It wasn’t pretty, but yesterday’s market action proved once again… well it proved nothing more than technicals matter more to markets today than over the last two years. When a market does little more than go up with great persistence, technicals seem to matter very little, but post a market correction; they have proven to matter a great deal. With the S&P and Dow breaking through their respective 200-DMAs in yesterday’s trade, all eyes remain on the key technical moving average.

Since the February sell-off, the S&P has successfully tested its 200-DMA at two key points, and now those levels are important places for it to hold. The S&P 500 fell more than 1.5% in the morning trading yesterday, before recovering much of its losses and rising back above the 200-day moving average. At one point, the DOW was lower by nearly 400 points and before finishing the day in positive territory. Technicians say if the 200-day test fails to hold for the S&P 500, the next big levels to watch are the April low of 2,553 and the February low of 2,532.

The latest comments from Trump legal adviser Rudy Giuliani about the monies paid to Stormy Daniels adds to the uncertainty hanging over Donald Trump’s campaign dealings with Russia. Former Mayor Giuliani said Trump paid back lawyer Michael Cohen for the $130,000 he gave Daniels just before the election, and that it did not involve campaign funds. He also said Trump fired former FBI Director James Comey because he would not say Trump was not the target of an investigation. In addition to the concerns surrounding the White House, investors are also contending with trade issues with China. It has been reported that the U.S. has handed China a lengthy list of demands on trade, including a demand to reduce the bilateral trade deficit by at least $200 billion by the end of 2020. The deficit stood at $375 billion last year. Investors and traders can certainly blame a number of macro-factors that are hurting the major averages, impeding their progress for finding stability, but air pockets between current levels and key moving averages are acting as magnets for lower moves as of late.

Jeff Saut, Raymond James’ chief investment strategist, says he’s sticking by his call for now that the stock market bottomed Feb. 9 when the S&P 500 fell to 2,532.

“When the president is in trouble, the stock market is in trouble. I think it’s more about the president than it is about trade. I’ve lived in the D.C. beltway, and I’ve never seen it turned on its head like it is now. I think the American public is getting sick and tired of it.

In terms of just the economic backdrop and corporate earnings, Saut still believes earnings matter most to the market. With time, the earnings will overpower some of the geopolitical and White House issues.

“The S&P is supposed to earn $158 and change this year and $170 next year. If those numbers are right, there’s not a lot of downside in stocks.”

One variable that Finom Group’s Chief Market Strategist Seth Golden notes with regards to yesterday’s market action was that the S&P Futures gave their first oversold signal. However, he points out that the oversold condition comes on lower than usual volumes and may prove ineffective. Golden also states that at both times, when the market is selling down or on the rise, volumes have been very light since the Feb lows as volatility remained elevated, suggesting investors have moved to the sidelines. Moreover, it may take corporate buyback inclusions to solidify a move higher in the market and produce greater volume.

It’s hard to say how the S&P 500 will behave Friday. Asian markets finished lower across the board, overnight and European markets are higher in the early hour session. U.S. markets will likely take their lead from the pending release of key economic data that is highly anticipated. Nonfarm Payroll data is expected to be released at 8:30 a.m. today. After a surprisingly small 103,000 increase in March, economists polled expect job growth to have risen by 190,000 during the month of April.

In addition to the total number of jobs created in the month of April, economists will also be watching to see if the unemployment rate dips below the 4% level for the first time since President Bill Clinton was in office. The U.S. unemployment rate has been stuck at 4.1% for six months despite the steady job growth that has persisted. The strong jobs market coupled with businesses eager to hire has drawn more than 1.5 million people into the labor force over the past year. With that, the number of jobs created and the employment rate will both take a backseat to the critically important wage inflation data. It’s this particular metric that could either serve to support equities or further exacerbate declines on Friday. If the wage data comes in hotter than anticipated, it further supports the notion that the Fed will need or desire to move rates higher at a faster pace, a factor that has cooled equity markets in 2018.

Hourly wages have climbed 2.7% in the past 12 months vs. a 2% rate that prevailed during most of the nearly nine-year-old expansion. Economists don’t expect the April report to show any significant improvement. Wage growth is expected at 0.2%, and anything higher than that could ramp up expectations for more inflation and more Fed rate hikes.

“The economy and the world have both changed. We are in a world with more information, with more determination to control prices, with more competition and with more options partly because of the role of technology,” contends Robert Brusca, chief economist of FAO Economics. “We do not see a wage price spiral because firms will not raise wages if they cannot raise prices and firms in this economy cannot raise prices.”

Equity markets remain in a state of heightened volatility when compared to 2017, however and at present, the VIX is reading lower than its historic average of 19-20. In fact, a recent study by Goldman Sachs suggests the reaction of stocks to earnings news has been less than expected thus far this reporting season, although it has been above a medium-term average. Per the investment bank’s data, the average stock in the S&P 500 saw a move of 3.5% (either positive or negative) following the release of their company’s results, above the two-year average of +/- 2.8 percent.

The VIX has remained elevated in 2018, but dropped significantly in the month of April. While it is up more than 40% to date in 2018, it fell 19.6% over the month of April, its biggest one-month decline since November 2016. The VIX movement serves to prove that volatility simply can’t rise perpetually or else it would cease market activity. Such an extrapolation of the elevation in the VIX to date is proof positive of this thesis, given the lack of market volume/activity in 2018.

