Social media and social-financial media sites can be a scary place. Be it Twitter (TWTR), Seeking Alpha or StockTwits, they might be better understood to have a caveat emptor (buyer beware) sticker attached to the various social platforms. I participate and have participated in all of these venues in order to gather resources and disseminate information over the last few years. Nonetheless, what I come to find, more often than not, is that the vast majority of individuals that participate in the equity market aspect of these social platforms do so with a dedicated bias and in search for likeminded perspectives/people. That’s a dangerous tactic for managing investments and trades in my opinion.

StockTwits is one of the worst social media platform when it comes to such a pervasive issue that litters the minds for investors and traders. StockTwits, for all of its goodwill and good intentions, can’t help but to find “group think” as the dominant force for activity found on the social-market site. The platform has developed nicely over the years, but those engaging with the platform and “sharing” thoughts generally have not evolved with the platform. Cursing, pornographic material and general harassment can and have proliferated on the website for years, even as the moderators attempt to limit such violations of the spirit of StockTwits.

More to the point of this article, however, I’d like to offer a more elaborate and informative perspective on a popular subject matter that proliferates on StockTwits, VIX-Exchange Traded Products. As many might be familiar with my name, Seth Golden, they may not be familiar with my works within the VIX-complex and investing history.

I’ve written nearly a 100 articles on the VIX-complex, the VIX and VIX-ETP trading/investing over the years. I have also been featured in many articles by The New York Times, Business Insider, Thomson Reuters and even been featured on TD-Ameritrade for a live, on-air interview. I’ve been investing and trading VIX-ETPs since 2012, beating the benchmark average returns in continuum and I am presently beating the benchmark average rate of return in 2018.

Firstly, let’s caveat the subject matter by insisting that the VIX and VIX-ETP usage is a difficult subject matter to detail in a single article. As such, please feel free to read my previous works on TalkMarkets.com, Seekingalpha.com and since 2018, my website, finomgroup.com. To the point of this article, why so many traders fail when trying to trade within the VIX-ETP space, they generally do so because they haven’t researched the individual VIX-ETPs to the extent they would know what they are trading. Many folks on StockTwits and Twitter think VIX-ETPs such as UVXY, TVIX, VXX and SVXY (some of the most popular VIX-ETPs) are correlated to the SPDR S&P 500 ETF (SPY). This, unfortunately for those who think it is, couldn’t be further from the truth. Now, for those of you whom are reading this narrative and are way ahead on the due diligence curve of VIX-ETPs, we’d better understand the purpose of this article to serve as nothing more than entertainment. But for those of you, who just read what could be a yellow flag in your understanding, pay attention!

No, very sorry but VIX-ETPs have no more a correlation to SPY than I’m related to Abraham Lincoln. Funny as that may come across, it underlines my point to those who believe VIX-ETPs, derivatives within the VIX-complex, are correlated to an ETF. The sheer logic that an ETF/ETN is correlated to another ETF is of course lacking, but still yet… So let’s put what we know to the test by looking at a chart of one of the most widely used VIX-ETPs, Credit Suisse’s Long VIX Short Term ETN (TVIX).

That’s the 1-month chart of TVIX layered with the 1-month chart of the SPY. The SPY was nearly flat while TVIX decayed by nearly 35 percent. See the problem? You could obviously perform the same exercise with the S&P 500 index/SPX and find a very similar outcome. Why? Well because VIX-ETPs are not correlated to other ETFs or the SPX. At best it is loosely correlated to the SPX by way of its derivative construct. TVIX is an ETN or Exchange Traded Note; it’s not an ETF and should not be confused as such. The ETN’s return is based on the performance of the underlying index. Be it TVIX, UVXY, SVXY or VXX, they all track the performance of the S&P 500 VIX Short-Term Futures Index. Nowhere in the prospectus of any of these instruments does it suggest overtly or in the abstract that they are correlated to the performance of an ETF (SPY).

