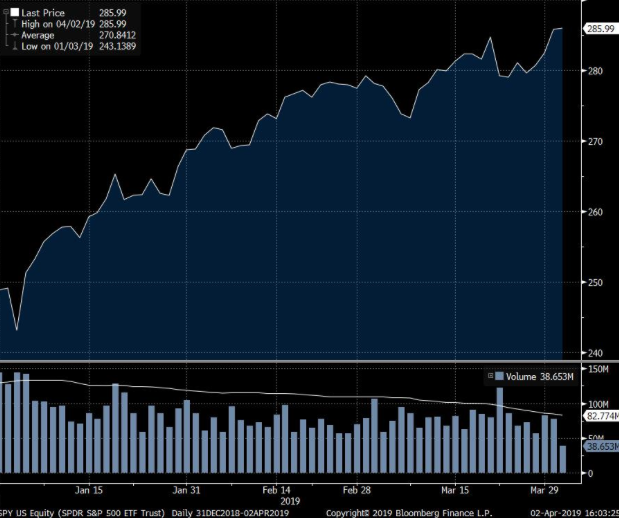

While the Dow Jones Industrial Average (DJIA) took a breather on Tuesday, falling .3%, the Nasdaq (NDX) rose by .25% and apparently nobody showed up for the S&P 500 (SPX) or its closely correlated Select Sector Spiders ETF (SPY) With the S&P 500 finishing almost exactly flat on the day, SPY had its lowest trading volume of the year.

That must be an ominous sign of what’s to come, right? If we line up the variables at play in the market presently…

- Earning season set to kick-off in the next couple of weeks

- The so-called blackout period for buybacks takes affect (to varying degree)

- Market rally YTD may simply be exhausted, given the lack of intermediate pullbacks

- Fund flows have been negative for the totality of the equity market rally

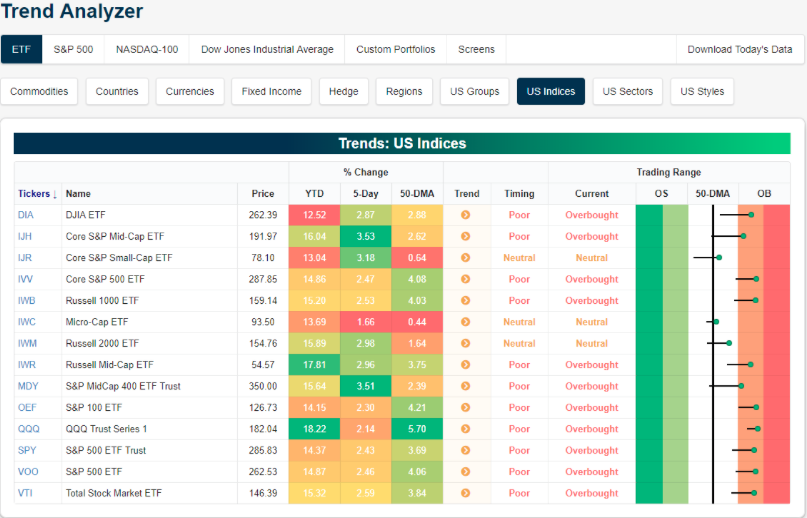

- Most indices and index ETFs are already overbought.

It’s certainly not the most favorably statistical and chronological set of considerations we must consider and when juxtaposed with the S&P 500 already having expressed the totality of the weekly expected move. ($37/points) And of course, the permabears are all over this low volume day in the SPY and the general low volume melt-up in the market through the 1st quarter.