While positive earnings haven’t served to produce greater market activity during earnings season, the VIX itself has remained with a more complacent reading below its historic average. Moreover, in terms of general fear in the market, the VIX has expressed a historic number of 20% one-day moves in 2018.

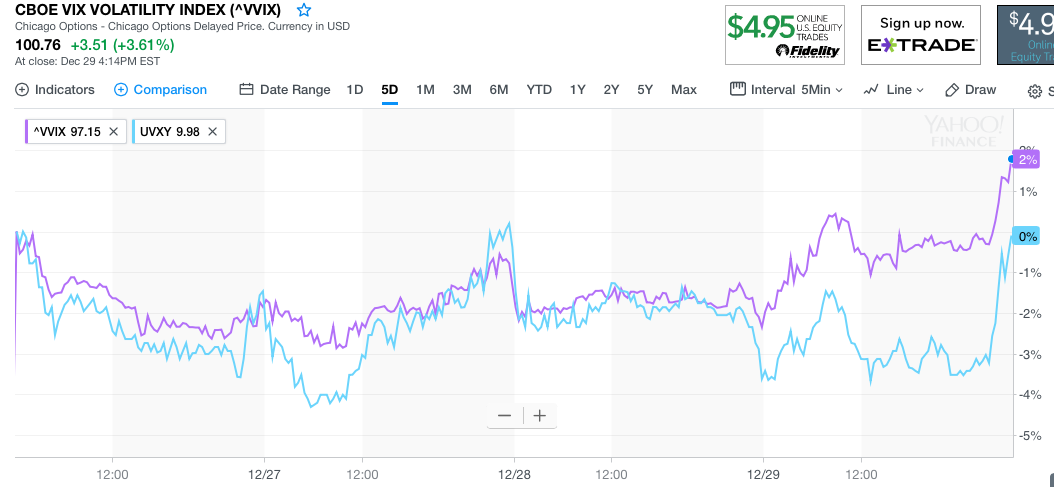

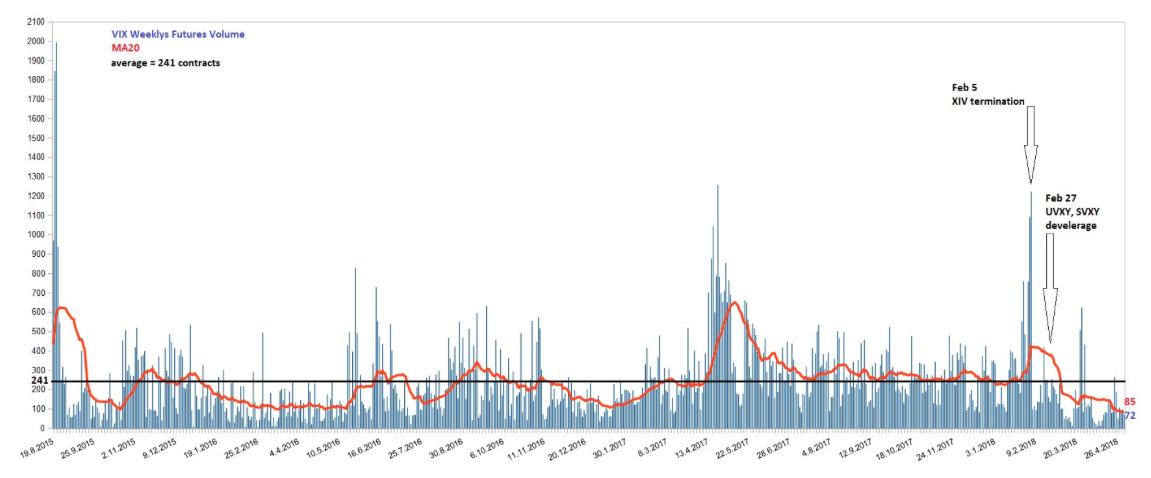

For VIX traders who might be fearful of another February 5th—Volmageddon type of event, such fears may not be warranted at present. In spite of the latest leg lower in the markets, the fear gauge has not necessarily moved higher over the last week or so. In fact, even with the S&P breaking below its 200-DMA, the VIX finished the day below 16 yesterday. A VIX reading 16 signals S&P daily moves of roughly 1% at present levels. The chart below also lends itself to the notion that another Volmageddon would prove quite difficult.

As one can see from the chart, VIX Futures volumes remain very low when compared to most of 2017 and the pre-February 5th VIX Futures levels. Such low levels may still produce sizable moves in VIX Futures, but prove a greater improbability for expressing a Volmageddon type event.

Friday is going to prove very critical for markets and investors given all the aforementioned risks. All eyes and ears will remain focused on the jobs report and any headlines out of the U.S.-China trade negotiations. At Finom Group we continue to trade what the market giveth and as such the following trade alert was executed and delivered to subscribers yesterday. The trade was completed for a healthy profit in an otherwise turbulent market day.

Subscribe to Finomgroup.com today and receive all our weekly research reports and trade alerts. To date, our trade alert success rate is above 90 percent!

Tags: SPX VIX SPY DJIA IWM QQQ