The story of the week: U.S. 2-year by 10-year Treasury yield inversion signals a recession on the horizon. Of course, on the horizon is a subjective forecast bringing about a litany of bearish financial media programming. The latest of the fear mongering commentary comes from the world renowned Ray Dalio, founder of the world’s largest hedge fund, Bridgewatter.

“The U.S. economy is taking a turn for the worse and there’s a 40% chance America could experience a recession before the 2020 presidential election. I think that in the next two years, let’s say prior to the next election, there’s probably a 40% chance of a recession.”

The reality behind the Dalio forecast of a recession before the 2020 presidential election, which mathematically is less than 2 years away, is that it simply reverts to his original recession probability forecast from Q4 2018. It was only 5 months ago that Dalio suggested a recession (35% probability) was not around the corner. The reason: Federal Reserve Chairman Jerome Powell’s signal, in the face of late-2018’s market selloff, that he would go slower on hiking interest rates. Dalio reduced his pre-2020 election recession odds to roughly 35%, from 50 percent.

See what an extended decline in Treasury yields and equities can do to even the most seasoned investors? All of a sudden, things have become so much worse in the economy that recession probabilities have risen… 5%, yes a whopping 5 percent. While we don’t mean to make too light of the bond market actions and general slowing of GDP on an annualized basis… 5 percent? Is that really what we’re talking about here? Financial media programming right?

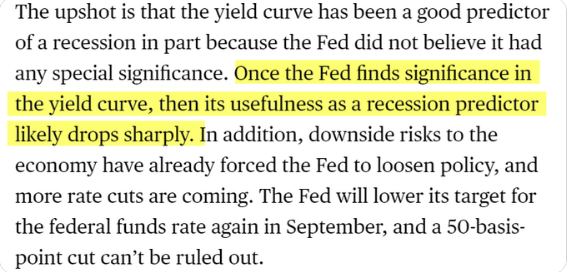

Finom Group is not of the opinion that the bond market is a leading indicator or signaling a recession… at least not by itself. Many significant issues that are unique to the current expansion cycle don’t lend themselves to the widely believed prediction of a pending recession and through the yield curve inverting. Probably one of the most significant reasons for our dismissing the yield curve’s recessionary forecasting ability is due to global central bank participation in the bond market since the Great Financial Crisis and European Debt Crisis that has served to suppress yields at the long-end of the yield curve. Even so, we don’t dismiss the natural fear brought about by both negative yields and an inverted curve. Fear, in and of itself can produce volatility and even find itself a self fulfilling prophecy if not found reversing in short order.

CNBC’s Jim Cramer discussed how the bond market moves have created a risk-off atmosphere and increased volatility in the equity markets.

“The stock market will continue to be volatile until the bond market finds some stability. As long as Treasury yields keep plummeting, investors will remain unsure of themselves. At least today, they finally found some stocks to buy along with bonds. It’s just that they’re the wrong stocks, the recession stocks, not the kind of leaders we want to get behind.”

