Welcome to another weekly State of the Markets video where Wayne Nelson and Seth Golden discuss all aspects of the macro and micro environment that reflects in the equity and debt markets. This week’s video is roughly 1hour and 26 minutes in length. Please feel free to review the outline below as a guide for the video. Click the following link to view the State of the Markets video.

- Despite mountains of evidence highlighting the mistake, market participants (ranging from retail novices to institutional pros) continue to enter and exit their strategies at exactly the wrong time. For example, they chase returns and buy at the top, and also bail and sell at exactly the wrong time too.

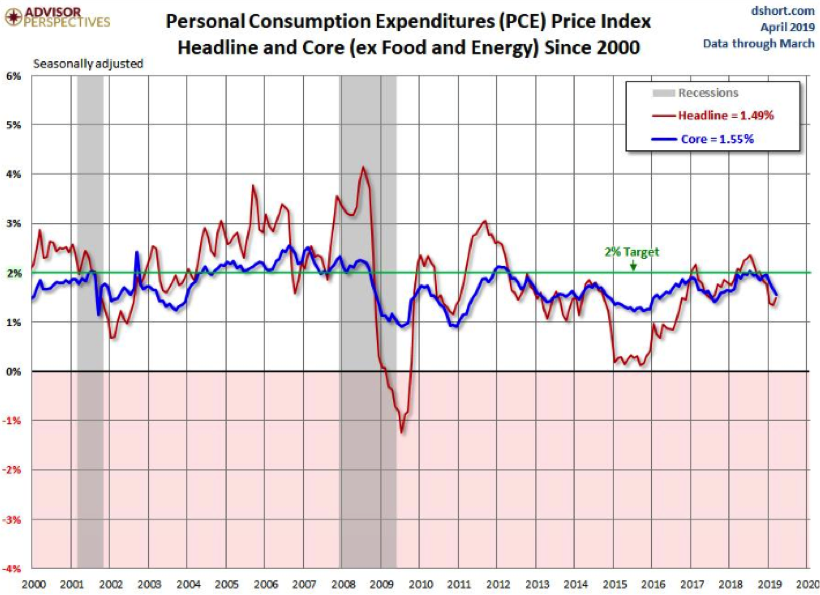

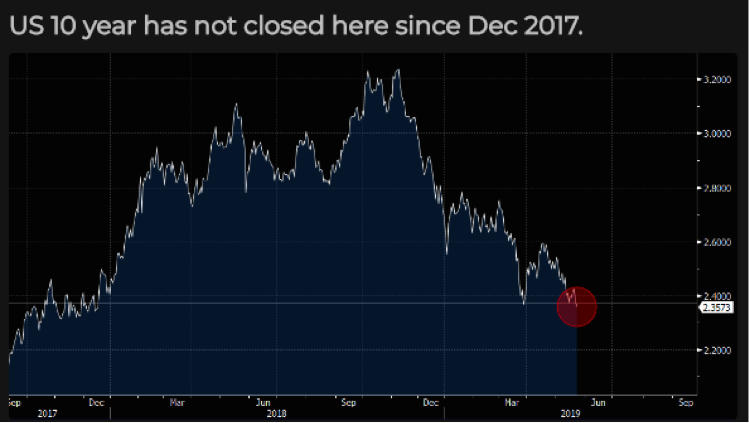

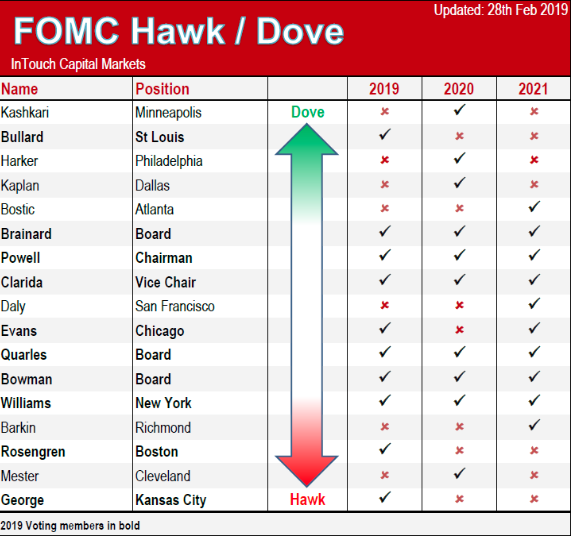

- Unless core PCE grows in the next few months, look for future Fed minutes to talk specifically about rate cuts FED

