With the G-20 Summit still hovering above the markets and economy, UBS’ global head of economic research Arend Kapteyn suggests that the globe is “one step away” from recession. While escalation isn’t what UBS expects, a failed meeting between President Donald Trump and China’s Xi Jinping that results in a new wave of tariffs would mean “major” changes to global GDP and market forecasts.

“We estimate global growth would be 75bp lower over the subsequent six quarters and that the contours would resemble a mild ‘global recession’ —similar in magnitude to the Eurozone crisis, the oil collapse in the mid-1980s and the ‘Tequila’ crisis of the 1990s.”

Traders blamed the worsened trade outlook for an equity pullback in May, with the S&P 500 down 6.5% last month. But further aggravation of the trade conflict could push global equities down 20%, Kapteyn said, with the prior U.S. outperformance relative to Europe eroding and emerging markets taking a heavy hit.

“In global sectors, Materials stands out as most vulnerable, but some defensive and crowded segments are also at risk amidst weaker growth,” he added. “For a bottom up perspective, we lean on our prior work to highlight trade and crowded growth exposed stocks.”

Obviously, this is not what the world desires to be the outcome from the upcoming G-20 Summit meeting between Trump and Xi. Most are of the opinion that while a deal is unlikely to prevail at the Summit, a truce has become increasingly likely. An outlier thesis on the upcoming meeting with Trump and Xi is Kristina Hooper of Invesco who has gone on the record warning investors that the market is too optimistic about a trade deal, suggesting disappointment lay ahead.

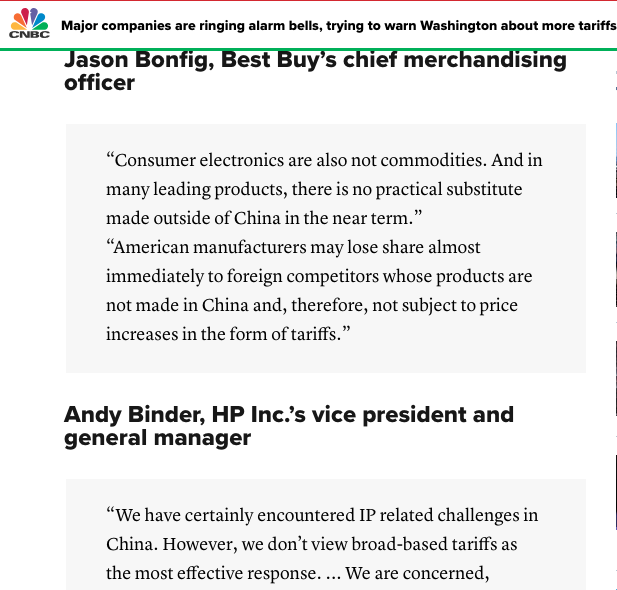

Moreover, while analysts and economists debate a deal/no-deal outcome, U.S. companies continue to press the White House and USTR to remove existing tariffs and forgo additional tariffs. More than 300 companies are talking to government officials in Washington this month about how detrimental the trade war between the U.S. and China has been and will be to their business.

Testifying in front of the Office of the U.S. Trade Representative, major U.S. companies including Best Buy, HP and Hallmark Cards are voicing concerns about how the additional tariffs that President Donald Trump threatened to slap on China would impact their businesses and cause them to lose business to foreign competitors.

We can discuss the G-20 Summit until we’re blue in the face, but a logical and likely mutually beneficial path forward will be found that can aid in reenergizing economic growth. In the meantime, all-too important earnings results are coming into focus. Micron (MU) results topped lowered expectations for the quarter and executives forecast improvement in the fourth quarter even though actual numbers were shy of Wall Street expectations.

The company reported fiscal third-quarter net income of $840 million, or 74 cents a share, compared with $3.82 billion, or $3.10 a share, in the year-ago period. Adjusted earnings were $1.05 a share. Revenue fell to $4.79 billion from $7.8 billion in the year-ago quarter. Analysts surveyed by FactSet had forecast earnings of 79 cents a share on revenue of $4.67 billion. Micron also said it planned to reduce capital expenditures in fiscal 2020 “to help improve industry supply-demand balance.”

“Both the DRAM and NAND markets remain oversupplied,” said Chief Financial Officer David Zinsner on the call. “Having said that, we are starting to see some signs of bit-demand improvement. As Sanjay mentioned, we expect strong growth in our DRAM bit shipments for the cloud graphics and PC markets in fiscal fourth quarter, followed by more normal bit growth in fiscal first quarter.”

