It’s finally here folks. The FOMC will announce its rate decision and hold its press conference after the release of the FOMC statement, at 2:30 p.m. EST. This FOMC day like previous ones under the leadership of Fed Chairman Jerome Powell comes with great politicization, polarization and provocation from the White House and media coverage. Whether we want to admit it or not, the Fed is in a rather untenable situation that demands precision with policy messaging and implementation.

It is widely believed that the Fed will not adjust rates when it makes its announcement later today, although a select few economists and Fed watchers have suggested the benefits of getting ahead of what is believed to be weakening economic conditions. Finom Group agrees with such sentiment as a game theory measure that may ultimately serve to level the playing field. To-date, the market has priced in 3 rate cuts for 2019 and with at least a 25 bps cut as early as July. But 3 cuts seems exhaustive for an economy expected to grow above 2% with low unemployment, strong consumer spending, a housing sector recovery already under way, auto sales growing at 17mm run rate, retail sales growing over 3% on an annual basis…which all sounds good, fine and great, but for the sake of price stability that has found the Fed shifting the way it views inflation/price stability. The Fed’s dual mandate that includes price stability seems an unachievable aspect of its total mandate and if for this issue alone, the economic conditions don’t reign supreme under the Fed’s scope of considerations and with regards to cutting rates.

A June rate cut would certainly put the market back on its heels and find many second-guessing the widely held view that as the market dictates, the Fed serves. Having said all of that, it’s still unlikely that the Fed would move to cut rates at today’s meeting. Moving too soon comes with its fare share of go-forward problems to consider should economic conditions persist and worsen.

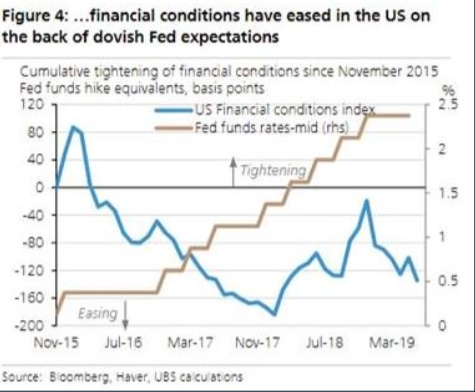

The Fed, without lowering rates in 2019 thus far, has already managed to ease financial conditions. When it announced a pause in rate hikes back in early January, the market breathed a sigh of relief and financial conditions loosened as shown in the chart below from UBS Financial.

The market has run fast and furious into the FOMC meeting and with the S&P 500 (SPX) rallying from 2,886 to a high of 2,930 and a 1% gain alone on Tuesday. The weekly expected move for the S&P 500 is $41/points this week, which has already been achieved as of Tuesday. Since falling some 7% through the month of May and producing several gaps in the chart of the S&P 500 on the way down, all the created gaps have since been filled in just 10 trading days… and for which the S&P 500 continued to rally.

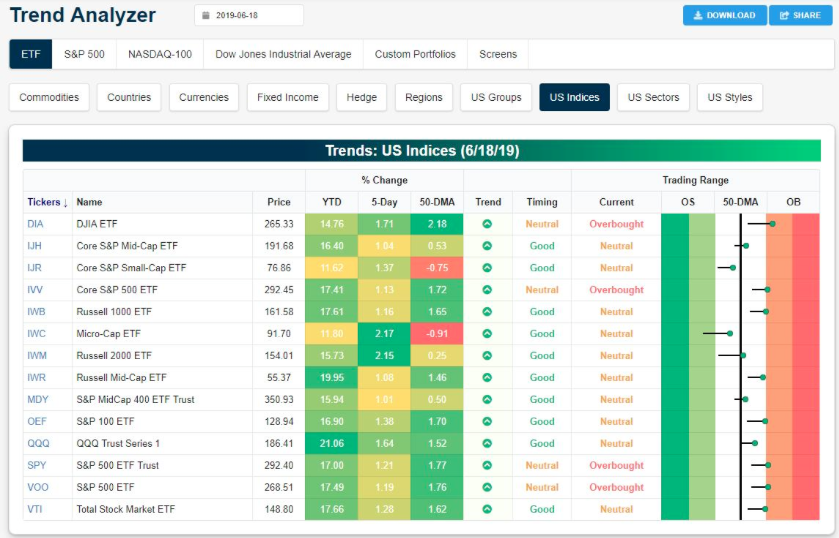

With Tuesday’s broad market rally, large-cap U.S. index ETFs have moved back into overbought territory after today’s rally. Small and mid-caps are neutral, with micro-caps the only one remaining below its 50-DMA. (Bespoke Investment Group table)

Tuesday’s market rally was largely predicated upon the European Central Bank President Mario Draghi signal the central bank was ready to support the Eurozone economy with various tools, if deemed necessary.

