In a holiday shortened trading week, investors began trading with markets under pressure Tuesday, ahead of quarterly reports from the likes of Netflix (NFLX) and IBM (IBM). When it was all said and done for Tuesday’s session, the Dow Jones Industrial Average (DJIA) fell some .52% with Boeing (BA) announcing that it doesn’t expect regulators to sign off on the 737 Max until June or July. That’s months later than the manufacturer previously expected. The delays pose another headache for carriers who have already missed one peak travel season without the planes.

The S&P 500 (SPX) finished Tuesday’s session down just 8.83 points and is set to bounce back on Wednesday as both IBM and Netflix reported quarterly reports that topped analysts’ estimates. Shares for both companies moved higher in the after hours session and appear set to rally on Wednesday.

Also plaguing markets in the background on Tuesday was the latest potential China pandemic, which may have reached Americas shores. Public health officials have confirmed the first U.S. case of a mysterious coronavirus that has sickened hundreds of people in China, the Centers for Disease Control and Prevention said Tuesday.

“We’re being proactive at all levels,” Nancy Messonnier, CDC’s director of the National Center for Immunization and Respiratory Diseases, said on a conference call with reporters Tuesday. “CDC will be working closely with the state health department on the particulars of this patient’s care.”

CDC officials said they continue to believe the risk of it spreading to the American public is “low.” Despite the headline risk that pervaded Asian markets on Monday, it appears the fears from the coronavirus have subsided for now.

