Two days after Apple (AAPL) warned on Q2 2020 revenues, the markets seem to have dismissed even this sizable warning and replaced fears of an earnings recession with record highs. The Nasdaq (NDX) and S&P 500 (SPX) both hit record highs once again yesterday as tech was bought up once again and AAPL shares rebounded sharply from the previous day’s loss. The new record high in the benchmark index is 3,393, a stones throw away from 3,400 and seemingly a “no-brainer” to be achieved near-term. But we’ll see if Wednesday’s rally has legs, with equity futures modestly pointing to a negative open on Wall Street Thursday morning.

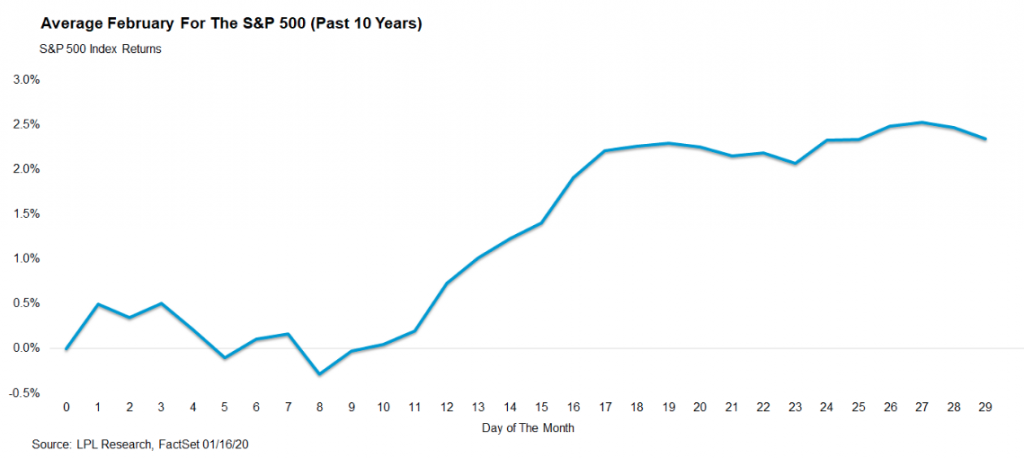

The rally in equities has been quite strong in early 2020, not as strong as 2019 when the S&P 500 rallied more than 10% through February, but strong nonetheless. Year-to-date, the S&P 500 is up 4.8% and looking to put in an outsized February gain during an election year. Remember, over the past 10 years no month has actually been better for stocks than February. Here’s what the average February has looked like for the S&P 500 the past decade.

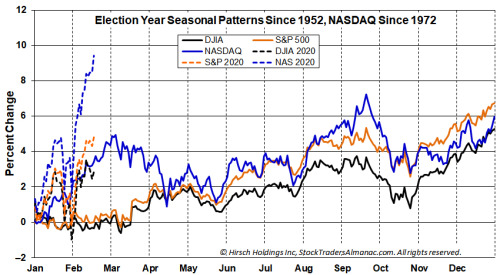

Bullish sentiment and momentum appear to be firmly in place and historical election year patterns suggests strength could easily continue for DJIA and S&P 500 into May, according to historical data from the Trader’s Almanac. The Nasdaq’s surge higher could be vulnerable to a retreat sooner, in March.

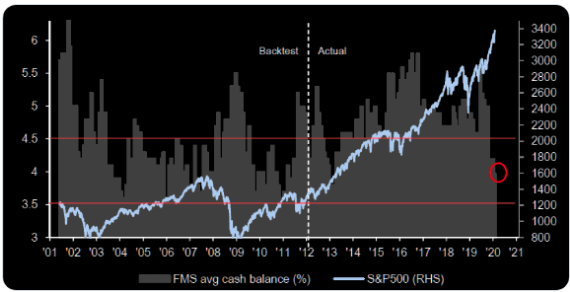

Some of these unusual February gains can be assigned to fund manager positioning and leverage to equities vs. cash and/or bonds. The latest BofAML fund manager survey identifies that cash levels fell to 4.0% from 4.2% in January, the lowest cash balance since Mar’13, and well under 5-year average of 4.9.