Speaking at the ECB Forum in Sintra, Portugal, Draghi gave a defiantly dovish tone, saying that if the economic situation deteriorates in the coming months the bank would announce further stimulus.

“In the absence of improvement, such that the sustained return of inflation to our aim is threatened, additional stimulus will be required.”

The ECB foresees “lingering softness” in the short term, in particular due to geopolitical factors and trade conflicts, which have weighed on exports and on the manufacturing sector — two important drivers of economic growth in the euro zone.

Draghi’s comments sent global yields lower and risk assets/equities higher, but the risk-on trade took its second leg higher with the confirmation of a President Trump and President Xi meeting at the G-20 Summit next week.

US President Donald Trump has announced plans for an “extended” meeting with Chinese leader Xi Jinping at the Group of 20 summit in Japan next week, a significant development aimed at resolving the ongoing trade war between the two countries.

Speaking at the White House Tuesday, Trump said U.S. and Chinese negotiators would resume negotiations on Wednesday ahead of his planned talk with Xi at the sidelines of the summit in Osaka.

Finom Group is of the opinion an actual trade deal will not be achieved from this meeting between the world’s two political giants. It is more probable that a trade truce is put into place, such as the truce that was installed at the 2018 G-20 Summit.

- Both parties agree to forgo the implementation and threat of additional tariffs during the negotiating period.

- Timeline set to loosen restrictions set on U.S./Huawei business cooperations and transactions.

- Agreement in principle to work toward a more pronounced trading partnership.

Finom Group suggests a deal is not necessary at this point to stage off further global economic weakness. The weakness in the global economy since the summer of 2018 and when tariffs were bilaterally imposed has been largely felt at the corporate level. The uncertainty surrounding global trade and the path of future tariffs has led to a slowdown in capital spending and general business sentiment, but at the consumer level the tariffs have had extremely little impact. The slowdown in capital spending has had a trickle-down effect for/into the manufacturing sector of the global economy.

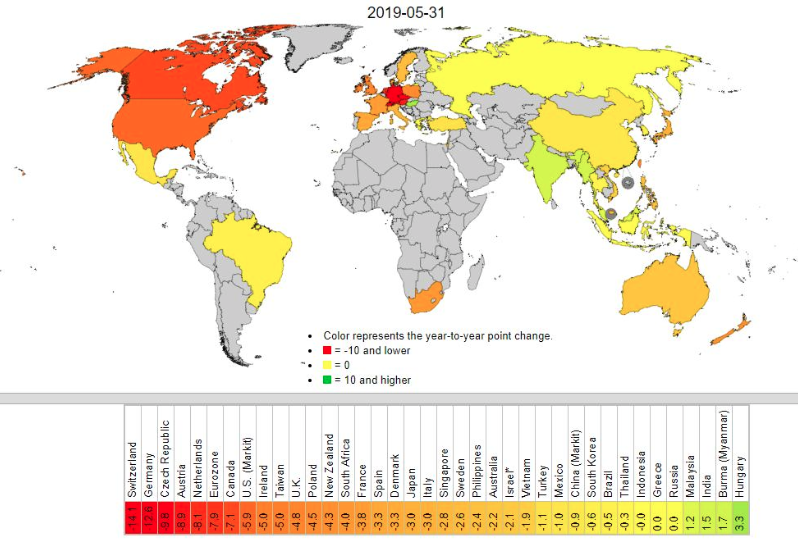

When we aggregate up manufacturing PMIs globally (blue), they’re now the weakest since 2015, when RMB devaluation fears weighed on economic sentiment. Some of this is just a “catch-down” from previously very elevated levels and likely just the normal up and down in global manufacturing. Nonetheless, we can see exactly when manufacturing began slowing and draw a direct correlation to when the tariffs between the U.S. and China were first imposed and have since escalated. And we can see the weakening of the global economy through manufacturing PMI data with the following global map of PMIs.

With Finom Group’s expectations coming from the G-20 Summit meeting put forth, our views are echoed by Blackstone’s chief executive and co-founder Steve Schwarzman. He believes there is little reason to be hopeful about the prospect of a trade deal coming to fruition before the end of the month.

“Trump and Xi must first decide “how far they are willing to go conceptually” before letting senior trade officials work out some of the finer details. I think the expectation of signing something is not on the table.

All that’s happening with this tension is its hurting both countries and the debate of who are you hurting more is interesting but fundamentally people would like to go back to a normal relationship.”

What has been offered by Finom Group and mirrored in Steve Shwarzman’s comments is also found in the commentary from CNBC’s Mad Money host Jim Cramer.