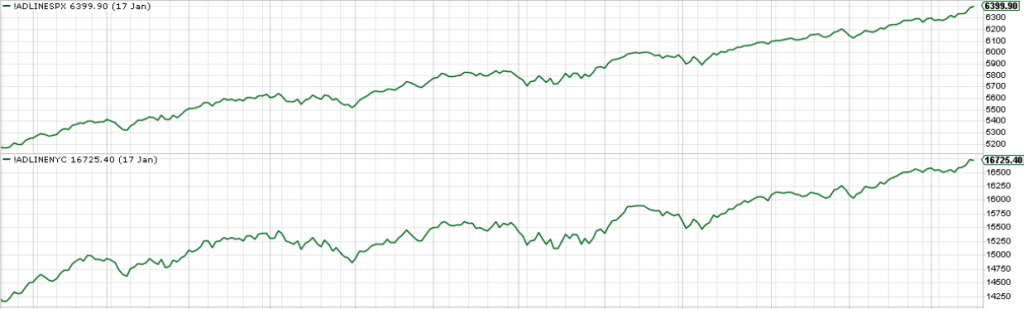

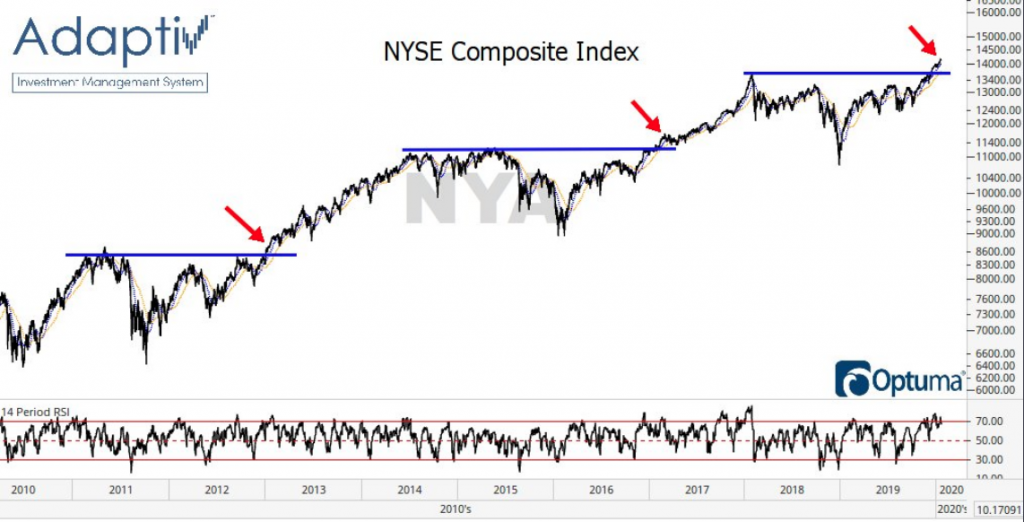

As the S&P 500 looks to bounce back on Wednesday, breadth remains quite strong and dip buyers continue to support the market. The chart below depicts both the S&P 500 A/D and NYSE Composite A/D lines which remain at their respective highs and suggest that until these breadth indicators show meaningful and sustained divergence, markets can remain in an uptrend.

The seemingly endless market, with broad breadth, is also seemingly finding more and more concerns as the S&P 500 P/E multiple stretches to its highest level of the cycle at 18.7X FW12M estimates. It has become increasingly difficult for investors and traders alike to buy stocks at present valuations and with indices at all-time highs.

- The U.S. market cap is now above $23 trillion after 22 months

- Very broad NYSE Composite Index finally breaks out after 2 year consolidation.

- Broad & global world stock market above its January 2018 high last 2 months.

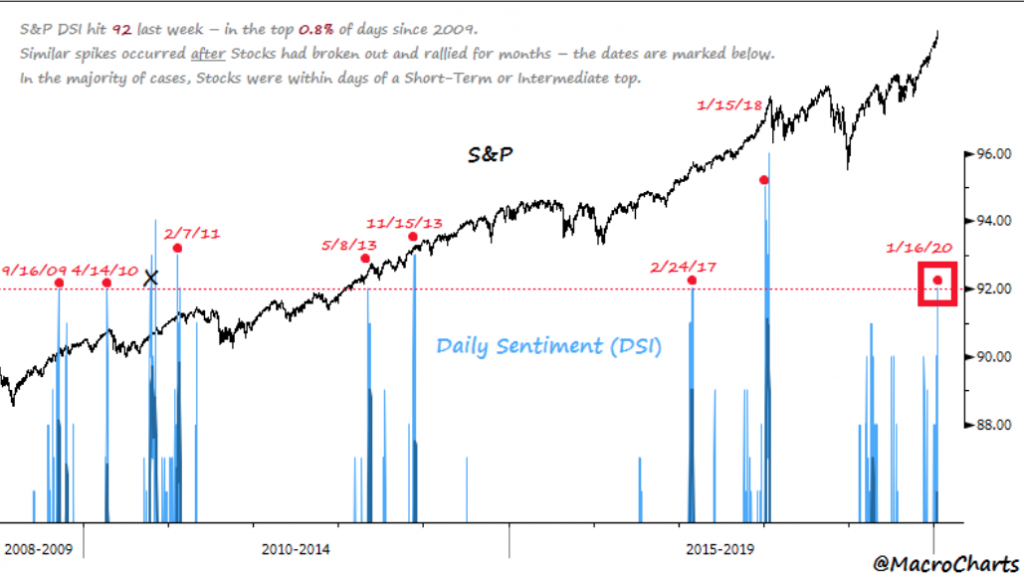

Beyond just the incredibly strong market breadth and clear breakout recently in the NYSE Composite Index, sentiment has also remained quite robust, fueling the “buy any dip” mentality for stocks. The S&P 500 DSI (Daily Sentiment Indeix) hit 92 last week. This ranked in the top *0.8%* of days since 2009. Similar spikes occurred *after* equities had broken out and rallied for months. In the majority of cases, however, equities were also within days of a short-term or intermediate top.

Moreover, coming into the week, the chart above identifies the highest percentage of stocks making new 52w highs since January 2018. Breadth like this is a tricky thing because over the long-term it’s a good sign of underlying strength. Having said that, extreme readings can also portend overdone conditions in the near-term, which precede minor pullbacks.

