The market was hunting for a reason to alleviate the overheated and overextended conditions. Recall just how overheated the market was coming into the week, as depicted by the distance the S&P 500 had traveled beyond the 50-DMA, and with a 14-day RSI of 76 and 5-day RSI above 93.

If you want to believe the market is consolidating because of hot PPI and CPI readings released this week, be my guest, as we’ve seen hot PPI and CPI readings for the bulk of the calendar year and yet… that’s right; record high after record highs in the stock market. In fact, 65 new highs have been achieved in the S&P 500 during the calendar year, second only to 1995 which had 77 record highs.

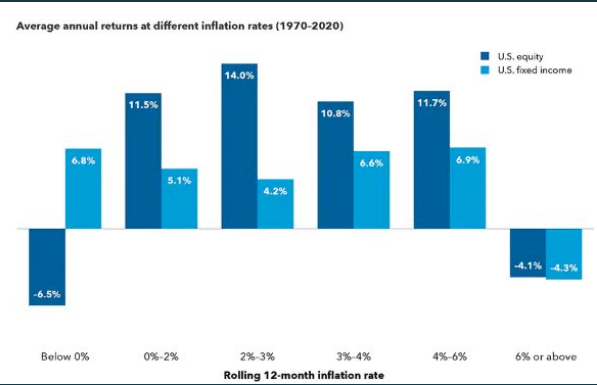

Don’t let the financial media fool you into thinking the market will all of a sudden wake up to the reality of higher inflation, as if the market has been asleep at the wheel all year long. No! The market knows full-well that inflation is running hot, which is historically a good thing for markets, because it’s a good thing for earnings. That’s right, I said it; it’s a good thing.

If you want to start worrying about inflation, you can do so if the Core CPI travels beyond 6% YoY. Right now, it’s at 4.6% and we may very well see 5% print in the months ahead. But that still isn’t 6 percent. Furthermore, when it comes to equity market and bond market performance at the noted CPI levels in the chart above, our sample size is quite small, just 4 times since 1970. And as for the Fed…

Indeed, much of the financial media’s attention focused on how the Fed’s reaction function to the hot CPI number. “They’re going to have to speed up the rate of tapering, and possibly hike rates twice in 2022.” That was the hyperbole and speculation of the day, which was par for the fear mongering course of the financial media. And any guest that would tackle the subject matter marched out with glee, only to lean into the speculative narrative.

Let’s be logical folks, at least for the moment. The Fed took a full quarter to lay down and deliver their evolving message on tapering. A full quarter! Do you really think it makes sense to adopt that the Fed, which just outlined their tapering plans will announce an adjustment to those plans at the very next Fed meeting and with:

- Consumer Confidence finally rising again

- Strong consumer spending and retail sales, again

- Jobless claims below 300K for 3 straight weeks

- Nonfarm payrolls jumping to 500K+ finally

- ISM services jumping to 66+

- A Pfizer and Merck antiviral pill in the works

- A newly passed Infrastructure Bill passed

- Container freight costs rapidly falling

- Natural Gas futures dropping 15%

- Supply line issues potentially peaking past peak shipping season

That list could be made ever-longer, but that’s actually the job of the Fed; to maintain a watchful eye on a multitude of factors and data points. It’s why they remain data-dependent, and why the Fed needs to see how the data plays out post the first tapering tranche… and not before. So we let the media have its day in the sun, to lure the unsuspecting viewer/investor into believing doom and gloom are on the horizon. The savvy investor, however, knows how this game is played and acts according to the most probabilistic outcome!