And the beat goes on… with the three major indices surging above high water mark levels in 2018. The Dow was the last major index to seek out and conquer a whole number as it marched above 25,000 in yesterday’s trade. The S&P 500 rose 10.93 points, or 0.4%, to close at 2,723.99. The Nasdaq Composite Index gained 12.38 points, or 0.2%, finishing at 7,077.91 in yesterday’s trade. Analysts have said that the upbeat sentiment for equities is buoyed by a protracted rise in commodity prices, solid economic data, and bond yields remaining at historic lows. The recently passed tax-reform legislation is also noted as a major contributing factor, boosting equity prices. This brings us to the end of the trading week whereby we have one last piece of significant economic data on the docket.

At 8:30a.m. EST, we will see just how strong the labor market remains in the way of the Nonfarm Payroll report. Expectations show that economists expect to see that 188,000 jobs were created during the month of December. Economists expect the unemployment rate to have held steady in December at 4.1%. Hourly earnings are expected to have grown at a 2.5% clip year over year in December, according to estimates, a figure that matches November’s wages number. The payroll report will come on the heels of a very strong ADP private sector payroll report released on January 4, 2018. The ADP private sector payroll report showed that 250,000 jobs were created in December of 2015, blowing past estimates.

European markets continue their march higher, following U.S. equities. The Stoxx Europe 600 index rose 0.4% to 395.31, on track for its highest close since Nov. 6, 2017. Germany’s DAX 30 index jumped 0.7% to 13,263.11 Friday, while France’s CAC 40 index added 0.6% to 5,445.11. The U.K.’s FTSE 100 index added 0.2% to reach 7,710.20, on track for a closing record.

Market Volatility: Low

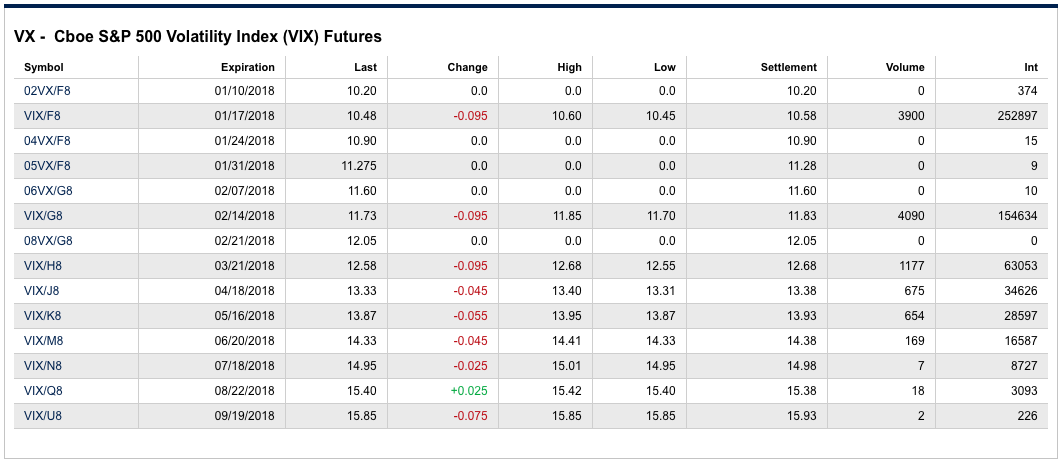

Volatility levels remain extremely low in the New Year. The VIX touched below 9 in the last two trading sessions and is presently only marginally above 9 going into the final day of the trading week. As it has been the case over time, M1 and M2 VIX Futures are pointing down at 6:30 a.m. EST.