Micron Technology Inc. has resumed some shipments to Huawei Technologies Co. after determining that they didn’t fall afoul of U.S. curbs on exports to the Chinese telecom giant, the memory chip maker’s chief executive said Tuesday. Micron had stopped all shipments to Huawei after the Commerce Department in May added the Chinese company to a blacklist, a move the Trump administration said would prevent U.S. technology from being used to undermine U.S. security and policy interests.

FedEx (FDX) also reported better than anticipated adjusted earnings results in their fiscal Q4 period that sent the stock higher in after hours. The company reported fourth-quarter net losses of $1.97 billion, or $7.56 a share, compared with net income of $1.13 billion, or $4.15 a share, in the year-ago period. Adjusted for items such as retirement-plan accounting and business integration costs, among other things, earnings were $5.01 a share.

Revenue rose to $17.8 billion from $17.3 billion in the year-ago period. Revenue in its ground and freight segments increased 11% and 5%, respectively. However, revenue declined 1% for FedEx Express, its largest business segment, to $9.5 billion. Analysts surveyed by FactSet had estimated adjusted earnings of $4.85 a share on revenue of $17.8 billion.

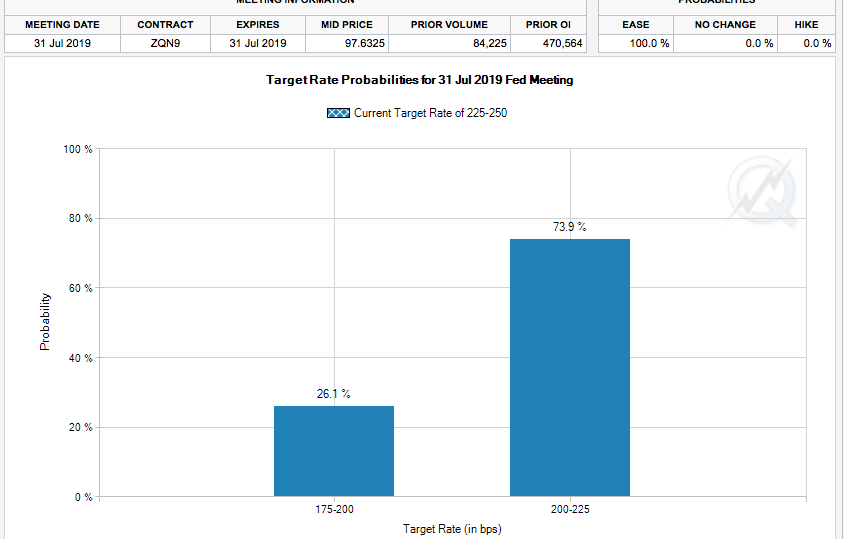

Equity markets in the U.S. suffered a decline on Tuesday and after sideways to slightly lower action on Monday. The greater declines on Tuesday were likely spurred by the perceived mixed messaging from the litany of Fed officials speaking on the economic outlook and potential rate cut/s near-term. The market is currently pricing in a 25 bps rate cut in July, but it is increasingly pushing for a 50 bps rate cut which certain officials discussed “might be too exhaustive”.

St. Louis Fed President James Bullard, who dissented from the Fed decision to hold rates steady last week in favor of a quarter-point rate cut, repeated in an interview Tuesday that he thought a quarter-point cut would be a wise “insurance” move. But Bullard said he didn’t see the need for a half-point cut.

“I think 50 basis points would be overdone,” Bullard said on Bloomberg Television.

While Fed Chairman Jerome Powell’s comments were pretty consistent with what he delivered in the post FOMC press conference recently, Bullard’s comments seemingly usurped and found investors disappointed with a 25 bps cut probability.

Taking the Fed speeches and paring them with worse than expected economic data releases on Tuesday and it proved a potent cocktail for a market sell-off. The Nasdaq (NDX) led index declines with a 1.5% loss only to be followed by a near 1% drawdown in the S&P 500 (SPX) The Dow Jones Industrial Average (DJIA) outperformed, down less than .7%, even with the Transports (DJT) sector continuing to come under pressure. While the S&P 500 recently hit a new all-time high, within days, the following all collapsed to a relative low:

* Small caps

* Transports

* Banks

This has happened only twice in the last 40 years, both leading to a 15% drop in the S&P 500 within 2 months.

