It was an ugly day for the Dow Industrial Average yesterday with a rather large intraday reversal. While the point loss was modest, at down just 42 points, it marked the 7th consecutive negative print for the index. The Dow also experienced a more than 170-point swing intraday from positive to negative territory. On the other hand, the Nasdaq had another strong day, up more than 55 points with the S&P 500 adding nearly 5 points on the day. But the Dow’s performance has proven a drag on investor sentiment as all 3 indices are presently expressing a negative open for the markets in the 5:00 a.m. EST hour.

Regardless of how the market performs from one day to the next and through the many developing headlines, the backdrop for equities in 2018 looks quite strong. Some of the factors supporting earnings are as follows:

- Earnings: S&P 500 earnings are expected to grow in the 17-19% range for 2018 with Q2 earnings currently forecast to grow roughly 20 percent.

- Companies have announced plans to spend $650 billion to repurchase shares this year, which would be an all-time high. If buybacks meet expectations, investors could be rewarded with a “buyback yield” of roughly 2.8% n addition to the S&P 500’s dividend yield of 2%.

- Rising rates are generally a favorable backdrop for financials, especially financials that have seen little multiple expansion and an elongated period of low rates. When rates tick up, banks earn higher interest rates on the loans they issue. Banks could return more profits to shareholders this year.

- The tech sector is healthy, vibrant and leading the market higher overall. The sector is fueled by innovations in areas such as artificial intelligence and manufacturing automation, and we are seeing strong demand for digital content and data analytics.

- Consumer spending remains strong in spite of modest inflation. Consumer spending improved at its fastest pace in five months this April.

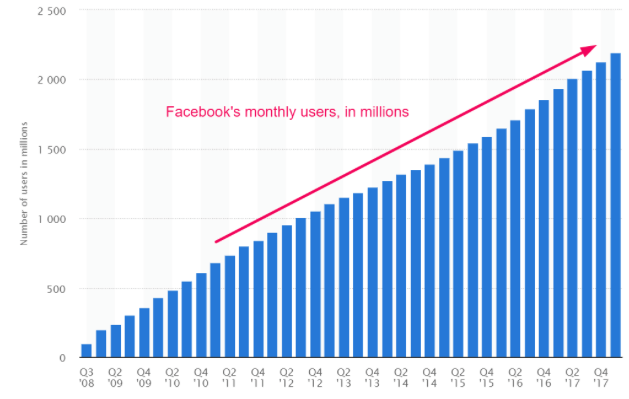

You’re going to hear a great deal about the tech sector going forward and especially since it is so dramatically outperforming the Dow Industrial Average. Terms like dotcom, bubble and bubblicisiousness will be thrown around by the permabears to describe the divergence and dramatic outperformance of the Nasdaq when compared to the Dow. While it’s the job of the permabears to %^#!, whine and complain about tech sectors surge to all-time highs and some of the incredible price-to-earnings multiples, that’s the way it’s supposed to be. The bottom line is that the current composition of the tech sector is nothing like that from the dotcom bubble. The earnings are real for today’s technology titans that contribute to the Nasdaq’s outperformance. The sales are that much more relevant. Companies like Facebook, Netflix, Amazon and Alphabet dominate our world and continue to see magnificent growth rates. Look at the chart of Facebook’s ever-growing user base below that underlines its tremendous sales and earnings growth.

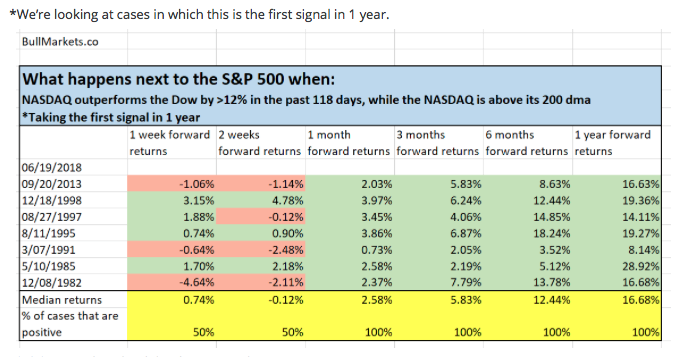

Here’s another fantastic study regarding the Nasdaq and how the S&P performs over the median to long-term when the Nasdaq is showing such strong performance. The study was performed and offered by Troy Bombardia of Bull Markets.

Based on the table from Bombardia, it looks like the S&P 500 would be in for a strong performance over the next 6-12 months, barring any macro-economic impact of negative consequence. Given historic precedence, while the permabears are doing their best job of complaining about the Nasdaq and general market trends it’s the bulls’ job to profit from it. After all, you’ll never know when the ride comes to a halt!

Moreover and speaking of bear warnings, let’s take a look at Federated Investors’ Phil Orlando’s latest warnings for investors and the markets.

“We’re expecting an air pocket here that will take the market down to let’s say the 200-day moving average over the summer months,” the firm’s chief equity strategist said Tuesday on CNBC’s “Futures Now.”

“We thought a 5 percent air pocket, give or take, over the next month or so made perfect sense,” Orlando said. “Once we get all of the concerns about the midterm elections, the Federal Reserve, etc., behind us post-Labor Day, we’re looking for a very solid, very strong fourth quarter rally into year-end.”

Orlando has a 3,100 year-end target on the S&P 500, about a 12% jump from current levels and one of the highest on the street. Orlando also believes investors shouldn’t ignore sectors such as industrials, financials and energy.

Based on Phil Orlando’s comments, we can further gather a sentiment of near-term turbulence resulting in long-term gains. There remain some broad geopolitical concerns looming over the markets near term that center on trade and elections. So let’s review these concerns as we’ve previously reviewed what has supported the market.

- Trade negotiations seem to have stalled between the U.S. and its allies and the U.S. and China. Without favorable headlines in the near term, investors will continue with the tug-of-war that has kept a lid on the S&P 500 and from allowing the broadest index to reach all-time highs.

- Interest rates are expected to rise, but under the right pretense and conditions, growing economic strength and modest inflation. But even so, rising rates serve to curtail multiple expansion.

- Mid-term elections are on the horizon and could bring some heightened levels of volatility back into the markets. Since April, volatility has been squeezed out of the market, but this could change as polls begin to indicate the potential for either the House or Senate to be overtaken by a majority Democrat party. Contentious campaigning by both Democrats and Republicans during the mid-term election cycle could serve to roil markets to some degree as candidates take aim at current economic policies and those implemented under the Trump administration.

- While U.S. financial markets are generally taking central bank tightening in stride due to strong economic growth, it remains to be seen how the end of easing in Europe affects European equity markets later this fall.

While headwinds remain ever present in the market, we’ll have to see how the trading session goes. Finom Group remains risk neutral, trading the day-to-day action while maintaining a long-term outlook centered on a growing economy, growing corporate earnings and sales as well as limited inflation. Unfortunately, the Dow is more heavily littered with equities that have leverage to global trade, which is seemingly casting a shadow over today’s market activity. Caterpillar and Boeing are two such Dow stocks currently preventing the index from moving higher and contributing to what may turn out to be another losing trading session. Caterpillar (CAT) gapped down below its 200DMA and confirmed the breakdown with yesterday’s loss. CAT last traded below its 200-DMA over two years ago.

European markets have taken their cues from Asian markets that found the Shanghai and Hang Seng Indexes both lower by 1.3% on the day. In the U.S. there is limited economic data releases scheduled as jobless claims and leading economic indicators will roll in ahead of the markets open bell. And with that, good luck and have a positive trading day!

Tags: SPX VIX SPY DJIA IWM QQQ