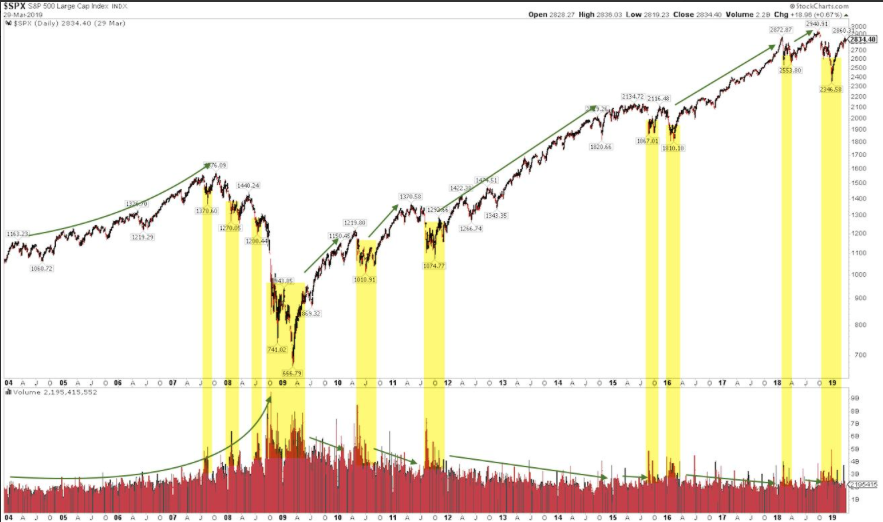

One of the most dubious comments the permabears articulate in perpetuity is, “Market melted-up on low volume” and “Market is declining on higher volume”. Well duh! That’s quite literally how the market works, as an expression of human emotion, nature. Fear is more powerful than even greed, especially when fear is being realized in the market. The following chart identifies that volume absolutely is higher during market panic.

The point is, there’s nothing wrong with the market trending higher on low volume; it’s just the way it is folks. Volume on the way up is less than on the way down, forever and always!

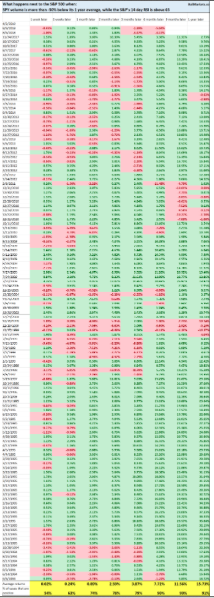

From a historic and statistical standpoint, here’s what happens next to the S&P 500 when SPY volume is more than -50% below its 1 year average, while the S&P’s 14- day RSI is above 65 (i.e. low volume in an overbought market).

The statistics are pretty clear. The stock market’s short term returns are mostly random, but 6-12 months forward returns are more bullish than random. Given the strength of the market through the Q1 2019 period, it is increasingly likely, regardless of volume, that a near-term pullback presents itself to investors.

Equity futures are pointing to a higher open on Wednesday and after a meager performance Tuesday. The resumption of the positive futures trend comes from mixed messaging and the market clearly choosing one message in favor of another. PMI data from the U.S. and China recently sparked a sharp rally in equity markets and China’s latest Services PMI proved the regions economic stimulus programs are taking hold.

China’s service sector rose to a 14-month high in March due to stronger demand. The Caixin China services purchasing managers index rose to 54.4 last month from February’s 51.1, which was a four-month low, Caixin Media Co. and research firm Markit said in a release on Wednesday.

“More evidence is needed to determine whether the Chinese economy has stabilized,” Zhengsheng Zhong, an economist at the CEBM Group said in the release.

With respect to China’s economy improving in the last couple of months and signs of a manufacturing rebound around the globe, comments on the subject of economic strength and/or weakness surfaced from the IMF on Tuesday. The global economy has lost momentum but will avoid a recession given the “more patient” Federal Reserve and stimulus from China, said IMF Managing Director Christine Lagarde.

“While 70% of the global economy will experience a downturn this year, “we do not see a recession in the near term. In fact, we expect some pickup in growth in the second half of 2019 and into 2020,” Lagarde said, in a speech to the U.S. Chamber of Commerce.

In her speech, Lagarde warned again that there would be no winners in a trade war between the U.S. and China. She said if tariffs on all goods traded between the two countries went up by 25 percentage points, that alone would reduce U.S. annual gross domestic product by up to 0.6% and China annual GDP by up to 1.5 percent.

It’s with respect to Lagarde’s trade remarks that equity futures are higher on Wednesday and ahead of key U.S. economic data.

American and Chinese officials negotiating a trade deal have resolved most of the outstanding issues but are still haggling over how to implement and enforce such an agreement, the Financial Times reported late Tuesday.