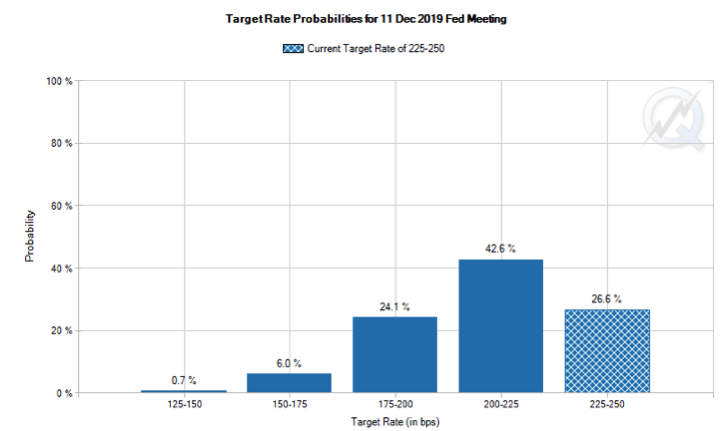

- Fed Meeting Minutes Extrapolation: Many participants viewed the recent dip in PCE inflation as likely to be transitory, and participants generally anticipated that a patient approach to policy adjustments was likely to be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective. Several participants also judged that patience in adjusting policy was consistent with the Committee’s balanced approach to achieving its objectives in current circumstances in which resource utilization appeared to be high while inflation continued to run below the Committee’s symmetric 2 percent objective. However, a few participants noted that if the economy evolved as they expected, the Committee would likely need to firm the stance of monetary policy to sustain the economic expansion and keep inflation at levels consistent with the Committee’s objective, or that the Committee would need to be attentive to the possibility that inflation pressures could build quickly in an environment of tight resource utilization. In contrast, a few other participants observed that subdued inflation coupled with real wage gains roughly in line with productivity growth might indicate that resource utilization was not as high as the recent low readings of the unemployment rate by themselves would suggest. Several participants commented that if inflation did not show signs of moving up over coming quarters, there was a risk that inflation expectations could become anchored at levels below those consistent with the Committee’s symmetric 2 percent objective—a development that could make it more difficult to achieve the 2 percent inflation objective on a sustainable basis over the longer run. Participants emphasized that their monetary policy decisions would continue to depend on their assessments of the economic outlook and risks to the outlook, as informed by a wide range of data.

- In their consideration of the economic outlook, members noted that financial conditions had improved since the turn of the year, and many uncertainties affecting the U.S. and global economic outlooks had receded, though some risks remained. Despite solid economic growth and a strong labor market, inflation pressures remained muted. Members continued to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes for the U.S. economy. In light of global economic and financial developments and muted inflation pressures, members concurred that the Committee could be patient as it determined what future adjustments to the target range for the federal funds rate may be appropriate to support those outcomes.

- After assessing current conditions and the outlook for economic activity, the labor market, and inflation, members decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent. Members agreed that in determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee would assess realized and expected economic conditions relative to the Committee’s maximum-employment and symmetric 2 percent inflation objectives. They reiterated that this assessment would take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. More generally, members noted that decisions regarding near-term adjustments of the stance of monetary policy would appropriately remain dependent on the evolution of the outlook as informed by incoming data.

- Members observed that a patient approach to determining future adjustments to the target range for the federal funds rate would likely remain appropriate for some time, especially in an environment of moderate economic growth and muted inflation pressures, even if global economic and financial conditions continued to improve.