Possibly more importantly to investors is not the near-term achievement for the S&P 500, but the seemingly dismissal of many risk factors for which the market is being presented. Apple’s warning may prove just one of many ahead of Q1 2020’s earnings season. Overnight, the shipping giant Maersk also warned investors on its FY2020 outlook.

“The outlook for 2020 is impacted by the current outbreak of the Coronavirus (COVID-19) in China, which has significantly lowered visibility on what to expect in 2020. As factories in China are closed for longer than usual in connection with Chinese New Year and as a result of the COVID-19, we expect a weak start to the year….Expect Chinese factories to operate at 90% of capacity by early March…”

In addition to these such earnings and/or revenue warnings from global corporations, Goldman Sachs sounded the alarm on Wednesday to clients about a possible correction in the stock market, noting investors are underestimating how big of a risk the coronavirus really is.

“We believe the greater risk is that the impact of the coronavirus on earnings may well be underestimated in current stock prices, suggesting that the risks of a correction are high,” strategist Peter Oppenheimer wrote in a note.

“Equity markets are looking increasingly exposed to near-term downward surprises to earnings growth. While a sustained bear market does not look likely, a near-term correction is looking much more probable.”“We believe the greater risk is that the impact of the coronavirus on earnings may well be underestimated in current stock prices, suggesting that the risks of a correction are high.

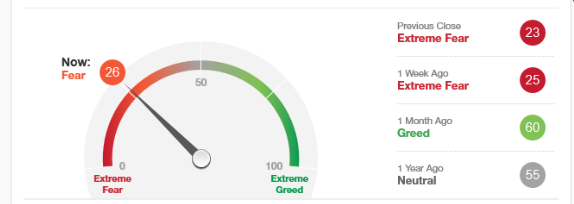

Despite the warnings and suggestive commentary from the analyst community, markets have continued on their path to record highs. Finom Group is of the opinion the current market trend is unsustainable and suggests that investors use the uptrend as an opportunity to rebalance their portfolios in a manner that produces higher cash levels. After all, given cash levels of fund managers who typically underperform the market, why follow such behaviors? Having said that, Finom Group is also of the opinion that active weekly trading is an optimal market participation until the market decides a more protracted correction is found.

Everyday analysts and strategists are marched out for media interviews. The questions of the day are all surrounding the topic of the coronavirus and liquidity injections from central banks, mainly China’s PBOC at this point. In terms of the coronavirus, the analyst’s are always asked, “What do you think results in the market waking up to the reality of the situation in China?”

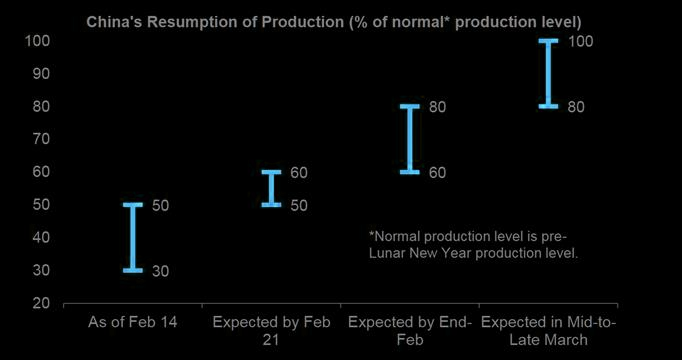

On the surface, it does seem as though global equity markets are dismissive of most anything related to the coronavirus, which has shut down the worlds largest manufacturing hub and 2nd largest economy in China. The normalization of Chinese commerce has yet to come full circle, but is on the slow mend. Morgan Stanley suggests that normalization of China’s production engine is best resumed by month’s end.

“Macro and micro data suggest production activities are resuming at a slow pace in China, reaching 60-80% of normal levels by end Feb and normalizing only by mid-to-late March. If the spread of the virus is not contained within the next two weeks, the disruption to production could extend into 2Q20.”