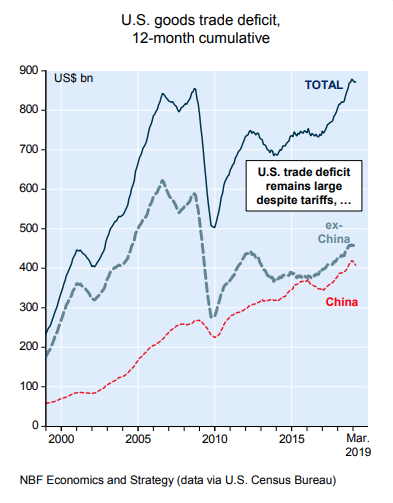

The ongoing trade feud has proven a self-destructive process whenever put forth throughout history. To the extent the White House Administration has set its course on tariffs as a means to curb the U.S. trade deficit with trading partners, very little if any progress has been made, very little. As the following chart taken from the National Bank web site indicates (May 2, 2019), on a 12-month cumulative basis, the total American trade deficit in goods remains near an all-time high.

Although there is some evidence that imports from China may have been reduced, as predicted some US import demand may have been diverted to other countries. The IMF has labeled this effect the Trade Diversion Effect. The next chart below indicates that while the trade deficit with China is falling (in large part due to tariffs), it is clearly being compensated with rising trade deficits with the rest of the world.

Moving beyond the Fed and the G-20 Summit expectations and anticipations, investors will need remind themselves that earnings drive the market over time and earnings are expected to tick lower for the Q2 2019 period. With that in mind, Adobe (ADBE) put in a fantastic result during the Q2 2019 period. After the closing bell on Tuesday, Adobe reported financial results for its second quarter fiscal year 2019 ended May 31, 2019 and which beat analysts’ estimates.

Q2 FY2019 Financial Highlights

- Adobe achieved record quarterly revenue of $2.74 billion in its second quarter of fiscal year 2019, which represents 25 percent year-over-year growth. Diluted earnings per share was $1.29 on a GAAP-basis, and $1.83 on a non-GAAP basis.

- Digital Media segment revenue was $1.89 billion, which represents 22 percent year-over-year growth. Creative revenue grew to $1.59 billion and Document Cloud achieved revenue of $296 million. Digital Media Annualized Recurring Revenue (“ARR”) grew to $7.47 billion exiting the quarter, a quarter-over-quarter increase of $406 million. Creative ARR grew to $6.55 billion, and Document Cloud ARR grew to $921 million.

- Digital Experience segment revenue was $784 million, representing 34 percent year-over-year growth.

- GAAP operating income in the second quarter was $750 million, and non-GAAP operating income was $1.05 billion. GAAP net income was $633 million, and non-GAAP net income was $901 million.

- Cash flow from operations was $1.11 billion.

- Remaining Performance Obligation was $8.37 billion.

- Adobe repurchased approximately 2.5 million shares during the quarter.

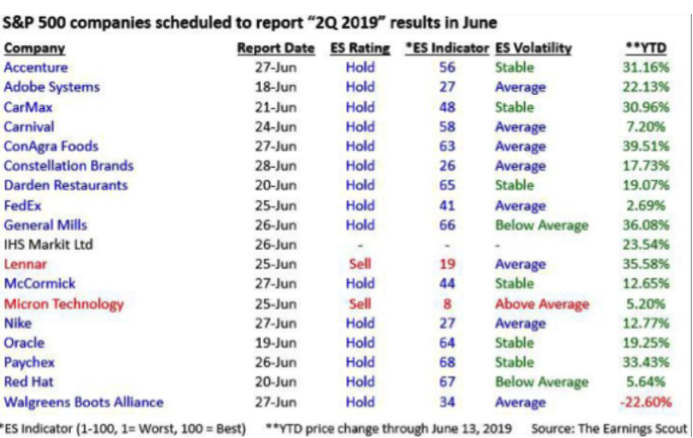

Shares of ADBE are responding positively to the company’s issued results, even as EPS guidance is shy of analysts’ forecast for the current period. The earnings parade will take a backseat to the Fed today, even with Oracle (ORCL) set to report after the bell. Next week, the most important and anticipated earnings releases will come from Micron (MU), FedEx (FDX) and Nike (NKE). All three are multinational companies with exposure to China and/or the Eurozone.

It’s the earnings picture that outweighs the noise surrounding interest rates and the U.S./China trade feud, even though the two are linked over time. Whether a trade deal is achieved or not, the Fed cuts or not, Morgan Stanley’s chief U.S. equity strategist isn’t of the opinion either will change the trajectory of earnings for 2019.