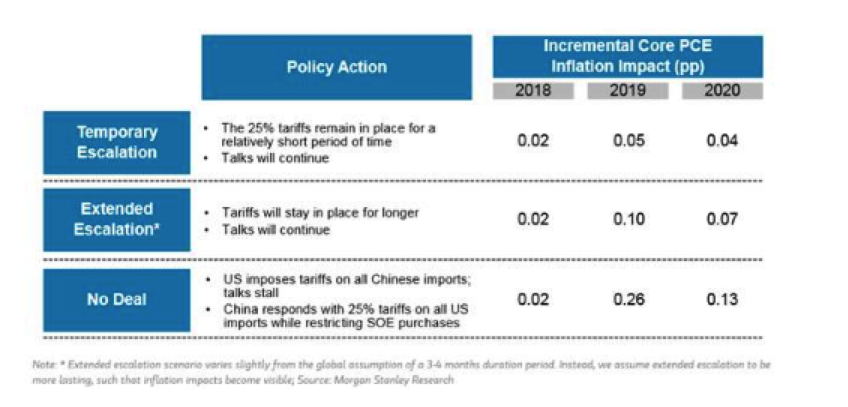

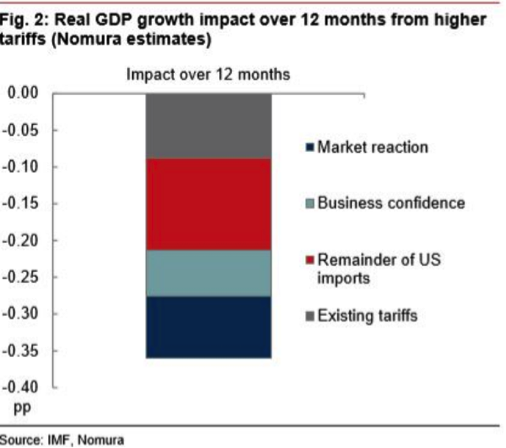

MS economists believe U.S. tariffs on Chines imports can be absorbed in five ways:

- Reduced Yuan profit margins of Chinese producers

- USD appreciation against the Yuan

- Substitution away from Chinese-produced goods

- Reduced profit margins of U.S. producers, importers, distributors, and retailers

- Higher consumer prices. Tariffs on capital goods should ultimately raise the cost of production for consumer goods, but the higher cost is likely to be spread out over a number of years since capital equipment is durable and often financed with debt. They expect ~10% of the cost of tariffs on capital goods will be absorbed by higher consumer prices per year. They expect higher intermediate input costs to pass through gradually to consumer prices as well, with ~20% of the tariff costs being absorbed by higher consumer prices per year. With ~50% of tariff costs absorbed by lower Chinese import prices and substitution away from Chinese goods, and between 20-50% absorbed by lower profit margins, it would be difficult to justify much higher pass through estimates for intermediate inputs and capital goods.

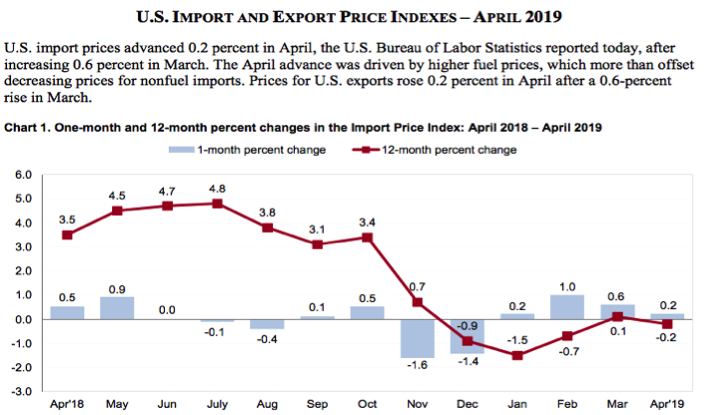

- Logically, tariffs should be a catalyst for higher inflation, as higher costs should boost price growth.

- So far, we’ve seen the opposite happen. Import price growth has slowed considerably: In April, import prices (excluding petroleum) fell 1% year over year, the biggest drop in nearly three years. Consumer price growth has moderated as well, fueling calls for a Federal Reserve (Fed) rate cut to give inflation an extra nudge. So far, the negative impact of slower global growth on inflation has outweighed any broad price impact from tariffs, although inflation has been rising on goods facing tariffs.