The misunderstanding comes to pass for many would-be traders of these VIX-ETPs in that the SPY does aim to track the performance of the SPX index. So generally, when the SPX goes up, SPY goes up. And sometimes, when the SPX goes up, certain of the VIX-ETPs like TVIX, UVXY and VXX go down. But it’s in the sometimes that reveals further the faulty assumed correlation between VIX-ETPs and SPY. More often then not, even when the inverse occurs, the SPX and SPY go down, these noted VIX-ETPs have still decayed in price. Why? As noted before and taken directly from Credit Suisse’s S-1 filing for all of their VIX-ETPs, they are not correlated to SPY or even the SPX, but rather S&P 500 VIX Short-Term Futures, a very different animal altogether. The VIX itself is another metric taking its reading from SPX options. Please review a more detailed definition of the VIX via the following bullet points:

- The VIX is priced from a portfolio of S&P 500 (SPX) options defined by the CBOE, and the futures price from the market’s expectation (Implied Volatility) of where the VIX Index will settle at expiration. One component in the price of SPX options is an estimate of how volatile the S&P 500 will be between now and the option’s expiration date.

- This estimate is not directly stated, but is implied in how much buyers are willing to pay. If the market has been expressing great gyrations, option premiums will be expensive. To the contrary, in a quiet market they will be cheaper.

- The moves of the VIX track prices on the SPX options market, not the general stock market; this is a key point. The SPX options market is large, with a notional value greater than $100 billion, and is dominated by institutional investors.

So now that we have a firm understanding, based on factual findings, that VIX-ETPs are not correlated to SPY, let’s more closely reveal how easy it would be to dispense with the notion that it is. All one has to do is review the chart of SPY layered with the VIX or SPX layered with the VIX chart. See below:

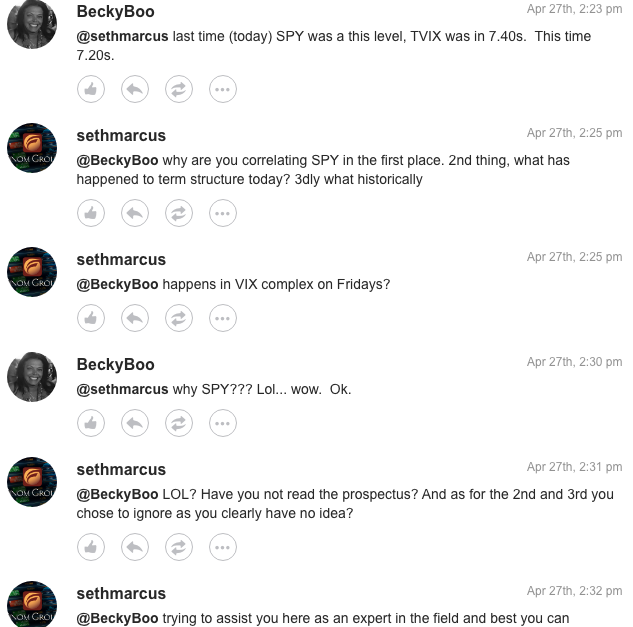

So of course the SPY is basically flat as it were in the previous chart, but the VIX is down some 30% over the 1-month period. You’ll recall from the previous chart, TVIX was also down over 30% during the same period. As it is outlined within the Credit Suisse prospectus and in the exampled charts that could be expounded upon by duration there simply is no correlation between SPY and VIX-ETPs. The unfortunate aspect of this exercise and dissemination is that regardless of the facts, on social media platforms, when attempting to inform others of their misunderstandings they prefer a defensive stance. Check out the dialogue/screenshot between myself and BeckyBoo from a week or so ago.

In conclusion and how I hate to seem trite by ending an article with such verbiage, beware of your participation and those around you when participating in social-market/financial platforms. I genuinely try to inform others on such platforms with the insistence of many questions, as an attempt toward self-discovery. As far as my website/platform is concerned, we share facts and not bias. Sometimes the facts aren’t favorable to a traders position, but at least having unbiased facts can assist in better decision-making.

Tags: SPX QQQ VIX SVXY TVIX UVXY VXX

Thank you for the excellent article…

Thank you for reading Dave, and your excellent videos and daily updates.

Seth, I’d like to thank you in advance for helping me make my first million trading the VIX complex.

Well, as part of your broadening resource base, I’m happy to see you doing very well and continuing the process. Congratulations Kevin and I look forward to see more of your success in the future!!