The outlook is dicey, but investors again, seem to be whistling past the issues as China’s PBOC is injecting liquidity/capital into its financial system/markets, thus backstopping equity market declines. China said on Thursday it lowered its benchmark lending rates. The PBOC cut the one-year loan prime rate from 4.15% to 4.05%, and the five-year rate from 4.80% to 4.75%. The PBOC publishes the rates every month. Thursday’s move was the first cut since October last year, according to Refinitiv data.

Some analysts said Thursday’s move can only help the Chinese economy so much.

“The ten basis point reduction will help companies weather the damage from the coronavirus at the margins,” Julian Evans-Pritchard, senior China economist at consultancy Capital Economics, wrote in a note after PBOC published its latest loan prime rates.

“But even if the … cut is passed on to all borrowers, that would only decrease average one-year bank lending rates from 5.44% to 5.34%. The ability of firms to postpone loan repayments and access loans on preferential terms will matter more in the near-term,”

It definitely seems as though the provisions from the PBOC have provided a sentimental boost to global equities as the coronavirus seeks containment near-term and China aims to resume normal commerce activities in the coming weeks. Until then, it remains to be seen if the large speculative trader positioning sustains the current pace.

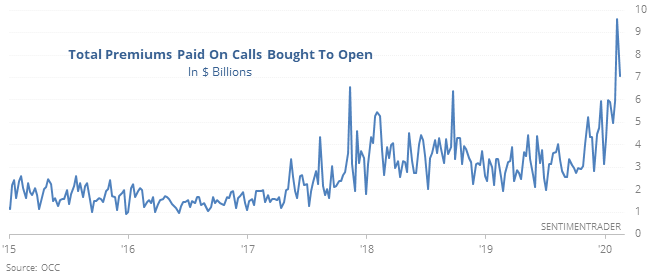

According to the SentimenTrader, each week that goes by without a pullback, traders become more aggressive, and by some measures, they’ve never been more exposed. They’ve been spending heavily on that opinion. With the surge in call buying, their total outlay has exceeded more than $7 billion in premiums paid each of the last two weeks. That’s far beyond anything we’ve seen in the past 20 years. Over the past 5 years, it’s almost double the previous record.

As the blogger suggests, this kind of “carefree” speculation typically ends poorly and with many traders finding a punishment of sorts. We’ll have to see if this positioning is any different than past outcomes when speculation was high or extreme. It’s important to distinguish that the market evolves over time and market expressions are always different, but that doesn’t mean that outcomes will be different.

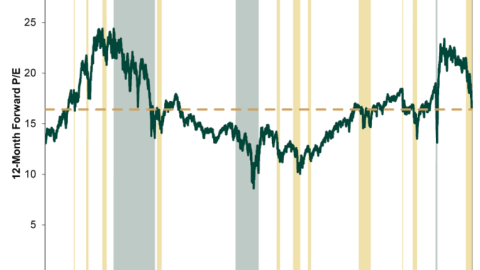

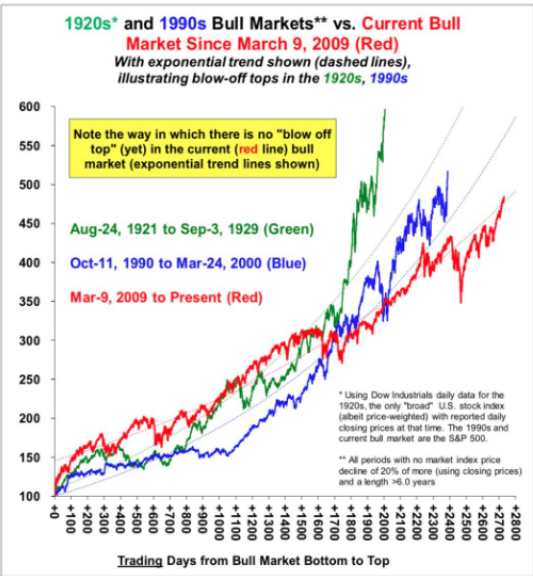

As we’ve discussed in past articles and Research Reports, the stock market’s rally has been highly leveraged to the tech sectors. The Nasdaq Composite, NASDAQ 100, and S&P 500 tech sector have surged since October, prompting market pundits to compare today vs. historical melt-ups that were followed by crashes (e.g. “today is just like 1999”). But least we remind investors that the current melt-up over the last decade or so shows a more modest uptrend than past cycles.