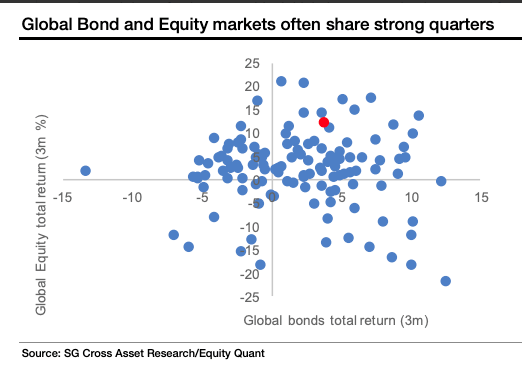

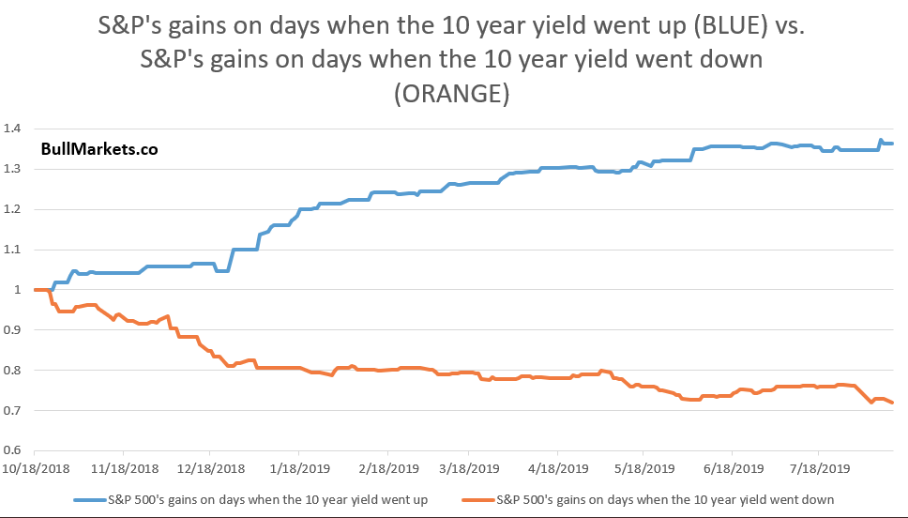

We very much agree and have suggested the exact same sentiment, offered by Cramer, in the recent past. Remember, over the past 200 days, all of the S&P 500’s gains have occurred on days when the 10-year Treasury yield went up, and all of the S&P 500’s losses have occurred on days when the 10-year yield went down. The two have an extremely tight correlation as depicted in the chart below:

Given the tight correlation and undeniable trend depicted in the chart above, we can’t help but to recognize that the correlation and performance trend did not hold true on Thursday. Bond yields continued to plunge to lower depths, but the S&P 500 and peer indices all rose on the Thursday. History doesn’t always predict the future.

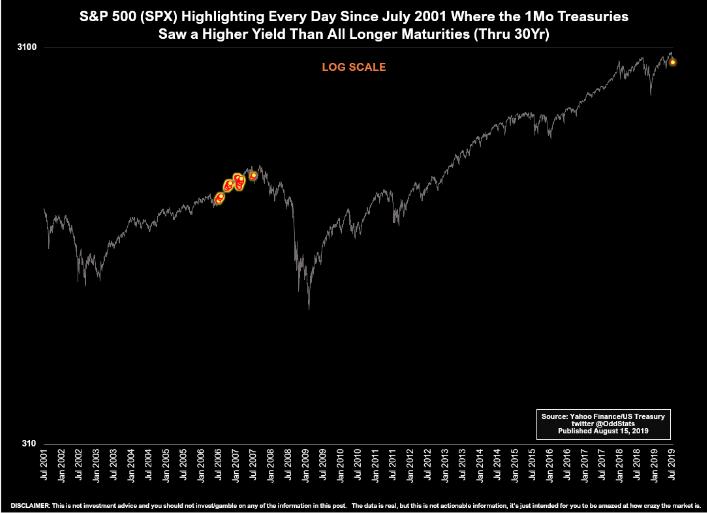

According to the U.S. Treasury data, something very odd happened Thursday also. The 1-month Treasuries yielded higher than all longer maturities (thru the 30y). That hadn’t happened in 12 years. In fact, it’s only ever happened in 2006, 2007 and Thursday.

Some additional commentary from Jim Cramer lends itself to recognizing the hunt for yield remains amongst one of the key reasons investors from around the world are fleeing to U.S. Treasuries.

“Investors in the rest of the world are … are swapping out of the debased euro and their lousy bonds with negative interest rates so they can have it their way in our market. When long-term interest rates plummet like this, it’s not just a product of demand from overseas. It’s also a sign of fear, fear that we’re going into a recession.

Still, the American economy is robust with low unemployment”.

