by Mike Wilson

Jon Krakauer’s Into Thin Air chronicles one of the deadliest years on Mount Everest, when 12 mountaineers died trying to scale the highest peak on earth. The story reveals both the best and the worst traits of people as many of the climbers try to reach the summit without proper regard for the risks. While scaling Everest has some highly technical aspects, the most dangerous feature is its sheer size. The peak is 3,000 feet above the start of the “death zone” – the altitude at which oxygen pressure is insufficient to sustain human life for an extended period. Many fatalities in high-altitude mountaineering have been caused by the death zone, either directly through loss of vital functions, or indirectly by wrong decisions made under stress or physical weakening that lead to accidents.

This is a perfect analogy for where equity investors find themselves today, and quite frankly, where they’ve been many times over the past decade. More specifically, either by choice or out of necessity investors have followed stock prices to dizzying heights once again as liquidity (bottled oxygen) allows them to climb into a region where they know they shouldn’t go and cannot live very long. They climb in pursuit of the ultimate topping out of greed, assuming they will be able to descend without catastrophic consequences. But the oxygen eventually runs out and those who ignore the risks get hurt.

This most recent ascent began in October from a much safer place of lower valuations (15x P/E and an equity risk premium of 270bp). It also was based on a reasonable narrative that China’s long-awaited reopening was finally about to begin and could provide an offset to the slowing US economy. As a result, this rally was led by more economically sensitive stocks like global industrials, financials and China equities, and we were happy to go along for that stage of the climb. However, by December, the air started to get thin again with the P/E back to 18x and the ERP down to 225bp, so we decided to head back to base camp alone. In the last few weeks of the year, we lost many climbers who pushed further ahead in the death zone.

With the turn of the new year, the surviving climbers decided to make another summit attempt, this time taking an even more dangerous route with the most speculative stocks leading the way. The new narrative was that the Fed was finally going to pause its rate hikes at the February 1 meeting, and even begin cutting rates by the second half of the year. This assumed that inflation would continue the rapid fall that began last summer. It was like a shot of oxygen and, all of a sudden, the death zone felt like base camp. Investors began to move faster and more energetically, talking more confidently about a soft landing for the US economy. As they have reached even higher levels, there is now talk of a “no landing” scenario – whatever that means. Such are the tricks the death zone plays on the mind – one starts to see and believe in things that don’t exist.

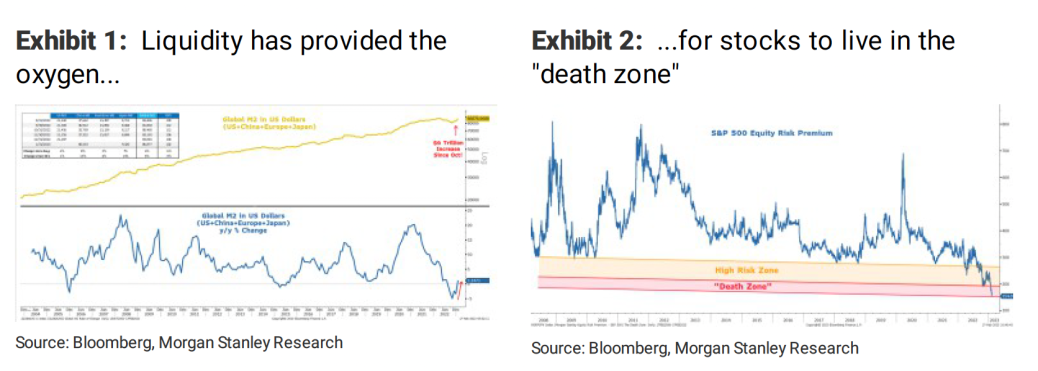

With the P/E now at 18.6x and the ERP at just 155bp, we are in the thinnest air of the entire liquidity-driven secular bull market that began back in 2009. Meanwhile, interest rates are breaking out to the upside with inflation turning back up and a Fed pause now off the table. In fact, additional rate hikes have been priced into the markets’ expectations, with the terminal rate reaching 5.25%.

Bottom line: the bear market rally that began in October from reasonable prices and low expectations has morphed into a speculative frenzy based on a Fed pause/pivot that isn’t coming. And, while the economic situation appears to have improved at the margin, this will not forestall the earnings recession that has a long way to go, based on our negative operating leverage scenario that is well under way. As the Fed is tightening, financial conditions are continuing to loosen thanks to the liquidity provided by other central banks (mainly the PBOC and BoJ), China’s reopening and a weaker US dollar. Since October, global M2 has increased by a staggering $6 trillion, providing the supplemental oxygen investors need to survive in the death zone. While this oxygen supply can last a bit longer and help the climbers go farther than they should, it can also trick them into thinking they are safer than they really are, which leads to them getting hurt.

Morgan Stanley: Mike Wilson