The duration for which the strength of the uptrend has persisted is very hard to ignore and has given many strategists and analysts “cause for pause”. Even after Tuesday slight dip, The S&P 500 is up roughly 2.9% so far this month and has climbed more than 9% just since the beginning of November. Recall that at the beginning of November 2019, Canaccord Genuity’s chief market strategist Tony Dwyer was calling for a market pullback on the order of 3-5 percent. The call seemed at odds, at the time, given the typical seasonal tailwind for stocks in the Q4 holiday retailing season.

To be fair, Dwyer’s call for a pullback on November 5th, 2019 was also accompanied by a “buy that dip” call. Dwyer even recognized his reasoning for becoming cautious after a strong rally leading into November as follows:

What makes me most nervous:

- When the S&P 500 (SPX) does absolutely nothing over the past nine days and our indicators suggest pullback

- When the same folks saying to sell the market and be defensive in early October are now saying seasonal factors should push market higher into year end on cyclical sectors

- When there is a CNBC article highlighting the new giddy atmosphere on Wall St., and I am the cautious one

The pullback that never came to be and which was met with a rally that has persisted through end of year 2019 and to-date is once again met with some angst from Dwyer, and a host of other strategists, portfolio managers and analysts. For the “right here and now” aspect of market commentary from Tony Dwyer, he is of the opinion that investors should take offensive positioning off the field. His main reason…

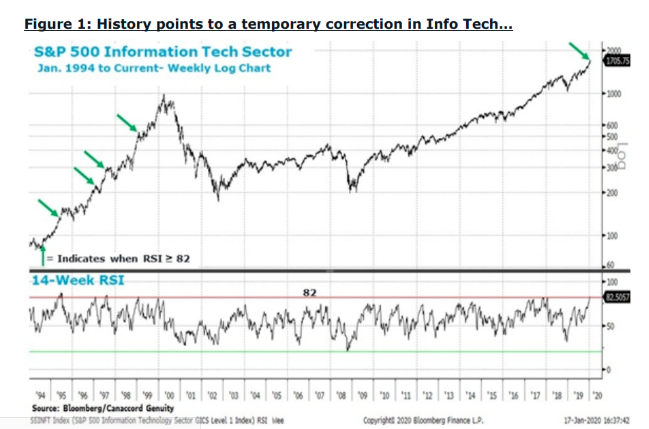

The market, and the information technology sector in particular, “have reached a point that warrants a change in view.” The S&P 500 Information Technology sector has reached what he calls a “historically extreme level” for only the fifth time since 1990. (Chart above)

JC O’Hara of MKM Partners, said in a note to clients to “swim at your own risk” at these elevated prices. A pullback could be around the corner.

“I think it is safe to say this market has risen further, faster than most think.

The S&P 500 hasn’t had a daily move of more than 1% in either direction since October, O’Hara said, creating an abnormally calm market.“

From Tony Dwyer’s perspective, one of his key indicators for intense market rallies that is signaling a potential warning for investors comes out of the tech sector.

“History has shown that either a long-duration consolidation period or a nasty pullback can help relieve market excesses, and we have evidence the move higher in Tech has created the type of environment that generated temporary corrections in the pre-dotcom era.”

As the markets’ rally persists it has also been met with rather extreme calm. We haven’t seen a 1% decline in the S&P 500 now in 71 trading sessions. The realized 30-day volatility for the index is near 100-year lows, Michael Wilson of Morgan Stanley said in a note to clients. Risk is skewed toward volatility rising, he added, but a catalyst may be needed to create that move.