And if you thought the U.S. economy is getting weaker, well it’s all relative and demands a degree of objectivity. Finom group recognizes that the economy grew above trend-growth pace in 2018. Naturally, this type of growth has its limitation so far as sustainability is concerned, especially if an exogenous event such as tariff impositions take place. In 2019, the economy has slowed to a trend-growth pace. This is often recognized by annual GDP growth in the range of 1.7-2.5 percent.

In speaking to the relative STRENGTH of the U.S. economy, while recognizing the global economy is weakening at a faster clip, we can’t help but to understand what drives the U.S. economy. It’s something that serves to uniquely separate and possibly insulate the U.S. from the type of economic weakness found in other industrialized nations like China and Germany.

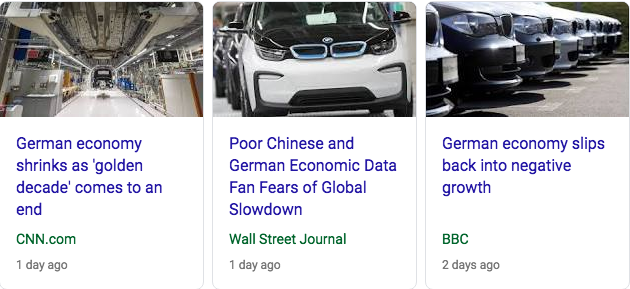

Economic data released Wednesday revealed that the German economy shrank by 0.1% in the second quarter of 2019, having grown by 0.4% in the first quarter. Manufacturers and the construction sector bore the brunt of a global slowdown.

The shrinkage in GDP (gross domestic product) growth marks the end of a decade of expansion for the German economy, which has grown by an average of 0.5% quarter-on-quarter every quarter since the end of the 2008/9 recession, expanding in 35 of the last 40 quarters.

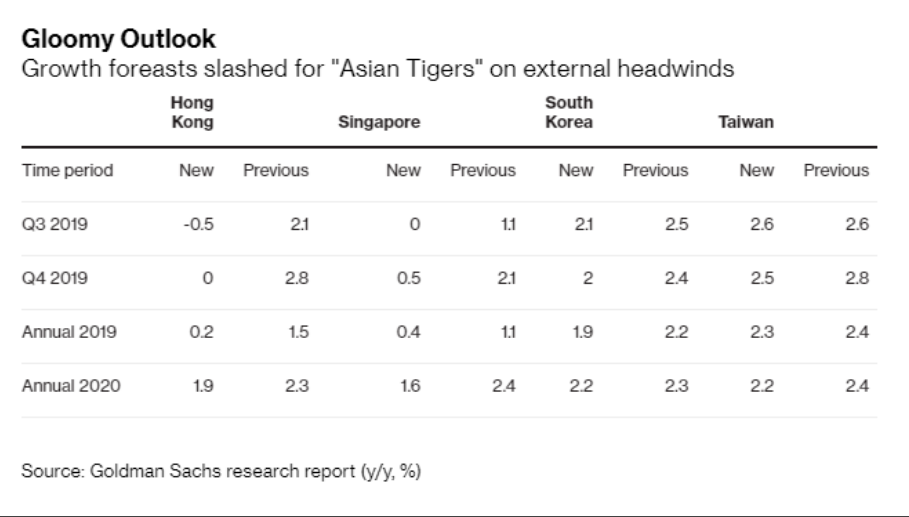

Germany, Britain, Italy, Brazil and Mexico each rank among the world’s largest 20 economies. Singapore and Hong Kong, which are smaller but still serve as vital hubs for finance and trade, are also suffering. Goldman Sachs has also recently slashed its growth forecast for what it refers to as the Asian Tigers.

The U.S. is largely a consumer-based and services driven economy, with limited reliance on manufacturing. For these reasons the U.S. is also a heavy importer of goods for those consumers to… consume. In the case of the some of the aforementioned regions of the world, their consumer remains healthy, but the scale of the U.S. consumer-driven economy helps to offset decelerating growth in lesser areas of the economy that contribute to GDP.