Myron Brilliant, executive vice president for international affairs at the U.S. Chamber of Commerce told reporters that 90 percent of the deal is done, but the final 10 percent remains the trickiest part of the negotiations and would require trade-offs on both sides.

While the headline is newer, the status of trade negotiations is pretty much on par with where they were back in mid-February. And while the focus of the early morning hours seems to be on China/U.S. trade negotiations, President Donald Trump has been contemplating, tweeting and warning a closure of the U.S./Mexican border could be in the cards. This may be more of a tactical bloviating on the part of the U.S. President, but if past is prologue…

Nonetheless, we have to consider the trend of crisis migration within the White House Administration going forward. While one of the previous crises seems to be calming and nearing a positive outcome, a new one is popping up in the way of U.S./Mexican border controls.

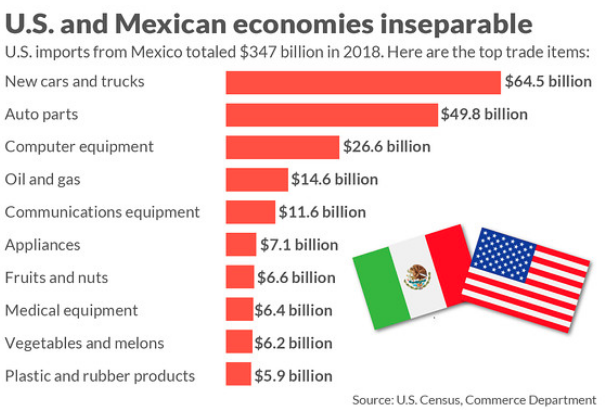

The slowing U.S. economy could suffer a savage blow, business leaders and economists say, if President Trump acts on his threat to shut the Mexican border to block a rising tide of migrants.

Households would face immediate repercussions, they say, in the form of higher prices for groceries and other key consumer staples. And businesses could suddenly confront shortages of key parts and materials, especially in the auto industry.

“Obviously it would not be very good for the U.S. economy that’s already downshifting,” said Sal Guatieri, director of economist research at BMO Capital Markets. The auto industry would face serious disruption. About one-third of imported auto parts come from Mexico,” he said. “A lot of fruits and vegetables are also imported from Mexico. Prices would likely skyrocket.”

We’d be of the opinion that while President Trump’s rhetoric is usually hyperbolic in nature, there’s rationale and/or preparations behind the scenes efforting a greater approach to dealing with the “border conflict” issues. At present, this situation is in pre-crisis status and wouldn’t be advantaged by a real border closing as the U.S./China trade negotiations carry forward.

It certainly seems a geopolitically charged market day in the early Wednesday hours. With crude oil now over $62 a barrel, but with the price at the pump virtually unchanged YoY, we’d be on the lookout for the next President Trump tweet aimed at OPEC. And with the geopolitical undertone of today’s market environment outlined we should probably prepare for incoming economic data of the day.

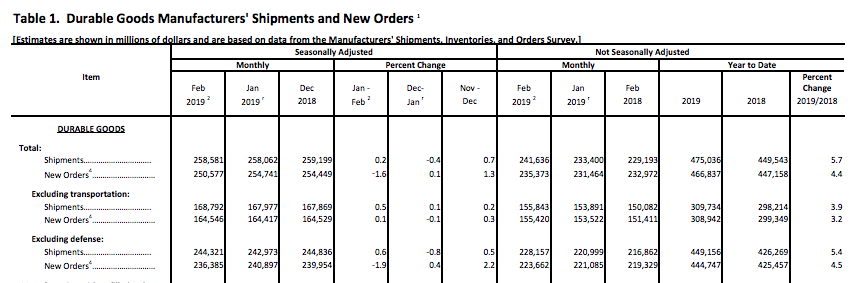

On Tuesday, the Census Bureau said that orders for durable, or long-lasting, goods fell in February for the first time in four months and business investment continued to soften.

Durable-goods orders sank 1.6%, largely because of fewer bookings for commercial aircraft and defense-related hardware, the Commerce Department said Tuesday. The decline was less than economists had forecasted. Additionally, new orders rose above 4% on a YoY basis.

