“…primarily because the market is giddy about rate cuts. The adage “Don’t fight the Fed” applies here. The last five times the Federal Reserve (Fed) began cutting rates outside of recessions (1984, 1987, 1989, 1995, and 1998), the S&P 500 rose an average of 11.1% over the subsequent six months and 15.8% over the next year, as shown in the LPL Chart of the Day, Initial Rate Cuts Outside Of Recessions Have Helped Stocks.

“Even though fundamentals may not justify the market going much above our 3,000 forecast on the S&P 500, with the Fed tailwind behind us, we’ll ride the wave for now.”

Another factor lending itself to what is still minimal bullish sentiment in the market continues to be corporate buybacks. While buybacks are slightly below the pace of 2018, a recent report from J.P. Morgan Chase shows that buybacks do what their intended to do.

“Stocks of companies that buy back their shares tend to outperform both short and long term, and we estimate over 4% outperformance for high-buyback companies in the U.S. and Europe over the past 20 and 25 years.”

Are buybacks rising too fast and consuming too much of corporate free cash? The report concludes that the level of buybacks is about in line with the 15-year average (they are about 2% of the market capitalization of the S&P 500 each year), and only appear higher because profits are higher and the markets are at a record. It’s easy to disparage the activity of corporate buybacks and fail to see that not much has changed in that component of the market for a great many years. What is also easy to do is to forget the strength of the market rally since the December 24, 2018 bottom.

Nobody says investors have to like how or why the market has rallied or why the economy has expressed concerns, but not yet found a recession. But if you fail to recognize the facts and remove bias, you could miss out on opportunity. With recession and pullback warnings abound, what we encourage investors to keep in mind is what just happened in the market and what history tells us we MIGHT expect going forward, based on fact-driven historic data delivered by Chris Ciovacco Capital Management.

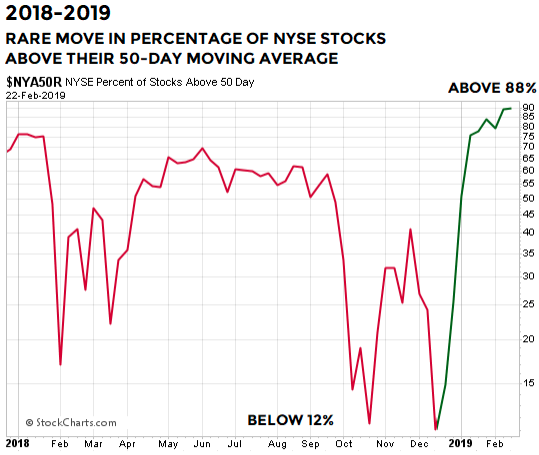

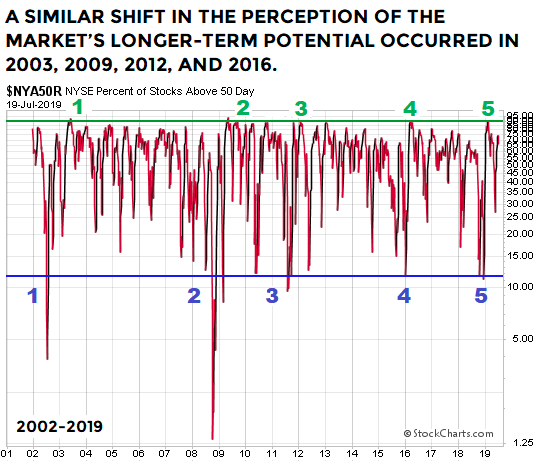

A rare event took place between the close on December 24, 2018 and the close on February 22, 2019. As shown in the NYA50R chart below, the percentage of NYSE stocks above their 50-dma dropped below 12% and then rebounded to above 88%; a move that showed a significant shift in the perception of the stock market’s longer-term potential.

Going back to 2002, a similar shift in market participant perceptions occurred in 2003, 2009, 2012, and 2016. In each case, the percentage of NYSE stocks above their 50-day moving average dropped below 12% and then rallied back above 88 percent.

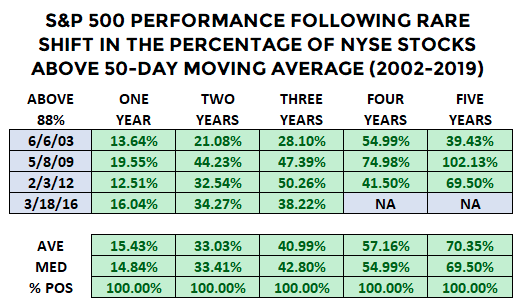

The table below shows S&P 500 performance in each of the four cases that featured the rare push from below 12% to above 88% in the percentage of NYSE stocks above their 50-dma.

The table above denotes time frames starting 12-months later, so do keep in mind there are always pullbacks within the time frames offered that may lend themselves to buying opportunities should economic conditions remain stable.

As we embark on a new Fed easing cycle, we are also brushing up against a new Presidential election cycle, which finds candidates offering their own warnings on the economy. The latest warnings come from candidate, Senator Elizabeth Warren. Finom Group takes up no political agenda in this latter discussion but for the sake of clarity and fact-driven analysis.

Warren is warning voters that the U.S. economy is stumbling toward a crisis akin to what the whole world lived through just 10 years ago. Seems a bit of a stress seeing how there is very little if any built up excesses in financial conditions and market valuations remain within their 10 and 20-year ranges.

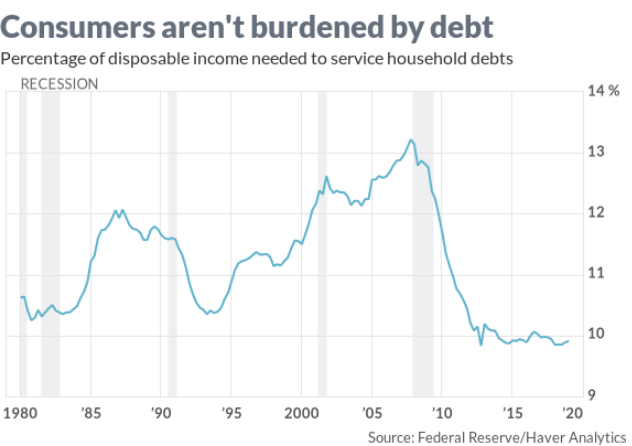

The heart of Warren’s case is that consumers are drowning in debt, as they were 10 years ago. At Finom Group we recognize that debt levels, corporate or household, do one thing long-term; debt rises. But Finom Group also recognizes that its not the size of the debt that matters, it’s the service ability of that debt that matters most. And as we can see in the chart below, based on debt to income ratios, debt burden is unusually low.

Federal Reserve data show clearly that the percentage of monthly income going for debt service is nearly as low as it has ever been, and not rising materially. The key to that is low interest rates and a healthy labor market that is producing rising wages.

The fact is, as long as rates are low, consumers can afford the borrowing they are doing. And they are doing less; consumers are closing credit-card accounts, not opening them, and home-equity line of credit balances are low and falling. Credit-card delinquency rates, while up a bit since 2015, are lower than at any point between 1991 and 2013.

Everyone has a recession concern or two to espouse and it has been that way since probably 2016. As the economic expansion cycle continues to set new records, expect those recession concerns to carry forward. It’s up to you to decipher fact from fiction, however, and to invest accordingly.