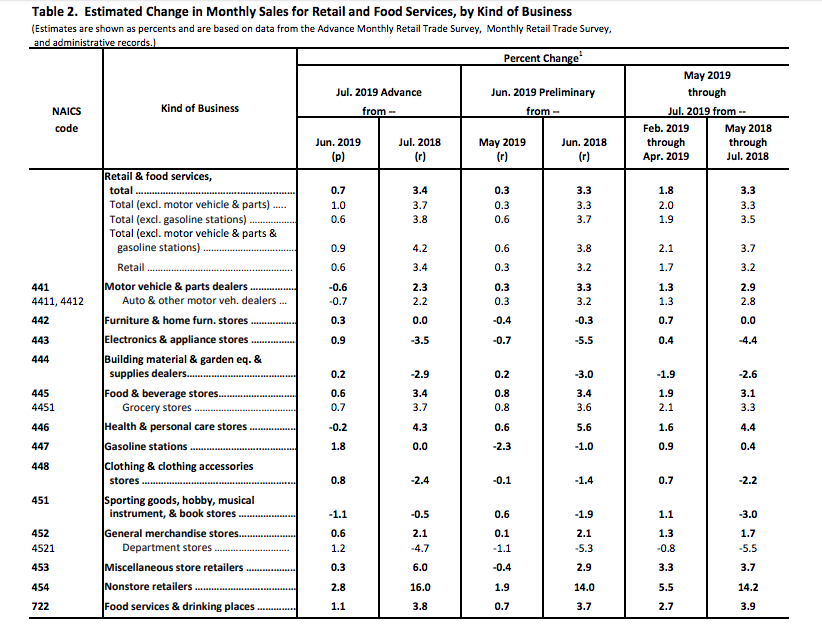

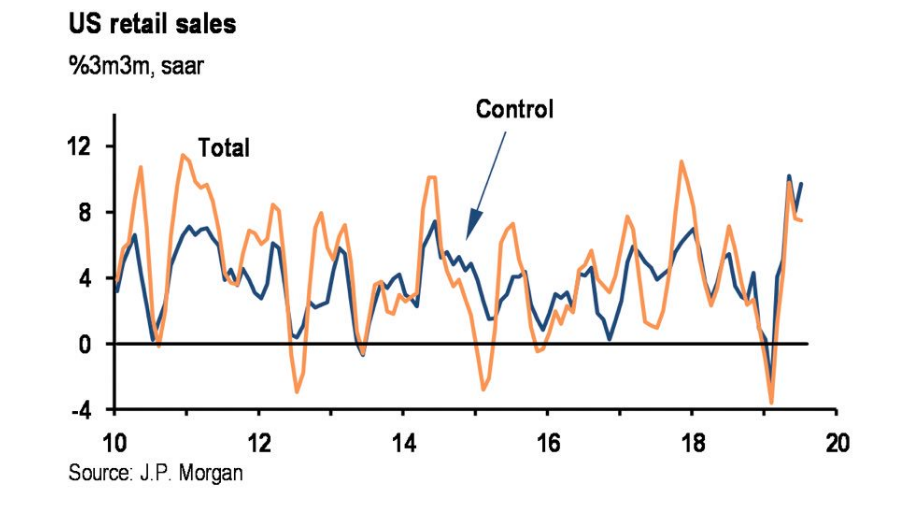

July’s retail sales identified that in the face of 4-straight 25 bps rate hikes, the longest ever government shutdown, a year-long trade feud, a very strong U.S. Dollar, two bear markets in crude oil prices and a somewhat hyperbolic POTUS, the U.S. economy has remained extremely resilient.