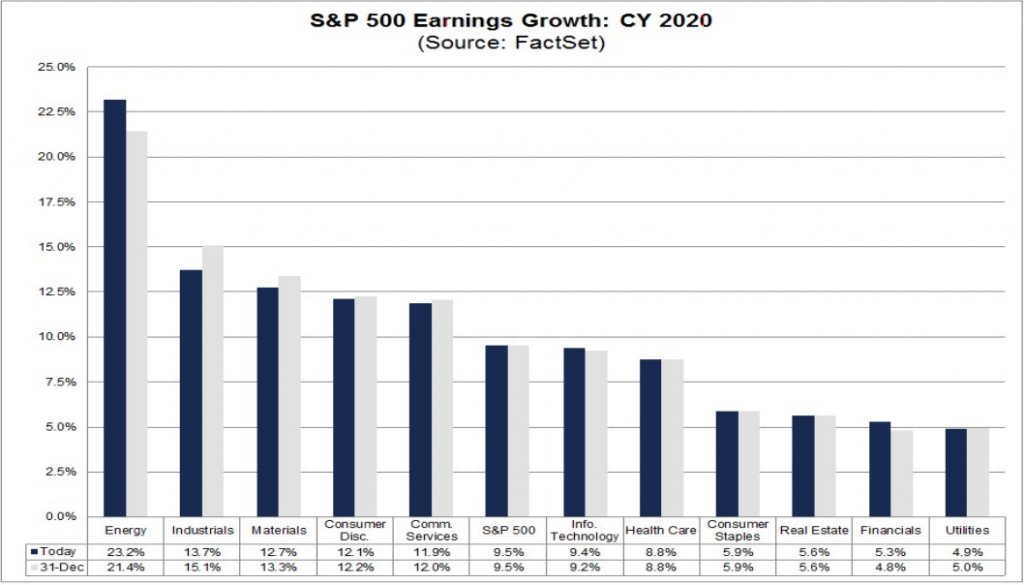

More recently Finom Group has inferred that the markets’ relentless rally is potentially indicating investors are sniffing out improved economic and earnings growth, beyond that which is already baked into the existing forecasts. FactSet is forecasting an earnings rebound in 2020, with EPS growth of roughly 9.5% YoY.

The probability for earnings growth upside, from even this strong YoY EPS growth forecast, is potentially being signaled by economists and investors alike. Jonathon Golub of Credit Suisse believes this is exactly why the market hasn’t faltered even with overbought conditions and sentiment at rather extreme levels. Golub raised his year-end target on the S&P 500 to 3,600 from 3,425, projecting an 8% gain from where the index currently trades.

“The prospects of better economics and earnings are fueling the most recent leg higher, and the data suggests that this trend will continue.”

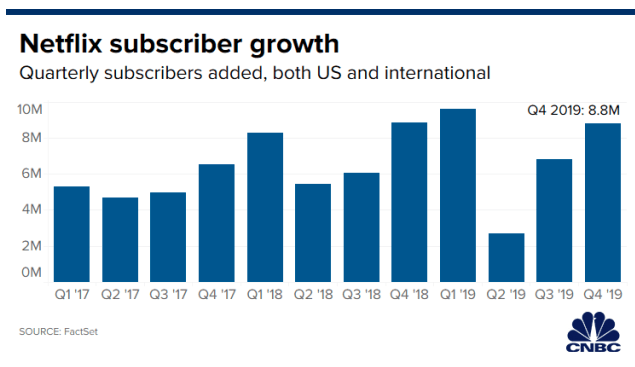

Speaking of those earnings forecasts and the upbeat tone for earnings in 2020, Netflix did indeed produce a healthy Q4 2019 report after the closing bell on Tuesday. The company beat on the top and bottom lines for the quarter, but gave disappointing guidance for the first quarter. Here are the key numbers:

- Earnings per share: $1.30 per share, however that’s not comparable to Refinitiv estimates

- Revenue: $5.47 billion vs. $5.45 billion expected, per Refinitiv

- Domestic paid subscriber additions: 550,000 vs. 589,000 expected, per FactSet estimates

- International paid subscriber additions: 8.33 million vs. 7.17 million expected, per FactSet

- For the first quarter of 2020, Netflix expects to report earnings of $1.66 per share on revenue of $5.73 billion. That’s compared to analyst expectations for earnings of $1.20 per share and $5.76 billion in revenue. The company also expects to add 7 million paid customers in the first quarter, which fell short of analysts expectations for 7.86 million subscribers.