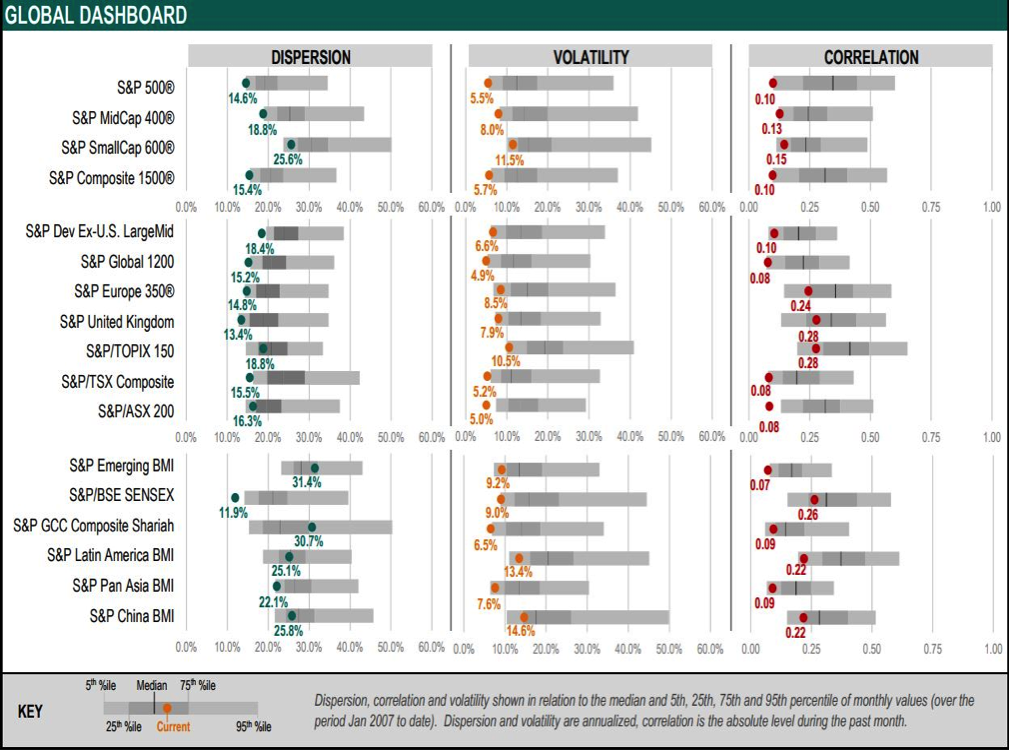

M1 VIX Futures are set to expire on January 17, 2018. Contango has risen over the last several weeks and is currently indicating term structure just below 12 percent. As equity markets have been trending higher, market complacency has remained very high with global correlations dropping, as indicated in the table from S&P Dow Jones Indices below:

A recent report updating market sentiment and levels of market complacency from the S&P indicates correlations, or the degree to which two different securities move in tandem with each other, have dropped sharply through 2017. For the S&P 500, correlations are at 0.1, according to data from S&P Dow Jones Indices, well below its median read, which is close to 0.35. A reading of zero would represent no correlation whatsoever, while a read of 1.0 would represent perfect correlation (a reading of negative 1 would mean perfect inverse correlation). “Record low correlations accompanied the relative lack of market swings, and indeed may be seen as a causal factor,” S&P wrote in a research report. “Markedly different reactions to the year’s major events created stronger diversification effects, dampening volatility in the benchmarks.”

What volatility trading showed in 2017 is that it was far easier to short volatility and VIX-leveraged ETPs than it was to buy volatility as a hedge. Having said that, I would be of the opinion that 2018 will prove a more difficult year for the short-VOL trade, but bring with it substantial market returns for the bulk of the year. Finomgroup.com is an active Volatility market participant.

Corporate Headlines

Apple Inc. posted information late Thursday evening confirming that all devices running its mobile and personal-computer operating systems are affected by two massive vulnerabilities publicly disclosed Wednesday. “All Mac systems and iOS devices are affected, but there are no known exploits impacting customers at this time,” a post on Apple’s support forum said. Apple said that recent updates to its Mac, iOS and tvOS software would help to mitigate against Meltdown, and that it was working on an update to its Safari web browser that would help fight off Spectre. Shares of AAPL are nonetheless trading higher in the pre-market Friday.

In other Apple headlines, a research note from UBS indicated that iPhone demand may have accelerated after the launch of the company’s flaghship “X” model in early November, boosting its overall average selling prices.

Despite supply chain volatility, fundamental iPhone demand appears to have improved post the iPhone X launch,” the UBS report noted. “This provides confidence in our iPhone estimates and could even mean upside to ASPs (average selling price) for Apple given the higher implied mix towards the iPhone X.

GoPro Inc. is said to be laying off 200 to 300 employees this week according to TechCrunch. The cuts were largely concentrated in GoPro’s aerial division, the segment of the company responsible for its Karma drone. Karma was an ill-conceived idea as the market for drones in the $700-$1200 range was found to be very limited.

Planet Fitness tells TheStreet.com that they have aspirations to go from 1,500 locations internationally to over 4,000 in the coming years. Shares of PLNT have soared some 65% in the last 52 weeks.

Morgan Stanley said it expects to take a $1.25 billion hit from the tax bill that President Donald Trump signed into law in December. The bank said in a regulatory filing that net income for the 4th quarter will include a tax provision of that amount, stemming from the re-evaluation of certain net deferred tax assets using the lower tax rate.

Constellation Brands Inc. said it had net income of $491.1 million, or $2.44 a share, in its fiscal third quarter to Nov. 30, up from $405.9 million, or $1.98 a share, in the same period a year ago. On a comparable basis, the company had EPS of $2.00. Constellation Brands said sales fell to $1.799 billion from $1.811 billion, below the FactSet consensus of $1.867 billion. The company raised its 2018 EPS outlook to $8.50 to $8.60 and its comparable EPS outlook to $8.40 to $8.50. The company also said its board has approved a new $3 billion share buyback program.

Fitbit: Roth Capital analyst Scott Searle started Fitbit with a Buy rating and $10 price target, as he believes that the value of its loyal installed base has been “largely lost on the Street.” He does not think Fitbit is “just another broken consumer electronics company” and he believes the company could monetize its user data around healthcare and digital therapeutics, Searle tells investors.

The first week of the trading in the New Year has proven to bolster equity prices further. The S&P has not experienced a pullback of 3% or greater in 14 months and it remains to be seen as to whether or not a pullback presents itself to take advantage. The economy is humming along and geo-political concerns have taken a back seat for now.

Another solid green day in the markets. Unbelievable!

I think you have a nice article for traders coming out shortly David!