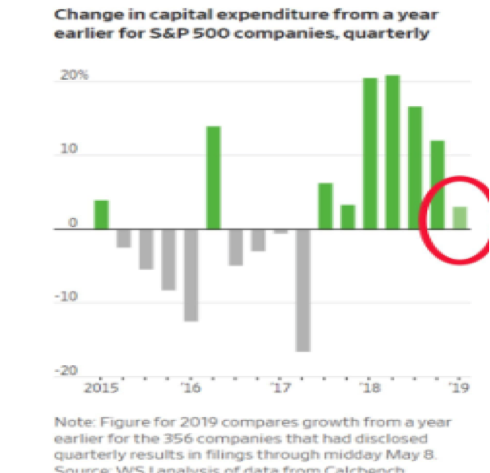

- Growth in capital expenditures is a key part of our economic outlook this late in the business cycle, and prevailing uncertainty could impede this source of future growth.

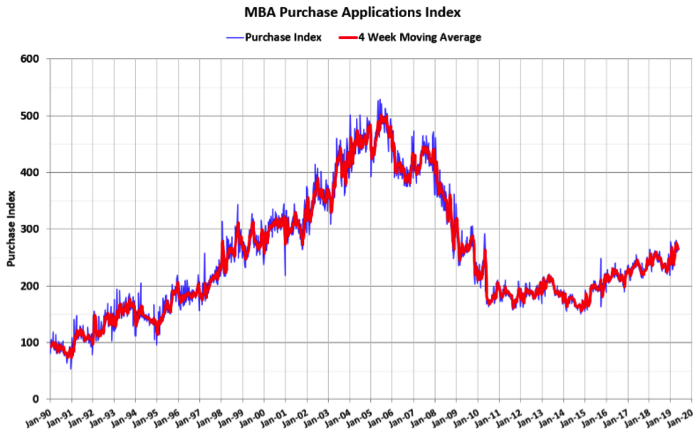

- Total mortgage application volume increased 2.4% last week from the previous week and was up 15% from a year earlier, according to the Mortgage Bankers Association.

- Refinances drove the numbers, jumping 8% for the week to the highest pace in a month and 31% annually.

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances decreased to 4.33% from 4.40%