On the heels of July’s .7% MoM and 3.4% YoY retail sales growth, which nearly doubled economists’ estimates, equities rallied Thursday as consumer strength seemingly nullified the fears being signaled from the bond market. Additionally, several firms were forced to raise their Q3 2019 GDP forecasts. But with regards to July’s retail sales, here is what J.P. Morgan had to offer:

“While still early in the quarter, this leaves US real consumption tracking a robust 3.0% annualized increase in Q319, above our forecast for a 2.4% gain.”

In addition to the notes on July’s retail sales from J.P. Morgan outlined above, Goldman Sachs and BofAML raised their Q3 growth forecasts.

- Following today’s data deluge, Goldman boosted its Q3 GDP tracking estimate by two tenths to +2.1%

- Merrill: “The data boosted our 3Q GDP tracking estimate by 0.4pp to 2.1% qoq saar. 2Q was unchanged at 1.8%.”

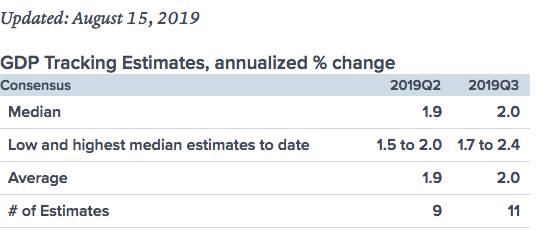

In addition to the upwardly revised GDP forecasts from the firms’ noted, The Federal Bank of Atlanta also raised its Q3 GDP outlook from 1.9% to 2.2 percent. CNBC’s Rapid update rose from 1.8% to 2% as depicted below:

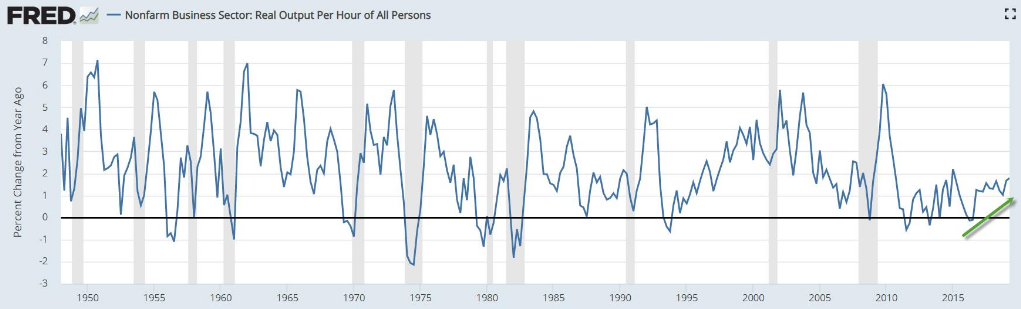

But things are weakening so much and the yield curve inverted, for a few hours on Wednesday? Do you see the disconnect? What also might be invalidating the signals from the bond market, like that from retail sales, is what we can see through productivity growth.

U.S. productivity rose at a healthy 2.3% annual clip in the second quarter following a revised 3.5% gain in the first three months of the year, the government said Thursday. The increase in output in the second quarter jumped 1.9% even as hours worked fell 0.4%. Unit-labor costs rose 2.4%. U.S. productivity has increased at an 1.8% pace year over year, the biggest gain since early 2015.

Here is what LPL Financial’s Ryan Detrick recently had to say with regards to the economy and through the lens of productivity growth:

“Economy continues to muddle through around 2.5% growth, but seeing this upward trend in productivity is a nice sign we likely won’t fall into a recession anytime soon.”

We repeat: “But things are weakening so much and the yield curve inverted, for a few hours on Wednesday?“ Playing devil’s advocate for a second here, let’s assume the yield curve is right and a recession does take place some 12-18 months out. This will likely prove the most visible and known recession prediction in history. All of a sudden, everyone sees it coming, no ambiguity and we’re all just awaiting the certainty of the recession and because that’s the likelihood… that we all see it coming because of the yield curve inversion? Is that what history teaches us; we all are of like mindedness and visibility of the, well, obvious??