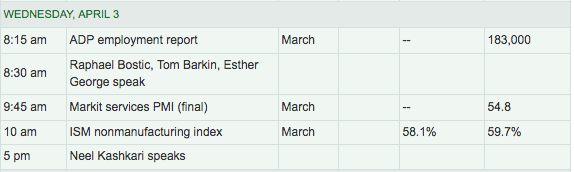

Of course and with respect to economic data for the week, the big piece of the pie for economists and investors alike will be delivered on Friday by way of the Nonfarm Payroll report. Beforehand, however, investors will get somewhat of a sneak preview at the jobs picture through the lens of the private sector payroll growth figures known as the ADP payroll report.

Last month, the ADP payroll report showed job gains equaled 183,000. Unfortunately, the Nonfarm Payroll report fell far short of the ADP insights in to job growth for the month of February. Many market participants are expecting a bounce back in the Nonfarm Payroll report in March, which likely makes Wednesday’s ADP report that much more relevant to the equity markets.

While equity markets have been quite resilient in 2019, the earnings picture hasn’t greatly improved. We’ll have to keep this in mind as investors and as we look toward capital deployment.

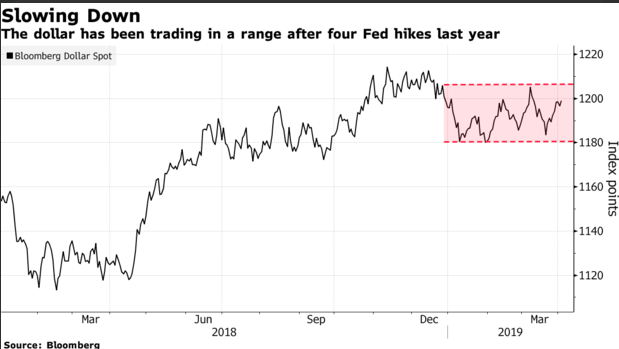

Some of the headwinds for H1 2019 EPS are still present. The U.S. Dollar Index (DXY) has remained elevated throughout Q1 2019 and shows limited signs of retracing downward at the moment. Brexit concerns still loom large and the German economy is teetering on recession. Combined with uncertainty residing within the Chinese economy, the U.S. Dollar has proven a safe haven for many global investors. Why is the DXY so relevant in the subject of corporate EPS expectations? Nearly 50% of U.S. revenues are derived overseas and a stronger dollar negatively impacts those repatriated revenues through the foreign exchange rates.

With respect to what may lay ahead for the DXY, Morgan Stanley suggests the best day’s for the currency may be in the rear view window.

“We think that USD has peaked for the cycle, will decline more than market expectations and won’t be the portfolio diversifier that conventional wisdom expects it to be,” the strategists said. “The resultant better equity outlook in the rest of the world relative to the U.S. should also reduce U.S. investors’ repatriation flows, which have supported USD recently.”

We’ll have to wait and see if Morgan Stanley’s forecast comes to fruition. Recall that Goldman Sachs actually advised to short the DXY back in January, with a downside target of $93.

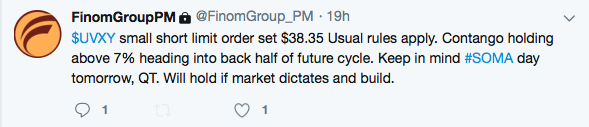

Ahead of the U.S. market open, global equities are higher with the VIX once again declining. Finom Group continues to deliver on our “trade what the market offers” strategy with another short-VOL trade on Tuesday.

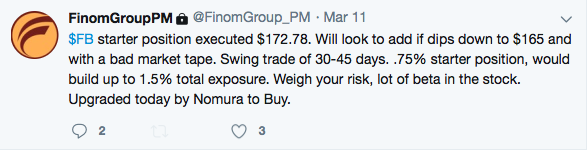

In addition to our short UVXY scalp Tuesday, our longer duration Facebook (FB) trade has hit its price target objective in the pre-market at $175 per share.

And that’s our Daily Market Dispatch and market set-up for April 3, 2019 folks!

Tags: APC DXY FB NDX SPX VIX SPY DJIA IWM QQQ UVXY XLE