Not necessarily a favorable statistic for bullish investors, but it stresses the anomalistic geopolitical issues that are guiding economic activity and proving disruptive. With that in mind we continue to see economic data tied to the month of May, when the U.S. threatened a 5% scaling tariff on all Mexican goods, deliver poor results. Last week, investors witnessed monthly manufacturing data in May decline precipitously. On Tuesday, New Home sales and Consumer sentiment data proved to deteriorate in the month of May as well.

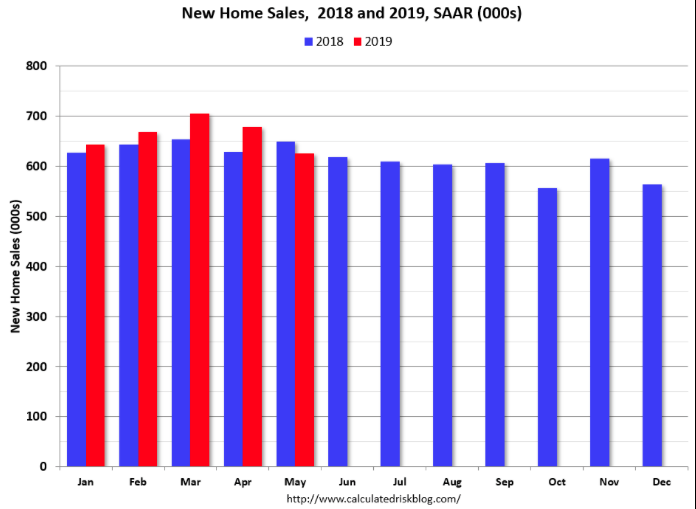

New-home sales ran at a 626,000 seasonally adjusted annual rate in May, the Commerce Department said Tuesday. The MarketWatch consensus forecast was for a 669,000 pace.

Sales in May were down 3.7% year-over-year compared to May 2018. Year-to-date (just through May), sales are up 4.0% compared to the same period in 2018. The months of supply increased in May to 6.4 months from 5.9 months in April. The all time record was 12.1 months of supply in January 2009.

“Few new homes are being built in the more affordable $150,000 to 250,000 range, though builders are doing better in that area,” said Robert Frick, corporate economist at Navy Federal Credit Union. “The number of new homes sold that are under construction is increasing as smart home shoppers are working with builders to lock in house earlier in the process, which can give them the opportunity to customize a home to fit their budgets. Overall, the number of new homes being built remains far below historical averages, meaning there is no major relief in sight.”

Although New Home sales remain above the run rate from 2018, economists and analysts alike were expecting a continued strong trend. Even with lower fixed rate mortgages available, the housing sector has shown some variability in its results over the last few months. It’s likely that the continued pressures from consumer demographics are negatively affecting home sales even as affordability increases.

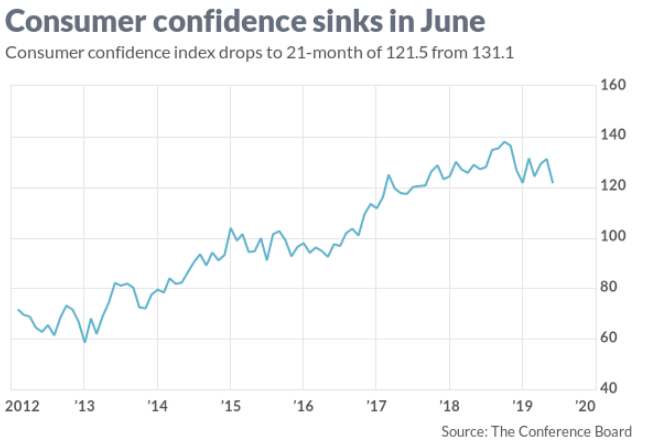

New Home sales wasn’t the only sore spot in the economic data released Tuesday, as Consumer sentiment proved to falter during the month of May. Consumers’ confidence fell in June to the lowest level in almost two years as Americans grew more worried about trade tensions with China and said it was harder to find a job.

The consumer confidence index slipped to 121.5 from a revised 131.1 in May, the privately run Conference Board said Tuesday. It was the weakest result since September 2017.

A measure of how Americans see the economy at present slid to a one-year low of 162.6 from 170.6. Part of the reason: More Americans said jobs were harder to get than in the prior month at 16.4% vs. 11.8 percent. Another gauge of consumers that looks out toward the next six months declined to a five-month low of 94.1 from 105.