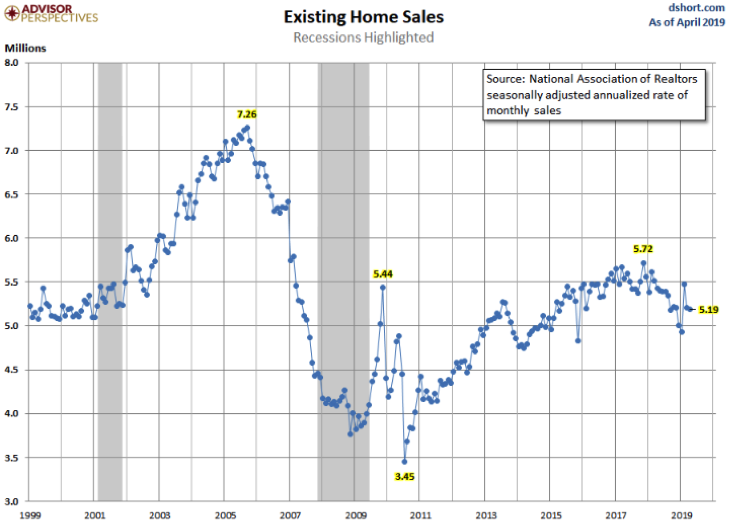

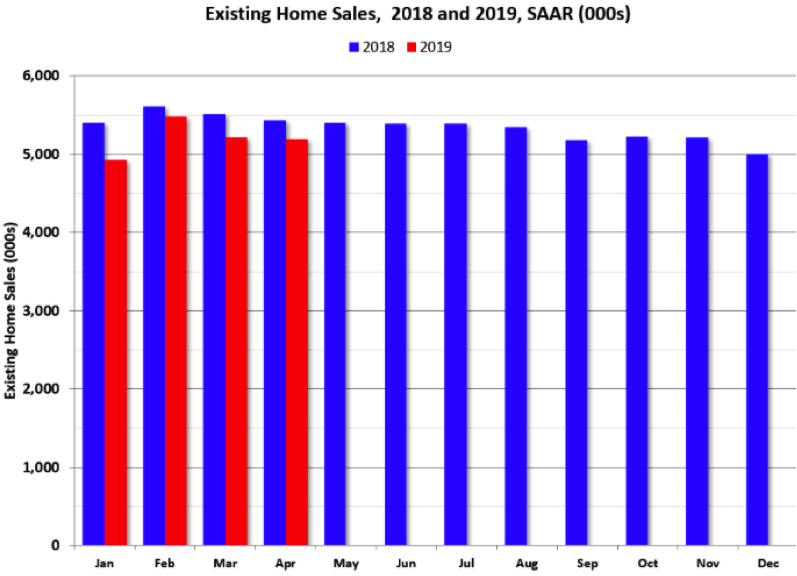

- Year-to-date, Existing Home sales are down about 4.9% compared to the same period in 2018. On an annual basis, that would put sales around 5.1 million in 2019. Sales slumped at the end of 2018 and in January 2019 due to higher mortgage rates, the stock market selloff, and fears of an economic slowdown (unfounded). The comparisons will be easier towards the end of the year.

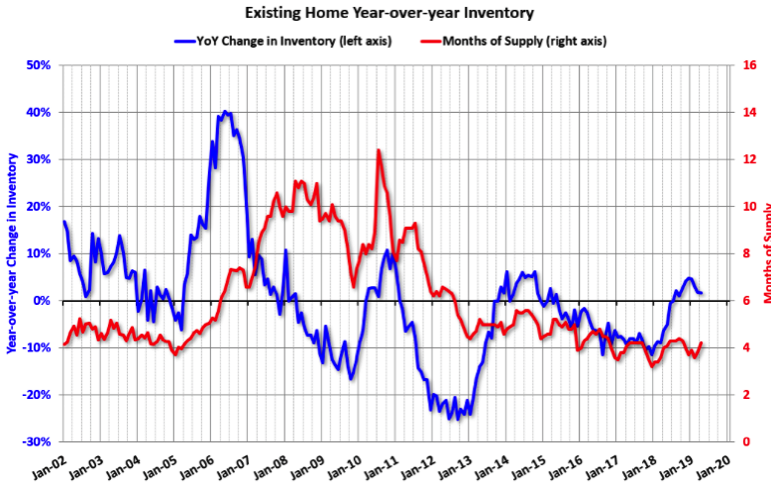

- Inventory was up 1.7% year-over-year in April compared to April 2018. Months of supply was at 4.2 months in April. This was below the consensus forecast. For existing home sales, a key number is inventory – and inventory is still low.

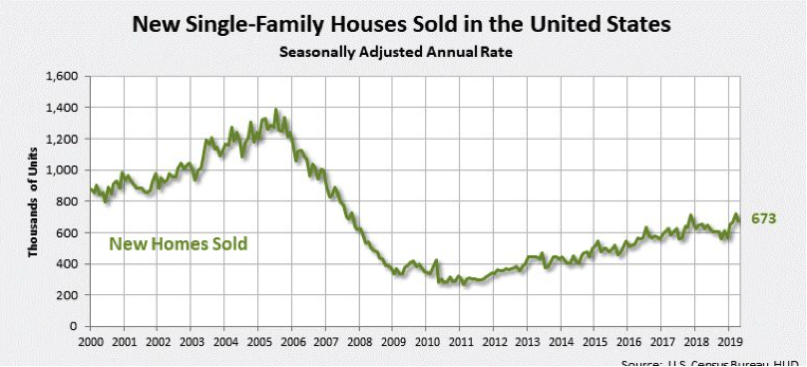

- New-home sales were at a 673,000 seasonally adjusted annual rate in April, the Commerce Department said Thursday. That was 6.9% lower than March, but that month’s tally was revised sharply higher. April’s figures nearly matched the MarketWatch consensus forecast for a 670,000 pace of sales.