To answer the sarcastic questions noted above, here is what Tim Duy of FedWatch had to say in a Bloomberg interview: (See Below)

If everyone is looking at, evaluating and asking the same question, we likely aren’t asking the right question. But speaking of the Fed, the next event for the central bank isn’t the September FOMC meeting. Next week is the Jackson Hole event in Wyoming, which is likely going to impress upon investors the central banks intentions with monetary policy and combatting the effects of the ongoing trade feud and implications from the bond yield curve inversion/s. With that being said, Fed officials are now speaking ahead of the event.

St. Louis Fed President James Bullard on Thursday became the first central-bank official to talk after the steep stock-market selloff and drop in long-term U.S. bond yields, saying the central bank didn’t need to respond with an inter-meeting easing action. In an interview with Fox Business Network, Bullard said the exact timing of any easing isn’t critical.

“A couple of weeks one way or the other probably doesn’t matter. What matters is you’re in the right zone for interest rates and that you’re reacting appropriately to incoming data.

I think we’re in the middle of a global slowdown and we’re just going to have to assess how this is going to affect the U.S. economy. Stocks are lower, in part, because many large U.S. companies earn the bulk of their profits overseas.

The steep selloff was big, but the [equity] market is way up this year. Even if nothing else was going on, you might have expected some repricing there.

There is an upside to the economy from the lower bond yields — it should boost auto and home sales. The consumer looks pretty good.”

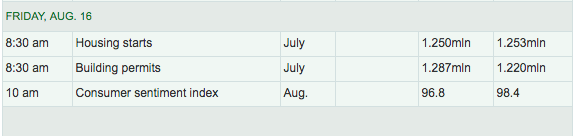

So we’re about to round out and come to the close of the trading week and what a wild, headline trading it week it has been. The weekly expected move was $56/points, which was breached again and to the downside. Monthly options expiration may play a role in Friday’s trading as the greater economic data reports have already been delivered for the week. With that being said, the economic calendar for the day is offered below:

With U.S. equity futures following in the lead of Asian markets overnight and building upon Thursday’s gains, the technicals for the S&P 500 come into focus. Robert Sluymer of Fundstrat, believes the near-term trajectory of the S&P 500 takes the benchmark average down to 2,728, the May-June lows, and finds support down there.

In analyzing the S&P 500 technicals we look at a few key factors. First is resistance, or levels that an index or stock may struggle to rise above. Despite Tuesday’s 1.5% gain, the S&P 500 ran right into its 50-day moving average near 2,940. As for support, or levels at which buyers are more likely to come back into the market, there are 3 key levels to consider:

- 2,822. The intraday low from August 5th is only about 1% below Wednesday’s close.

- 200-day moving average. Currently at 2,795, the 200-day moving average is a closely watched trend indicator that is commonly viewed as either support or resistance, depending on where the index sits in relation to it.

- 2,740. Perhaps the strongest level of support for the S&P 500 is 2,740. This key level has been tested 2 times so far this year, but it failed to close below that level either time. 2,740 also happens to be 9.5% below the July highs, right in line with a standard 10% correction.

While there remain calls for a retest of the December 2018 lows, Finom Group sees this as an unlikely occurrence. Nonetheless, market technician Carter Worth of Cornerstone Macro suggests the market will retest the December 2018 lows… again. In his latest CNBC Fast Money interview on August 14th, the infamous technician outlined his bearish market thesis.

It’s a bull-bear, technical debate between Robert Sluymer and Carter Worth. Who will be proven more accurate remains to be seen as the fluidity of the market evolves through the back half of August.

Last but certainly not least: Finom Group will be foregoing this week’s Weekly Research report do to consulting/scheduling obligations, but will resume with our usual Sunday Research report in the following week. For this reason, we have issued an extend SOTM video delivered on Thursday alongside today’s Daily Market Dispatch.