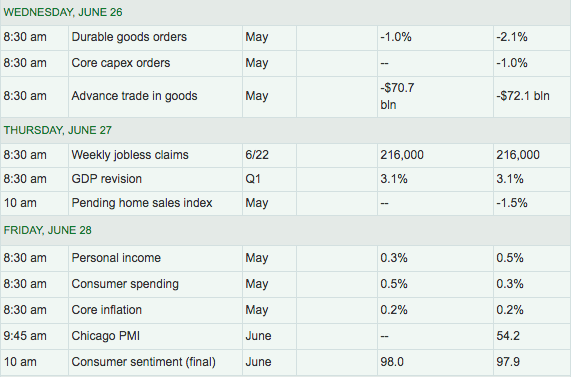

The economic data remains flowing through the week with Durable Goods coming into focus on Wednesday and expected to remain under pressure.

Probably the most important piece of economic data that remains front of mind with investors comes on Friday via the Personal Income and Expenditures data (PCE). With Fed officials dampening the hopes of a 50 bps rate cut in July, a worse than expected core reading on inflation could slant such an action in favor of a more impactful rate cut.

Despite the weakening economic data and threats surrounding global growth from the geopolitical strife in continuum, investors might keep their eye on the proverbial ball. The Fed remains a supporting factor for financial market conditions and aims to support the economic expansion; the Fed “put” so to speak remains a firm and healthy force in the market and one that many investors have learned not to battle. This point of fact was discussed in a recent TDNetwork Live interview with Canaccord Genuity’s chief market strategist Tony Dwyer.

Within the interview, Dwyer offers two suggestive phrases for investors to consider: “Don’t fight the Fed and don’t fight the tape.”

At Finom Group we continue to monitor the daily ebbs and flows of the market and the impact of economic and geopolitical issues on the “tape”. Our daily review of market correlations and divergences often suggest a trade is available to those opportunistic traders. One of our most watched market correlations in 2019 continues to center on the S&P 500 to 10-year Treasury yield (TNX) correlation. The correlation has proven the dismay of many investors, as yields have performed inversely to the S&P 500 and against the path of least resistance.

Undoubtedly, this usually tight correlation has defied history throughout 2019. It identifies mistrust in the Fed’s ability to stave off a recession, suggesting the Fed simply can’t cut rates quickly enough to stabilize economic growth. At present, the bond market is signaling that the Fed is being too patient according to Finom Group’s chief market strategist Seth Golden.

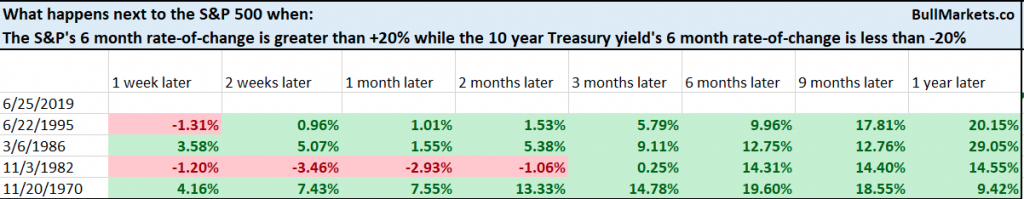

Regardless of what the Fed does going forward, and Finom Group is of the opinion the Fed will cut by 25bps in July, the present inverse SPX-TNX relationship is not unique, it’s rare but it’s not unique. The S&P has rallied more than 20% over the past 6 months while the 10 year Treasury yield’s 6 month rate-of-change is less than -20 percent. According to Troy Bombardia of Bullmarkets.co, it has happened 4 other times. This is normally what happens after there is a slump in the stock market, followed by a big rally. Simply put, the fears of a recession that prevailed in Q4 2018 but has yet to be realized, has not been lost on the bond market and still looms large even as the S&P 500 has risen nearly 18% in 2019.

As shown in the study below from Bombardia, all like examples where the S&P 500 has rallied more than 20% over the past 6 months while the 10 year Treasury yield’s 6 month rate-of-change is less than -20% have had a positive result at least 3-months out.