- Even though home sales fell in April, the trend is solidly up. The revised March sales figures were the highest since October 2007, and there were upward revisions to every month stretching back to December. Sales were 7% higher than a year ago in April.

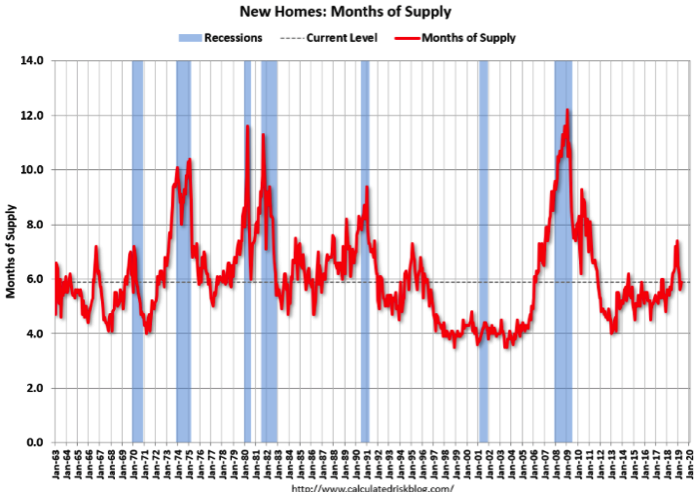

- The months of supply increased in April to 5.9 months from 5.6 months in March. The all time record was 12.1 months of supply in January 2009. This is near the top of the normal range (less than 6 months supply is normal).

- Target shares are up more than 9% Wednesday, putting the stock up more than 20% over the past 12 months, while Wal-Mart shares gained nearly 23% over the past year. The S&P 500 Retail ETF (XRT) has fallen just about 7% over the same period of time.

- Department stores are already being punished heavily by investors who fear they don’t see a soft landing, so now is the time for them to be innovative and take risks,” said Michael Dart, a partner at A.T. Kearney and author of “Retail’s Seismic Shift.” “Nordstrom should even consider going private again.”

- Broad discussion from CNBC Fast Money co-hosts on retail sector.

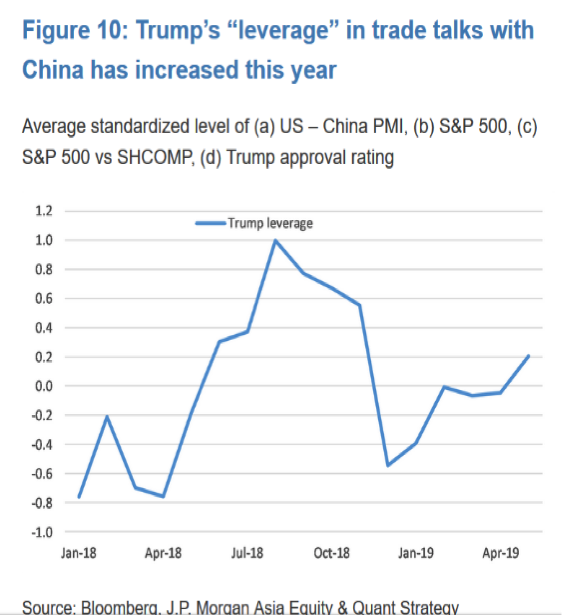

- “Altogether, the U.S.-China relationship has moved further off track over the past two weeks after a period of what appeared, on the surface, to be steady progress toward reaching an admittedly narrow agreement,” said a team of analysts at Nomura, led by Lewis Alexander, in a note to clients. We do not think the two sides will be able to get back to where they seemed to be in late April,” said the analysts, who now see a 65% chance that President Donald Trump will move ahead with 25% tariffs on $300 billion of Chinese products by the end of this year.