The company reported negative free cash flow of $1.7 billion for the quarter and expects to see negative free cash flow of about $2.5 billion for 2020. Netflix reiterated that its cash burn peaked in 2019 and said it’s now moving slowly toward being free cash flow positive in the future.

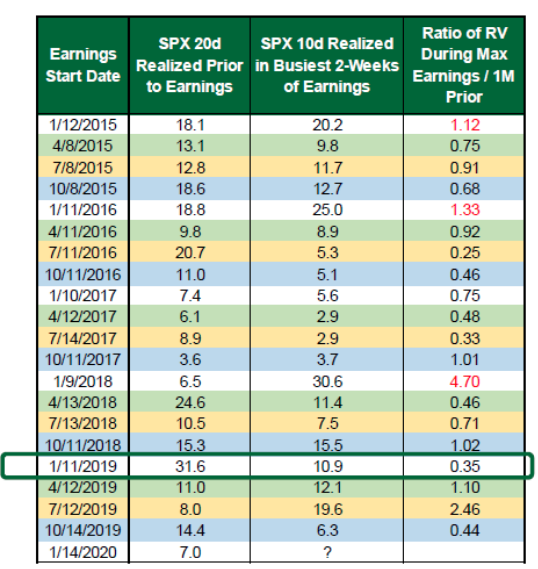

As earnings season will continue with tech titans reporting next week, investors might consider that the current rally has legs and may be found without much volatility, at least leading into the Iowa Primaries. During earnings last January, S&P 500 volatility fell from over 30% to under 11% during the busiest 2 weeks of the earnings season. With peak earnings season starting this week, S&P 500 realized volatility could remain muted.

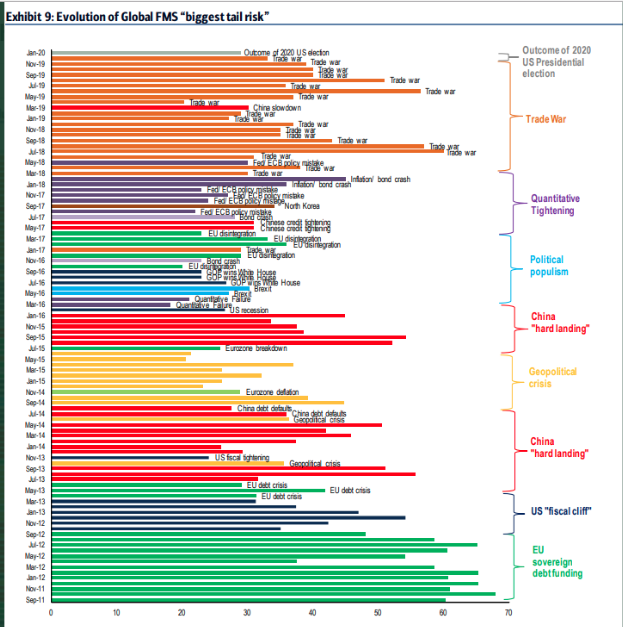

History doesn’t always repeat itself, but it proves useful to at least have an understanding of the probabilities during earnings season and ahead of the Iowa Primaries. And if you don’t think the election cycle is not front of mind with investors, think again. This may prove the catalyst for a pullback, if when it occurs. The latest BofAML Fund Manager Survey (FMS) shows that the former U.S./China trader has moved lower among the biggest tail risk to the economy and markets.