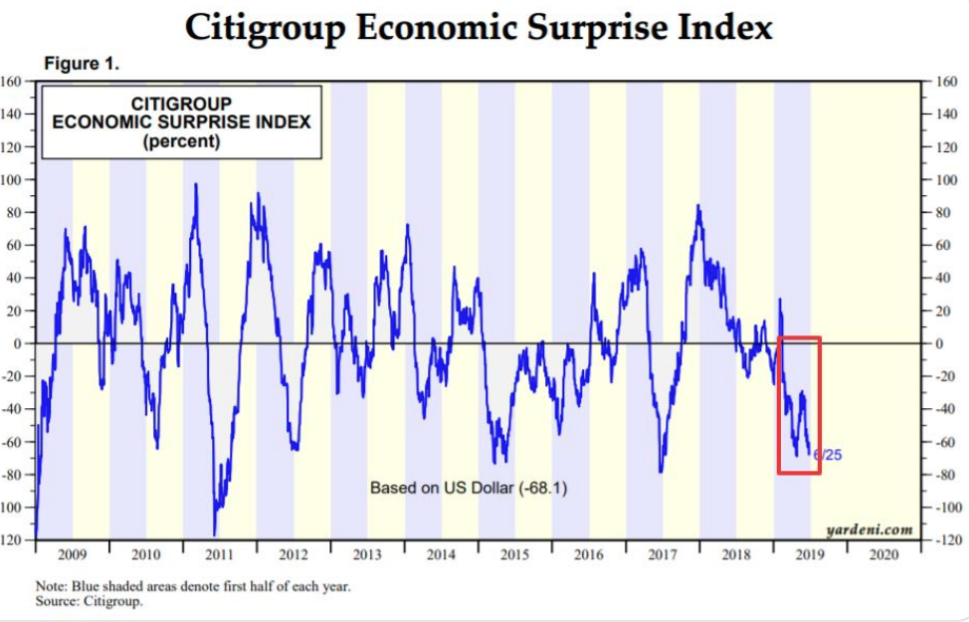

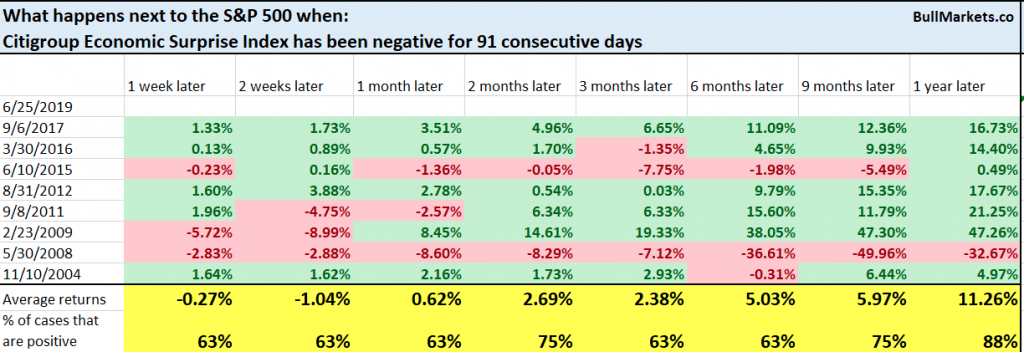

While the broader investing public continues to stress over the SPX-TNX correlation, the Citigroup Economic Surprise Index has also been cause for angst amongst investors. The Citigroup Economic Surprise Index has been in negative territory for 91 consecutive days. This is a long streak. This indicator is mean reverting. To reiterate, in order to see such anomalistic economic indicator results and/or readings, it demands anomalistic geopolitical developments to pervade the data sets.

What Finom Group has been suggesting is that when such geopolitical issues are removed or resolved, the data improves and proves to be favorable for the equity markets thereafter. This is evidenced by history and in the study depicted below:

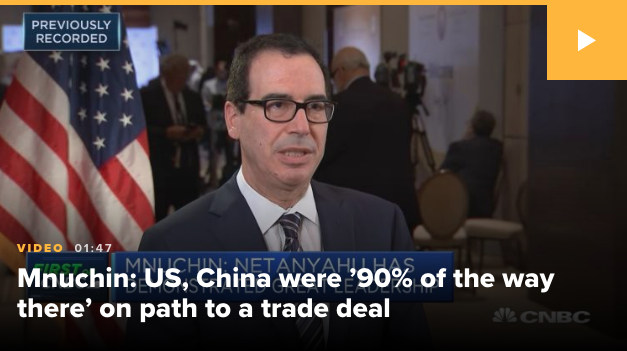

With all that being said, equity futures are reacting positively to none other than… that’s right trade headlines. U.S. stock index futures jumped Wednesday morning after Treasury Secretary Steven Mnuchin told CNBC that the U.S. and China were almost there on a trade deal.

“We were about 90% of the way there (with a deal) and I think there’s a path to complete this,” he told CNBC’s Hadley Gamble in Manama, Bahrain on Wednesday.

Piling on to this headline are reports that the U.S. is not likely to apply another round of tariffs on China’s exports to the United States.