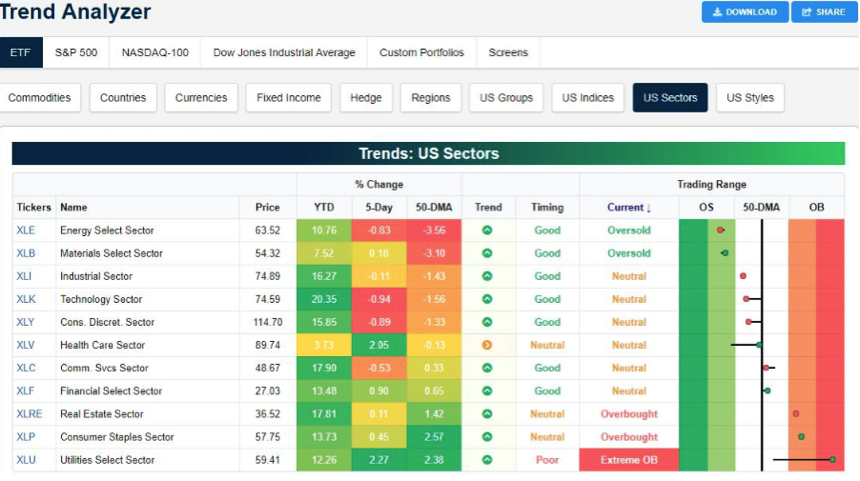

- Defensive Sectors have been outperforming with the Utilities showing the most Overbought conditions, followed by Consumer Staples and Real Estate.

- Fang stocks have proven a source of cash for investors as they sell the heavily priced/valued stocks in favor of cash.

- FUNDSTRAT: “One might wonder why we are not more bearish short-term .. and it’s because the U.S. equity market is the safe haven trade. .. Think of it this way, global equity managers and macro funds, to the extent they have any equity exposure, will Overweight the U.S.”

- There is no way for any person to gain a fundamental edge on expected [trade] outcomes .. There is zero visibility .. but we expect some détente by yr-end as 2020 U.S. political considerations and economic duress in China become practical issues by year-end.”

I have only watched the first half hour of your video:

I like your chart on Oil and S&P 500. Fall in oil price has always been bad for many equity indices over the short term. I’m not sure I’ve fully understood the reason why especially in the US where the allocation to the energy sector is so low (c5%). I firmly believe we should ignore the short term impact of falling oil prices on the stock market and concentrate on how the consumer and business will be affected by lower prices. My view is that a fall in oil is beneficial to the global economy both in the medium to long term. Even though PCE doesn’t take into account of gas prices etc what really matters in the economy is how much free cash the consumer and business have after they have spent their wages/income on essentials such as gas, food imported goods which are all heavily oil price dependent. Lower oil prices should help the consumer and business in the medium term. We saw a similar situation in early 2015 to 2016 where we saw a significant fall in equity and gas markets but then later on a recovery in the equity market as we go better economic news and fears over China slow down and war in Ukraine subsided. I welcome this oil price correction so that the bull market can run further.

Two breadth thrusts

You talk about there was such large buying pressure (indicated by the two breadth thrusts) during January which made it push through the Ichimoku cloud but who bought the equity market? If equity fund flows were so low was it all corporate buybacks? From your video, it sounds like people were buying mutual funds and index ETFs which I’m not sure that this was the case.

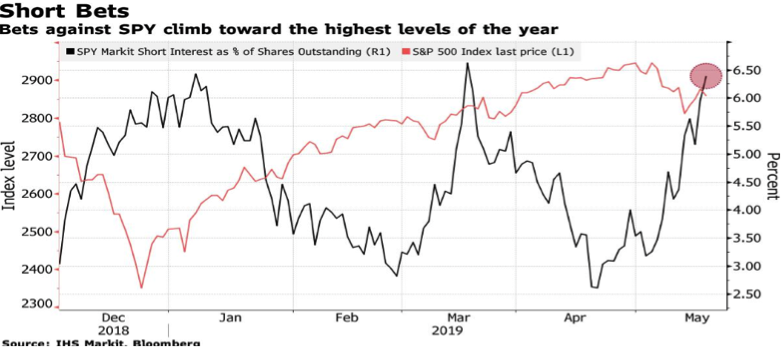

Pension fund rebalancing, corporate buybacks and light releveraging was enough to push it through despite outflows. Coupled with some short covering!