As Strategas points out in the chart above, the current uptrend/melt-up is actually quite linear, comparatively speaking. Absent such graphic details, however, most market pundits lean on recency bias and speculative positioning to support market crash theories.

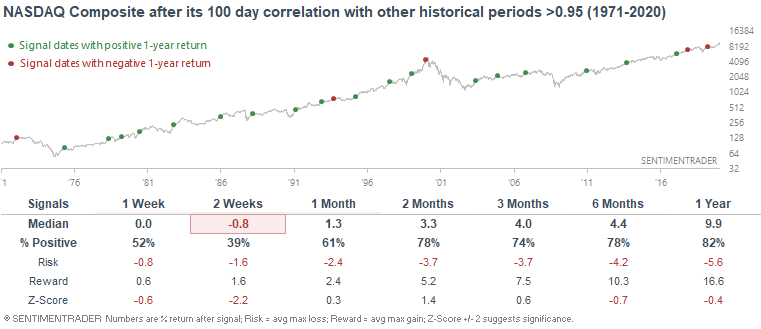

Bears will be bears and bulls will be bulls! So let’s just look at comparing the NASDAQ Composite’s rally over the past 100 days against other historical 100 day periods, and look at cases in which the correlation exceeded 0.95.

According to SentimenTrader, the 1999-2000 period was an extreme case. Looking at all the historical cases which were similar to today, the NASDAQ Composite’s returns over the next 2 weeks were poor, but there were more signals that led to gains than losses, especially dramatic ones.

It’s likely to be another hum dinger of a day on Wall Street, if Finom Group can age itself with that phrasing of market expectations ;-)! While the coronavirus may serve to stall the widely anticipated global growth and domestic earnings rebound, it shouldn’t do anything more than that. Laying beneath the current global slowdown in China and possibly domestically as an adverse reaction to China’s slowdown, is what appears to be global and domestic strength as viewed through productivity gains as of Q4 2019. If it weren’t for this latest global issue…

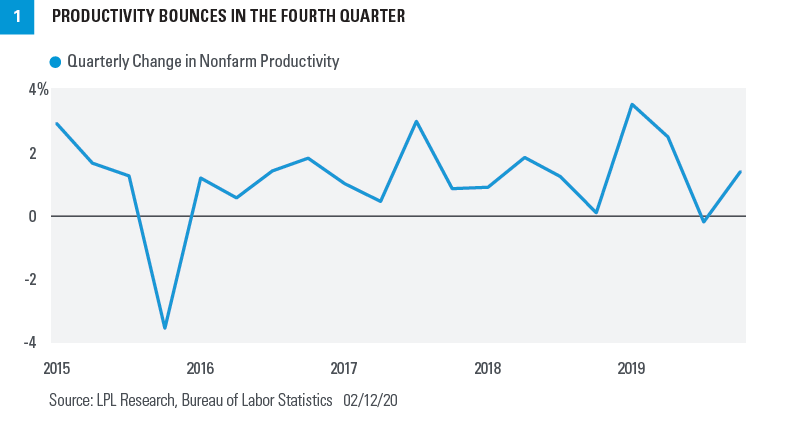

Productivity bounced back strongly in the 4th quarter of 2019, according to data from the US Bureau of Labor Statistics (BLS). Nonfarm productivity, which measures hourly output per worker, increased at a 1.4% annualized rate last quarter. As FIGURE 1 from LPL Financial shows, this was well above the 3rd quarter’s pace of -0.2% and a welcome rebound after the cycle’s first negative quarter since the 3.5% drop in the 4th quarter of 2015.

Nonfarm productivity growth suggests that U.S. companies are getting more output per employee, an important development in a late-cycle economy: Productivity lifts gross domestic product (GDP) growth while keeping employer costs contained. Productivity gained 1.8% for the year in 2019, versus 1.3% in 2018. Last year’s gain was the best year for productivity since 2010.

WHY PRODUCTIVITY IS IMPORTANT

Higher productivity is a powerful tool, as it can boost both consumer and corporate well-being. Productivity increases typically have come as businesses invested in capital improvements and employee training.