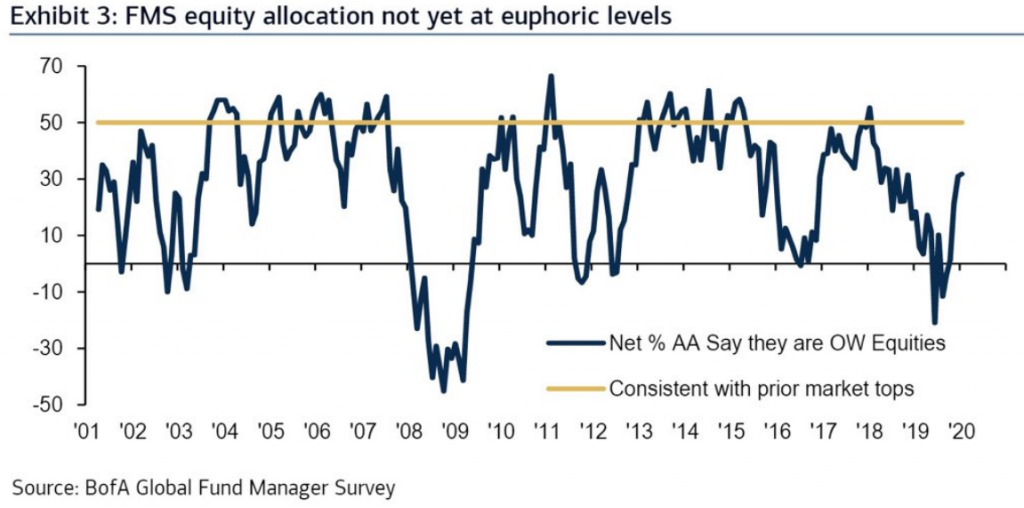

These same fund managers and capital allocators are slightly overweight equities, but rationalize that they are nowhere near extremes in part due to the election cycle.

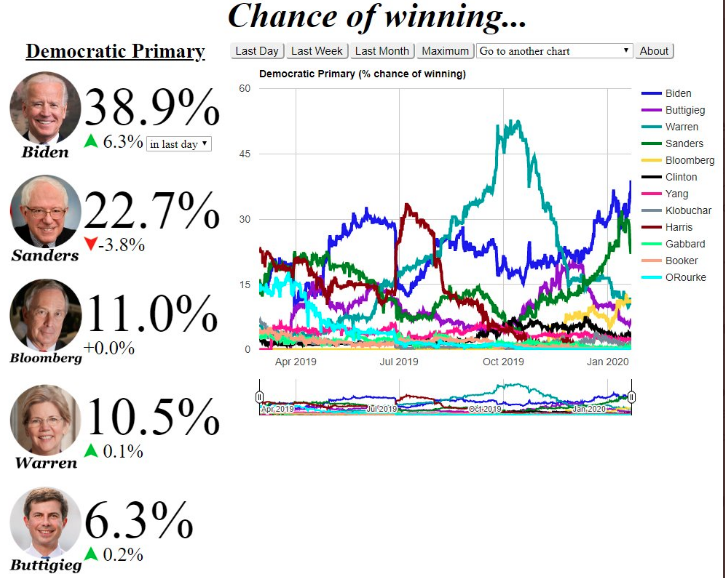

Finom Group continues to suggest that if a progressive Democratic candidate should win the Iowa Primaries (Bernie Sanders or Elizabeth Warren) the market would likely find its catalyst for the widely desired pullback in markets. At present and according to the latest polls, however, it doesn’t appear as though there is a credible threat from a progressive candidate. Of course, the polls could be wrong, as they have been in the past.