Wilson suggests the damage from the trade feud has already been exacted on the economy and corporate earnings. He notes that PMIs are a leading indicator, but not all the PMI deterioration is trade-related and as such a trade deal doesn’t exonerate further PMI weakness.

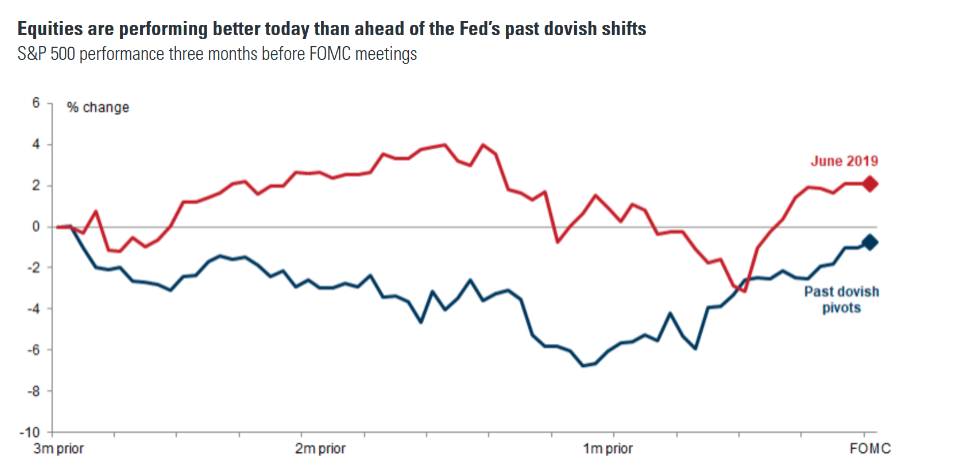

Wilson has argued the department store retail and restaurant dining sales coupled with freight index signals are all suggesting the market is overvalued and is at risk of a 10% correction near-term. He expects an earnings decline in the Q2 and Q3 period that will normalize the S&P 500 PE multiple and present a buying opportunity. Wilson is essentially “bar-belling” his outlook for earnings and the market with a bearish slant that could be offset with TIME and IMPROVED economic conditions down the road. But for now, the equity strategist believes market risk is skewed to the downside, ahead of the FOMC rate decision today. Oddly enough, the market has performed extremely well leading up to the announcement and when compared to prior waiting periods.

The binary risk to the market today will likely produce more certainty going forward. The most important word for today will prove to be “patient”. Most market participants desire to miss such a word, as it would prove to be absent the FOMC’s statement. Should it remain, we would expect a strong adverse reaction in the equity market and more significant volatility.

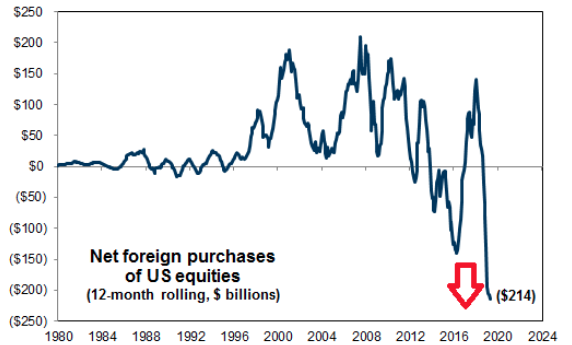

Market depth/liquidity remains poor and while the opportunity to buy the May dip had presented itself, outflows remain prevalent and with the largest equity buyer coming from share repurchase programs in 2019. Even foreign buyers of U.S. equities have largely turned sellers and have remained sellers in 2019.

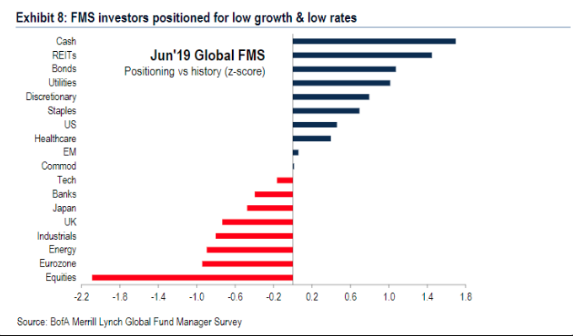

And where has all the money gone to in 2019? It’s clear from the chart below that capital has remained with a cash-heavy investing component and lightly trickling down into more defensive equity positions according to the latest BofAML findings.

Now consider a trade truce coupled with an FOMC in easing mode and what do you think happens to that cash pile? The market is a forward-looking pricing mechanism folks. We believe this is the notion behind the Mike Wilson near-term pain for long-term gain barbell approach to the earnings and market outlook.

Regardless of what takes place in and around the market today, Finom Group will continue to trade the market volatility as depicted in Tuesday’s dual trade alerts completed.