After seeing solid growth in productivity the first 2 quarters of 2019, a substantial slowdown occurred in the 3rd quarter as the U.S.-China trade dispute weighed on global growth and disrupted global supply chains. U.S. businesses have largely shelved investment in the face of elevated uncertainty, as nonresidential investment has dropped for the past 3 quarters for the first time since early 2016. But now, with a phase-1 trade deal in place, business confidence could rise as cost structure is better known going forward. We’re already seeing the results in business confidence through the latest CNBC survey.

Small business sentiment is on the rise to kick off 2020, with confidence nearing all-time highs, according to data from CNBC and SurveyMonkey. The CNBC/SurveyMonkey Small Business Confidence Index climbed two points in the first quarter, from 59 to 61, as concerns over trade policy impacts lessened, thanks to a trade deal with China and the signing of the USMCA. This is a sharp turnaround from the lows seen last summer as trade turmoil weighed on Main Street’s outlook.

The Small Business Confidence Index is calculated based on entrepreneurs’ responses to a set of eight questions about their businesses as part of the CNBC/Survey Monkey Q1 Small Business Survey. That poll was conducted Feb. 3–10 among a national sample of 2,118 small business owners ages 18 and up.

“There was a lot of worry about tariffs and the trade war that has been abated due to the agreement with China,” says Todd McCracken, president and CEO of the National Small Business Association. “Those concerns about what would happen with trade and supply chains are less worrisome than they were.”

Generally, business owners are feeling more positive about business, with 56% saying conditions are good and only 7% saying the opposite. Recession fears have also calmed down somewhat, with 49% of businesses saying a recession is likely in the next year, down from 53% this same quarter in 2019.

Everyone has an opinion on all things economic or market related, by and large, I think that’s the extrapolation from today’s article. Finom Group believes the economy, indeed, would be humming along at a trend-growth pace in 2020 if not for the coronavirus. In-kind, we would think the equity market would also continue to track the expected rebound in YoY earnings growth. Nonetheless, this is the economy and market for which we are presented with and as such cautious optimism may prove the best way to describe our current sentiment. It’s with that sentiment that we continue to actively trade the market with 3 successful trade alerts completed this week.

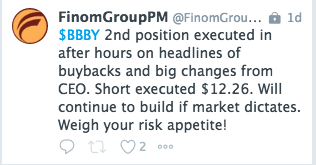

Despite the latest headlines surrounding Bed Bath & Beyond’s plan to financial engineer improved earnings results, the company’s new CEO Mark Tritton has yet to deliver plans that differentiate itself from the competition and which will grow sales. Retailers are valued against sales in the information technology era folks, not EPS and especially for specialty and department store retailers. Finom Group remains with a negative outlook for the home-goods retailer longer-term.

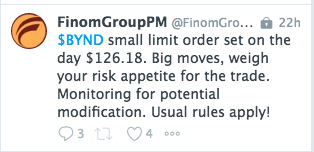

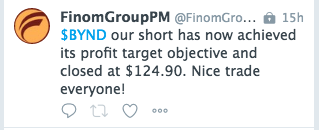

Despite the outsized valuation and media hype over the Beyond Meat business and IPO, the valuation remains a chief concern for Finom Group. We recognize the extreme growth associated with the consumer packaged goods business model when it is in it’s early stages and as the product seeks advancing distribution. This is the business cycle Beyond Meat is currently engaged.

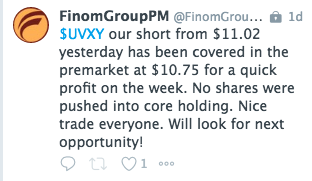

The issued with the CPG model and one with a limit product line-up is that post the distribution stage, reordering and sell-through are a much slower aspect of the firm’s business cycle. We believe this is currently lost on the valuation. Lastly, our usual short volatility trades have continued to work in 2020.

Stay nimble and vigilant as this market is seemingly aiming to lull unsuspecting market participants to sleep with a portrayal of a risk-free market. Subscribe today and trade with us in our Live Trading Room Monday-Friday!