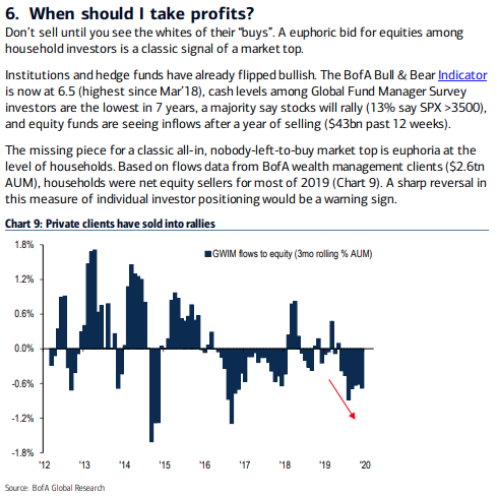

Furthermore, any such dip in markets we would also suggest provides an opportunity for investors to buy equities at reduced valuations. A 3-5% pullback would be a healthy digestive period for the market and alleviate some of the froth currently found out of favor for many market participants. Having said that, investors shouldn’t confuse the commentary from analysts and strategists concerning a potential pullback with the notion of selling ahead of such a potential pullback. At best, curbing some winners and locking in profits would suffice, but outright selling with the notion of buying back at relatively cheaper prices is often an errand approach that most investors fail to execute. Given this commentary, one might be asking themselves, “When should I sell?” Bank of America Merrill Lynch answers that question with the following notes below:

We would suggest investors avoid the cliches surrounding the retail investor being all-in and focus on prudent, long-term investing goals. Knowing what’s in your portfolio and why are more important than what the “other guy” is or isn’t doing with their investable capital. Speaking of that investable cash… Ray Dalio, founder of the hedge fund Bridgewater Associates, said during a CNBC interview on Tuesday on the sidelines of the World Economic Forum in Davos, Switzerland, that investors should be buying this market, rather than seeking safety in cash.

“Cash is trash,” said the hedge-fund luminary, who founded Westport, Conn.–based Bridgewater in 1975. “We recommend investors maintain a diversified portfolio of equity holdings.”

Last week, David Tepper, known for a number of correct calls on the market during the bull run since 2009, told CNBC’s Joe Kernen that he “has been long and will continue that way.” He equated the stock market to a horse and said: “I love riding a horse that’s running.”

While Dalio and Tepper remain optimistic and bullish on markets going forward, not everyone is found with contentment about the rapid rise in markets.

As we mentioned before, the rapid rise in markets that expresses extreme sentiment, low volatility, record low put/call ratio and rather extreme breadth scares a good many investors. They liken today’s market readings to those that preceded Volmageddon and a 5% intraday drop on the S&P 500 “day of reckoning” back on February 5, 2018. One such individual whom Finom Group has tracked over the past few years, Lance Roberts, chief investment strategist at RIA Advisors, is just one of many who are throwing in the towel as the market trends higher. Do we blame him?

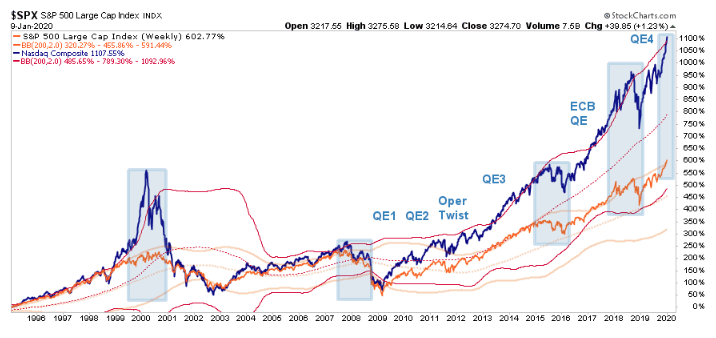

As Roberts sees it, the “overbought, over extended and complacent market” is heading toward a day of reckoning, and he used a tandem of charts to illustrate the excess.

First, this chart shows “the near-vertical price acceleration,” which is a hallmark of the kind of melt-up that takes place near the end of the cycle. He also pointed out that when markets get more than 2-std. deviations above their long-term moving average, reversions tend to hit stocks shortly thereafter.

Isn’t it cute that Roberts interjects the bull market with QE identifiers? We smell a permabear mantra afoot. The reality is that Lance Roberts is a pronounced and widely know permabear amongst social media participants. He’s well articulated, in many blogs, his disdain for the bull market and it’s seeming reliance on central bank influence. Nonetheless, here is what Roberts recently recommended to his readers:

“While the markets could certainly see a push higher in the short-term from the Fed’s ongoing liquidity injections, the gains for 2020 could very well be front-loaded for investors. Taking profits and reducing risks now may lead to a short-term underperformance in portfolios, but you will likely appreciate the reduced volatility if, and when, the current optimism fades.”

Mirroring some of Roberts’ concerns for the market in the near-term is Saxo Bank’s head of equity strategy Peter Garnry, who is flashing a short-term warning about a stock selloff, especially for technology names, which have led 2019’s gains.

“The acceleration that we have seen seems quite similar to what we saw in January 2018. During that month, the S&P climbed 5.6%, then dropped 3.9% and 2.7% in February and March 2018 respectively.

Investors aren’t buying much downside protection for stocks, Garnry said. But on the bright side, when this selloff gets out of the way, equities will probably keep marching higher.“

Investors shouldn’t dismiss Roberts’ commentary and suggestions simply because he has established a permabear reputation, as much of what he offered in his notes is factually represented in the markets. Garney also suggests that when a correction comes to fruition, it would prove an opportunity. What Finom Group would suggest is prudent planning. Having a game plan as an investor/trader is JOB #1. Without a game plan in place and a forward-looking thesis, many market participants can fall prey to the first headline they come across.

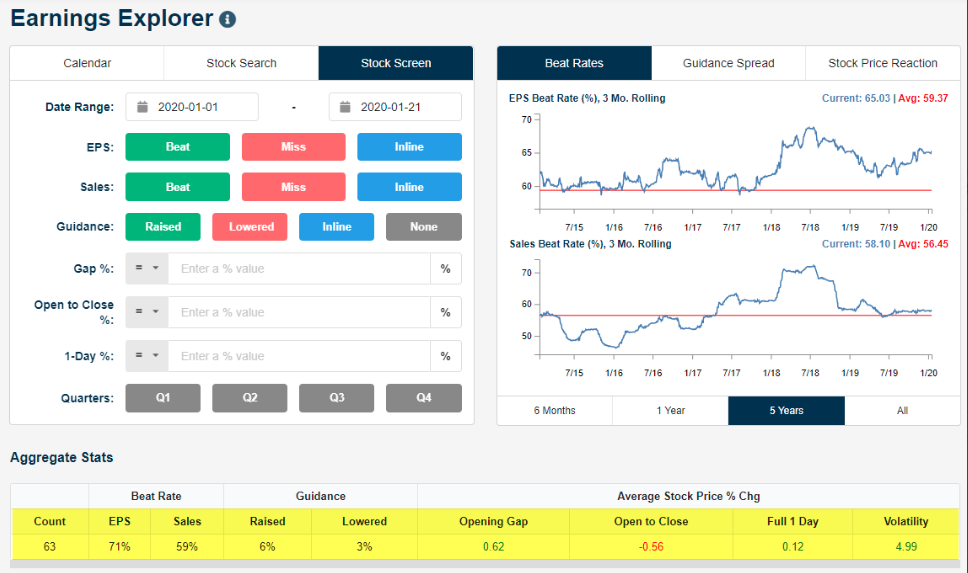

As we wrap up our daily market dispatch for Wednesday, earnings season remains a key focus for investors during an otherwise light calendar week for economic data. So what have investors been doing with the earnings reports that have been delivered thus far in 2020?

According to Bespoke Investment Group, there have been 63 earnings reports so far in 2020. The avgerage stock reporting has opened higher by 0.62%, but fallen 0.56% from the open of trading to the closing bell. So we’re seeing investors use earnings season as a reason to lighten up, potentially locking in those profits.